VDHG vs DIY VDHG

For this post, I will be using VDHG as an example. Just to let everyone know, I have no affiliation with Vanguard, I am not endorsing them in any way, I just use them as an example because a lot of Vanguard ETFs are quite prominent in discussions within the FIRE community.

I will say, however, I do have a significant holding in my portfolio of the VDHG ETF.

In other posts, I have gone through a breakdown of what is held in VDHG, and how it is simply made up of several other funds. In summary, it is made up of the following:

- Australian Shares Index Fund (Wholesale) – 35.90%

- International Shares Index Fund (Wholesale) – 26.30%

- International Shares Index Fund (Hedged) – AUD Class (Wholesale) – 16.10%

- Global Aggregate Bond Index Fund (Hedged) – 7.00%

- International Small Companies Index Fund (Wholesale) – 6.70%

- Emerging Markets Shares Index Fund (Wholesale) – 5.00%

- Australian Fixed Interest Index Fund (Wholesale) – 3.00%

The percentage next to each fund indicates the weighting of each smaller fund as part of the larger fund.

If you wanted to, however, you could easily purchase the individual ETFs that correspond to the above funds and essentially “build” your own VDHG.

You might ask, why would I go to all the effort of buying 7 different ETFs, when I could just buy VDHG? Well, that is a valid question, and one good reason is that it can save you money!

ETF Fees

The management fee for VDHG is currently 0.27% per annum.

The equivalent ETFs that make up VDHG have the following fees:

- VAS (Australian Shares) – 0.10%

- VGS (International Shares) – 0.18%

- VGAD (International Shares – Hedged) – 0.21%

- VBND (Global Aggregate Bond) – 0.20%

- VISM (International Small Companies) – 0.32%

- VGE (Emerging Markets) – 0.48%

- VAF (Australian Fixed Interest) – 0.20%

If you have all these individual funds, and you weight them the same as per VDHG, you end up with an equivalent fee of 0.18%.

So that is a saving of a whole 0.09%, alright, so I admit it is not the game changing number, but it is 0.09% that is sitting in your portfolio instead of lining the pockets of Vanguard, so if you are prepared to put in the effort, then you may as well, right?

How Much Effort is Involved in Building Your Own DIY ETF?

For this, I will be using the example of replicating VDHG using the individual ETFs. I will talk later about customising your own portfolio and what other advantages and disadvantages might be associated with this. But for now, I want to just look at recreating VDHG.

So how much work is actually involved in building and maintaining your own DIY ETF, and can you justify spending the additional time needed to build the portfolio, compared to just letting Vanguard do all the work.

Also, if I was building my own portfolio, wouldn’t that just mean I would be hit with additional brokerage fees to try and build the ETFs to meet the same diversification of VDHG. Well, this could be true, but it does not need to be the case. As long as you recognise it might take a significant amount of time to build the ETF from nothing. If you build the ETF using your regular contributions, then it will take a while, but it will not incur any additional brokerage fees.

Step by Step to “Building” DIY VDHG

From the outset, you need to realise you will never be able to perfectly match the breakdown of VDHG, with ETF prices changing constantly, trying to meet the weightings will be next to impossible. Even VDHG itself does not actually meet these weightings; they are just the target weightings of the individual ETFs. We will use these target weightings to try and build it for ourselves.

I will use real values of ETFs for this step-by-step guide to see how it would look in a real life scenario. Given the time needed to build the portfolio, I will start from using data in December 2018, this is the earliest data I could obtain for the ETF VISM and it should prove enough time for our DIY VDHG to be “built.”

Step 1)

For this, I will assume our regular monthly deposit will be $5,000. And this will represent a 5.00% target weighting (so to meet the 35.90% required for VAS, it will take approximately 7 months).

Step 2)

For the first 7 months, I will buy $5,000 of each ETF in no particular order:

- December 2018 – 77 shares of VGS bought at $64.85 each – $4,993.45

- January 2019 – 67 shares of VAS bought at $74.29 each – $4,977.43

- February 2019 – 100 shares of VAF bought at $50.06 each – $5,006.00

- March 2019 – 75 shares of VGE bought at $66.75 each – $5,006.25

- April 2019 – 92 shares of VISM bought at $53.40 each – $4,966.20

- May 2019 – 97 shares of VBND bought at $51.90 each – $5,034.30

- June 2019 – 72 shares of VGAD bought at $68.82 each – $4,955.04

Step 3)

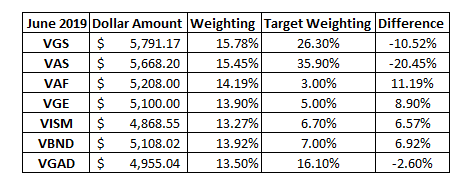

Then you need to look at the weighting of your portfolio as it currently sits and compare that to your target portfolio. The table below shows where we currently sit as of June 2019:

From this information, we take the MOST NEGATIVE difference, and that is what we choose to invest in the next month. In this instance, we will invest in VAS as -20.45% is the most negative number.

July 2019 – 57 Shares of VAS bought at $86.28 each – $4,917.96

Step 4)

Repeat Step 3) until you have a portfolio balanced as per your target.

I wanted to end up in a position where no individual ETF was greater than 3.00% from the target weighting. Remember, the weightings will change without putting any additional money in just due to the changing values of the individual ETFs.

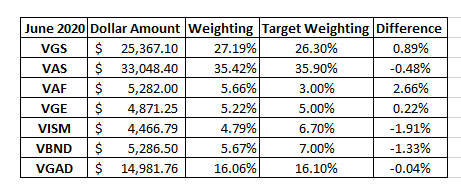

By June 2020 the portfolio looks like this:

As you can see, the weightings of each individual ETF are within 3.00% of the target percentage.

