Why It Rarely Helps to Look Backwards

Let me just start this post off by saying that what I have done was not a smart thing to do, it provides nothing of use and is unnecessary. I did it for simple curiosity and nothing more.

I should also start by saying the title might be somewhat misleading, it can obviously help to look back if you made mistakes and you can learn from them for the next time. If you keep reading the post you will see more about what I am on about with looking backwards.

Maybe I should explain what I actually did – well, as I have discussed previously between 2012 and 2015, I invested in US Property. Overall, it was an exceptionally good investment move for me and I made a decent amount of money. But I guess looking at stock prices now, I had a bit of a “What If?” moment in my head, what would have happened if I invested in ABC or XYZ instead? Like I said, these exercises are not useful at all, there is no useful benefit in real terms. But still, it can be a bit of fun, so why not!

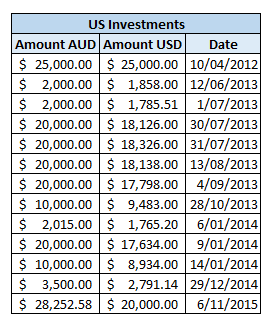

Investment Amounts

Let me explain what I did just to set the scene a little bit. The following is a list of my money transferred over to the US over the four-year period. I will use these numbers and instead simulate if I had invested into certain stocks instead.

So, over the period I invested a total of $182,767.58 (in AU) over the period. Now, which stocks did I select to simulate over the same period.

I should also mention that the finish date for this simulation will be 1/9/2020 – as this was the date I sold my last property in the US. My total return after investing in the US was around $520,000 (AU) – so this will be the benchmark to compare other investments.

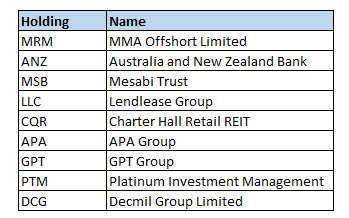

Stock Selection

I decided I wanted a bit of variety, and given property is not too diverse, I wanted to compare it to individual stocks for the most part to better represent a lack of diversity. I couldn’t just look at today’s listings though, as they might not have existed in 2012.

So, I went to look at the ASX200 back in 2012 and I selected 9 stocks using a random number generator. The following 9 stocks is what I came back with:

I also chose VAS so it could more closely match my current investment strategy.

Oh, and just for fun (depressing fun) I decided to add Bitcoin to the mix, you will see later why this one ended up rather depressing.

All the stock price history was gathered from Yahoo Finance – a pretty helpful and impressive resource with the historical data they provide

Results

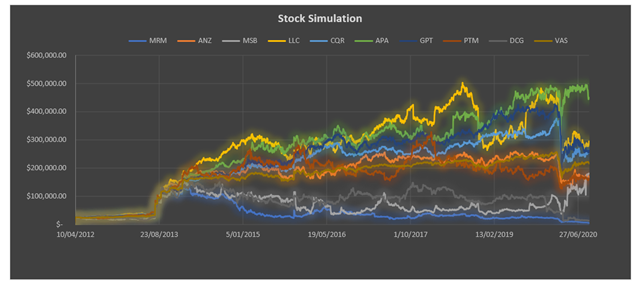

So obviously there is a bit going on in the above chart. The important thing to note is that none of the stocks finished above the $500,000 line. A couple of them did reach it momentarily but then suffered drops as we approached the 1/9/2020 date.

So that is great news! It means that by investing in the US property, I was far better off than had I invested in these 9 individual stocks and VAS ETF.

In fact, at the end even VAS was only around the $220,000 mark – now it had not fully recovered from the downturn suffered in March/April 2020, but even before that date it was not close to reaching the return that I was able to achieve from US property.

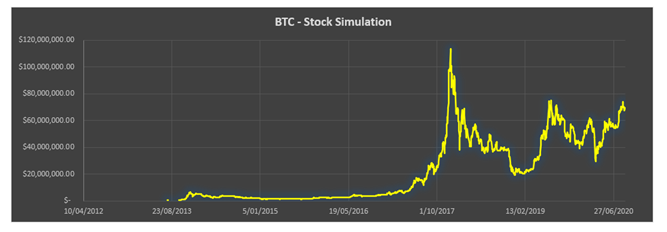

Unfortunately, the story does not end there, you may have noticed that I have not included Bitcoin in the above graph. If I did, every other line on the graph would be negligible, you can see the return from Bitcoin on the graph below.

The numbers on the graph might be written in a small font, but yes, it would have finished with a value around $70,000,000!!!! That is just insane, and to make it even more extreme, that is in US Dollars, it would be even more if it were converted to Australian Dollars.

It even peaked close to $120 million in the middle of 2017!

Also, if you are interested, if I had held on to it until April 2021 it would have reached around $400 million! These numbers are just ridiculously crazy, and I find them difficult to even fathom to be honest.

It really does just show how extreme Bitcoin has performed over the past 8 years (and 2012 wasn’t even right at the start). And yet, even with results like this, I still just do not “get” cryptocurrency, personally for me, I struggle to see the value and believe it is only worth this much because people are willing to pay that much for it. I just do not see where that inherit value actually comes from.

That is just my personal opinion and I am sure whoever is reading this has a different view of cryptocurrencies and that is perfectly fine. I am only expressing things from my point of view. My view may come from ignorance, because I will admit that I have not looked into Crypto a great deal.

Conclusion

That is the end of my little experiment, did it provide any real use or benefit? Well, no, not really. Was it somewhat interesting? Maybe a little bit. Overall, I just thought it might be a bit of fun to have a look at what could have been.

Although after looking at the first 9 stocks and 1 ETF, it was reassuring to know I made a good decision to invest in US Property. I will not get too hung up on missing out on the opportunity to invest in Bitcoin at such a low price. Nobody can predict the future, so it is silly to have regrets about financial decisions you made in the past.