Tracking the Main Expenses

I have talked before that typically for an individual (or family) there will be three main expenses in their budget:

- Accommodation

- Transport

- Food

For most people, these three items make up the majority of the standard expenses. It makes sense really, because we need to live somewhere, we need to get places and we need to eat.

In this post I want to have a look at how these three expense items have been trending for me since I first began keeping detailed expenses back at the start of 2019. I do wish I had started earlier, but I suppose it is better late than never.

I find it interesting to see how much my life has changed and how it has impacted my expenses accordingly, after looking at each item I will try to explain the reasoning why there have been changes over time.

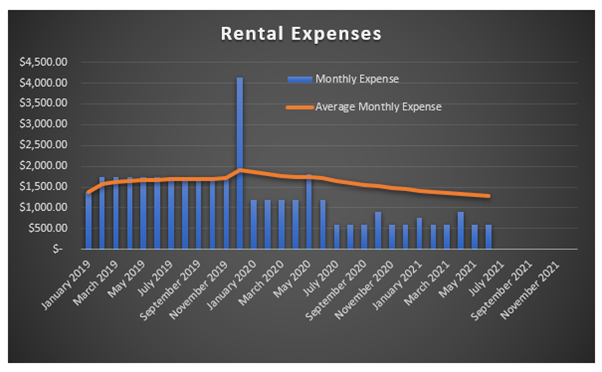

Accommodation

This is the most consistent which does make it the easiest to look at.

As you can see over time I have been able to bring down my average monthly expense when it comes to renting. At the start of 2019 I was paying around $1,600 per month and I have been able to bring that down considerably to around $600 per month. The best part is I do not believe I have reduced my quality of life in any way, in fact I would say my life is in a better position than it was at the start of 2019.

Over the past 2.5 years there have been a couple of significant changes to reduce the amount I pay in rent. The first one was moving at the end of 2019/start of 2019 to a place with cheaper rent (I went from $400 per week to $300 per week). There is a large spike in December as that coincides with paying my security bond at my current place.

The other big change was around July 2020 when my partner moved in with me, effectively halving my rent from $300 per week to only $150 per week. At this stage we do not combine our expenses so my financial commitment has been reduced significantly.

There was a small rental increase (up to $330 per week) at my current place starting in July 2021, which is not ideal, but I am still a long way ahead of where I was at the start of 2019.

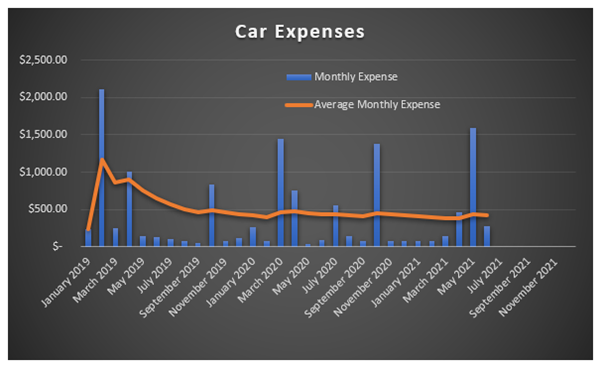

Transport

These expenses are much more volatile as you can see, with regular spikes to be paid for insurance, registration or any significant repairs.

The line graph on the above chart is a bit deceptive as it happened to start at a particularly high period, so although it has been trending down it is not truly reflective of reality.

In reality, my car expenses have increased since around July 2020 when I bought a second car, which has of course doubled my registration, maintenance and insurance costs. I am currently in the process of selling that car however and will hopefully significantly reduce my car expenses going forward.

Although there will still be spikes going forward even with one car, they will be less frequent, and my average monthly expenses will reduce overall.

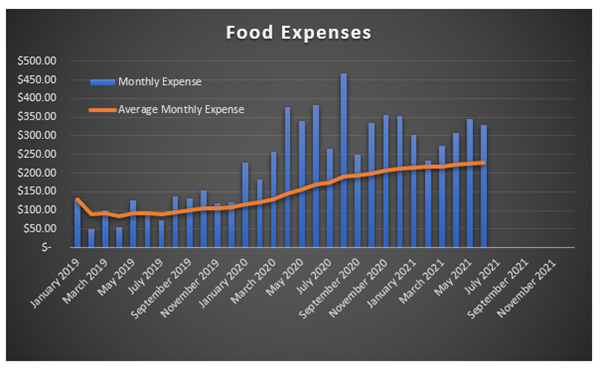

Food Expenses

This is another graph which is slightly deceptive, as it did start out particularly low at the start of my tracking in January 2019.

I am trying to think of how I was able to live on such a low amount of spending on groceries for around 12 months. Food prices have not increased that dramatically since then so I have to think of other reasons.

The only justification I can think of is that at my old place I used to live close to my parents, and I used to go there after work every afternoon and would quite often stay for dinner. I imagine this would have meant I could have eaten a lot more of their food and hence bought less for myself. There definitely seems to be a significant increase in spending that starts off around January 2020, which coincides with me moving further away.

I never really considered the additional food expense I would have moving away from my parents, but then again, I cannot really rely on eating their food as a long-term solution so it is probably best to get a realistic number for the purposes of future budgeting.

It appears that my realistic monthly average is around $300 per month. Now that I can see it, I might think about what I can do to reduce this number a little bit, as I would like to get it down to $250 per month (every little bit counts), as long as I do not sacrifice on my quality of life.

Summary

One of the benefits of tracking all my expenses is that I am able to analyse my previous spending history and really see if there are any concerning trends developing, or at least see where my money is actually going.

Without doing this exercise I would not have really noticed the significant increase in my food spending over the past 18 months, but now that I am aware of it I can try and make some more conscious decisions going forward.

I find this sort of analysis also rewarding because I can see in the numbers the amount of money I am actually saving in certain aspects (particularly in my accommodation expenses), and knowing that instead of spending this money on my lifestyle, I have been able to invest it in income producing assets and contribute towards my FIRE goal.