Step 5)

This is still a repeat of Step 3) – you still pick the ETF with the MOST NEGATIVE difference, in this case it will be VISM, and your regular investment will go towards that ETF.

I will mention finally, that although it may look time consuming, once I had the spreadsheet set up (which took about 30 minutes), it was as simple as dragging down an extra row to see which ETF had the lowest weighting, so for every investment purchase, it would take probably an additional minute to make the purchase.

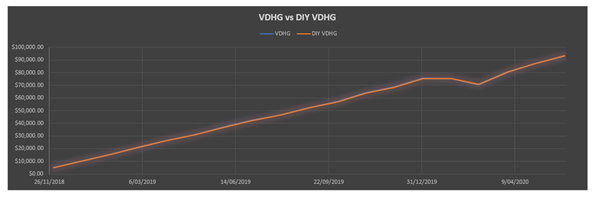

Below is a graph of the value of VDHG vs DIY VDHG over the time it took to build the DIY VDHG

As you can imagine, they pretty much fall on top of each other with no significant difference between the two approaches. By June 2020, VDHG was valued at $92,822.43 and DIY VDHG was valued at $93,303.80. I have a feeling this small difference in return could have changed if the order I initially picked the ETFs differed as well.

This is not the only way to build your own diversified ETF, or the only way to build towards your target allocations. For instance, given that I wanted a high weighting of VAS and VGS, I could have put more money in earlier in these ETFs before I put any money into VAF or VGE for example. I have just provided an example that COULD be adopted if you were hoping to build your own diversified ETF.

As you could see however, it was a time-consuming exercise, if you just bought VDHG right from the start, you would have the target allocation from the beginning. By building our own, it took us from December 2018 to June 2020. It could have happened quicker of course if we were to make more regular investments, but I wanted to adopt a strategy that is consistent with my own investment method (investing every month).

If you had enough savings to justify investing weekly for example, then you would be able to build this ETF is approximately 5 months. Or if you were prepared to pay additional brokerage costs, you could adopt this ETF immediately.

Advantages of VDHG

Now I want to explore the non-financial advantages of investing in a fund like VDHG

- Simplicity

As you can see from above, it is time-consuming to build your own VDHG, you may be paying a slightly higher fee, but it comes with the added convenience of all of the work done for you. It really could not get any easier. If you do not have much spare time.

2. Rebalancing is not necessary

If you do build your own, you may have issues of the some of the ETFs growing significantly faster than other ETFs, which could skew the weightings away from your target portfolio. If you are no longer contributing to your investments, you do not have additional funds to give to underweighted ETFs, so you may be forced to sell and rebalance to get back to your target weightings.

With VDHG this is done automatically which can be a great benefit, especially in a falling market.

3. Removes Personal Behaviour

It is hard to keep emotions out of investing, for instance if you see an ETF that is just skyrocketing in value, you may be tempted to buy it, even though it is already over-weighted in your portfolio. Or if an ETF is seemingly low in value, you may be tempted to take advantage of the discounted price, even if it is not under-weighted in your portfolio.

Anything that takes out emotions or personal influence with an investing strategy is a good thing (unless for some reason you build your strategy on emotions).

Advantages of DIY

I will now go into the non-financial advantages of a DIY approach

- Customisable

This is probably the biggest advantage of DIY in my opinion, the ability to customise it to exactly what you want to have in your target portfolio. Even in the High Growth option, VDHG, still has 10% in defensive assets, you may not want these as part of your portfolio so you can easily customise it and not include these.

Also, you may prefer to have a higher weighting away from Australia, 35.90% is a high weighting for a small market, you may prefer to increase your weighting overseas for example.

2. Withdrawal Phase

I have not talked about the withdrawal phase of the portfolio yet. But when it does come time to start selling assets to fund retirement, if you have your own DIY portfolio, you can pick and choose which assets you want to sell. For example, you may have an asset which is over-performing and currently over-weighted in your portfolio, so you would prefer to sell this asset first.

If you had it all in on VDHG, you would not have this option as it would just sell a chunk of all the underlying assets, including the under-performing ones.

3. Tax Inefficiency

The underlying funds that make up VDHG are managed funds, and not ETFs. This is not as tax efficient as an ETF so if you hold the underlying funds individually as part of a DIY approach, it would be more tax efficient.

This is due to the tax structure of the ETFs, where capital gains are not realised until you decide to sell your ETF shares. Whereas with managed funds, other investors selling their units will trigger a capital gain for all investors of the fund.

Conclusion

In conclusion, in my opinion, there are two main advantages with each option –

VDHG – Removes Personal Behaviour

DIY VDHG – Customisable

I know I did talk about other advantages earlier, but in my opinion, these are the two major factors which need to be considered if you were going to choose between either of these options.

If you are the type that can get emotional with their investing or likes to tinker often and make small changes to your portfolio. Then I would say that going with something like VDHG would be the best option for you.

However, if you are clear and logical with your investing, and follow a strict system regardless of any outside noise. Then adopting the DIY approach might be for you. However, this also requires you to be educated enough on using the power of customisation to your advantage. If you are early on in your financial investing journey and do not know a great deal, or if you do not have the time to analyse what sort of portfolio you should be targeting, then just going with VDHG might be for you.

For my own personal reasons, I started out my portfolio buying a fair bit of VDHG early on. I did not know a great deal, and followed a lot of the online discussions suggestions and just went all in on VDHG. Since then, I have been learning a lot more about diversification, as well as the underlying assets that make up VDHG, and due to this it has led me to divert away from an all in one approach. My main driver was wanting more international diversification in my portfolio.