To LMI or not LMI

To LMI or not LMI

Lenders Mortgage Insurance (LMI) is designed to provide lenders (banks and home finance providers) with an extra level of protection in case the borrower defaults or cannot repay their loan. I must stress that LMI in no way is additional protection for the borrower, the sole purpose of LMI is to help protect the lender from losing money.

When is LMI needed?

LMI may be required if your LVR (Loan to Value Ratio) is greater than 80% of your property’s ‘lender-assessed value’. This is important to remember as well, the 80% LVR is not necessarily related to the price you pay for the property, but is calculated in terms of how much the lender has valued the property. The price you pay for the property may vary significantly from the value the property is assessed at.

For example – If you purchase a property for the price of $500,000 and you have a deposit (after closing costs) of $100,000. It may seem that your deposit is 20% and your LVR is 80%. But if the property is only valued by the bank at $450,000. Then all of a sudden, your LVR will be up to 88.9%. If your LVR is greater than 80%, then generally you will be required to pay LVR.

In this example, if you were looking to avoid paying LVR, you would need to provide a deposit of $140,000 to maintain an LVR of 80.00%

How Much Does LMI Cost?

You would need to contact your lender for a detailed quote, but this WEBSITE provides a good estimate you can use if you were looking to get an idea of how much you can expect to pay.

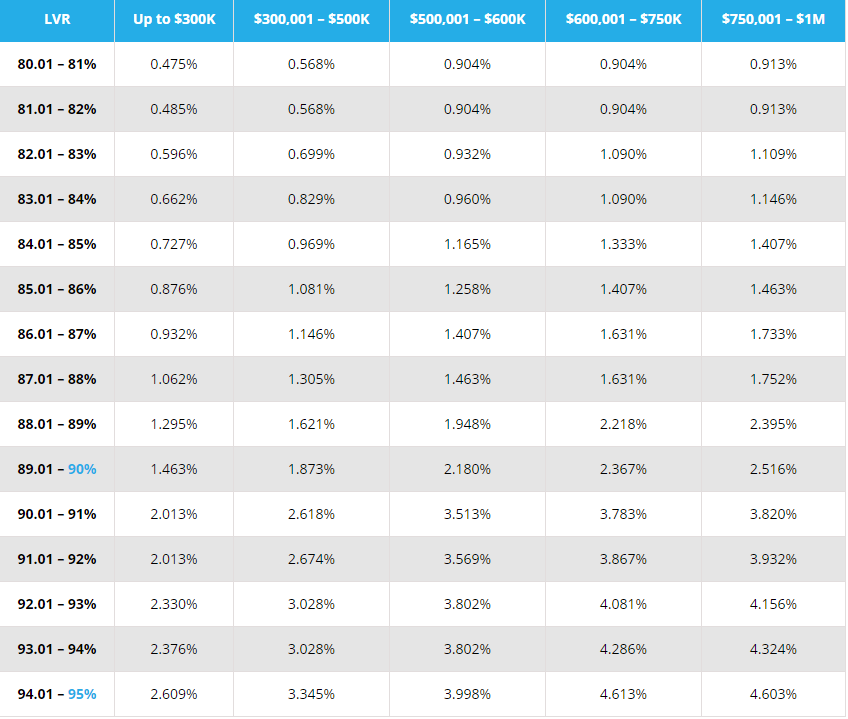

The following table from Home Loan Experts also provides a good summary of how to calculate LMI:

Example to calculate LMI:

- Firstly, this is only applicable to a standard home loan, it does not apply to low doc loans.

- Work out the LVR – For example, if you are borrowing $50,000 for a $500,000 property than your LVR would be 90.00%.

- Use the table above to find the applicable LMI rate for your LVR and loan amount. In our example, $500,000 value property at 90.00% LVR = 1.873%

- To calculate your LMI premium, just multiple this rate by your loan amount. 1.873% x $450,000 = $8,428.50.

- Then add stamp duty on LMI that is applicable the state the property is in. For example, in NSW the rate is 9.00%. $8,428.50 + ($8,428.50 x 9.00%) = $8,428.50 + $758.57 = $9,187.07

The above is just to estimate roughly how much you will expect to pay for your LMI. You will need to confirm with your lender what the exact LMI premium will be.

Is LMI Worth It?

This is where I get to the part where I really wanted to run the numbers and determine if it is the case. I want to run through a few different scenarios to determine if it is worth paying LMI or if you are better off saving your money for a bit longer to try and avoid it.

Without looking too much into the numbers, I would imagine that a lot of it would depend on the capital appreciation of the property in relation to how quickly you can save up the additional deposit.

For Example – We have $50,000 saved up as a deposit to purchase a $500,000 property. To avoid LMI we would need to save up an additional $50,000, and we can currently save $1,000 per week.

If we were to buy the property using a 90% LVR, then our LMI would be roughly $9,000 (as we calculated before).

We can assume a capital appreciation in the property of 3.00% per annum. If we were to wait 12 months to save up the additional $50,000, then the property would now be worth $515,000 – and we would still require an additional $3,000 to meet the 80.00% LVR requirement.

In this very quick example, we can see how it might have been better to pay the LMI initially as the price of the house increased by more than the amount of LMI we would have had to have paid.

Detailed Example 1

To gain more of an understanding of the financial implications on whether we should “LMI or not LMI”, I want to analyse with more inputs to see a true picture of what the results might look like.

I will be comparing two different scenarios:

Scenario 1) Purchase a $500,000 property with 90% LVR with LMI.

Scenario 2) Wait to save up deposit to purchase property with 80% LVR with no LMI.

I will use the following inputs:

Current Savings: $50,000

Weekly Savings: $1,000

Weekly Rent: $400 (this will be paid while waiting to own the property)

Weekly Home Owning Costs: $100 (this will be paid once property is owned)

Capital Appreciation: 3.00% per annum

Interest Rate: 2.50% per annum

LMI: $9,000 (based on 90% LVR for $500,000 property)

For the purposes of this example, all excess savings once the property is owned will be used to pay down the mortgage. I will simulate each scenario over a 5-year period as well. The LMI that is not used for Scenario 2, will be used as additional savings to obtain the 80% LVR sooner.

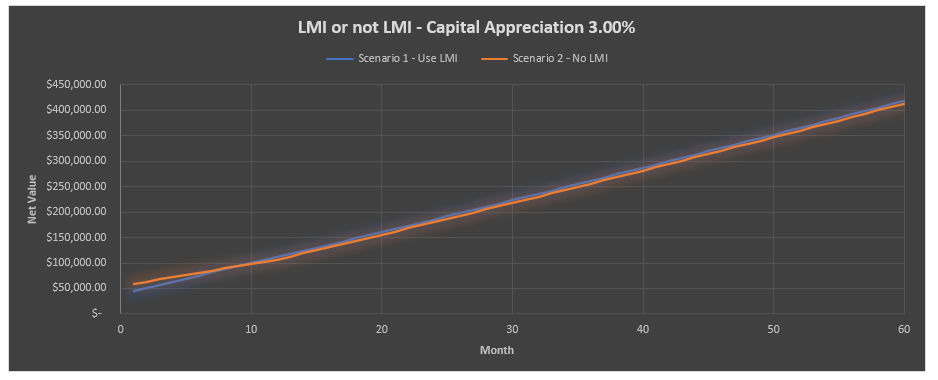

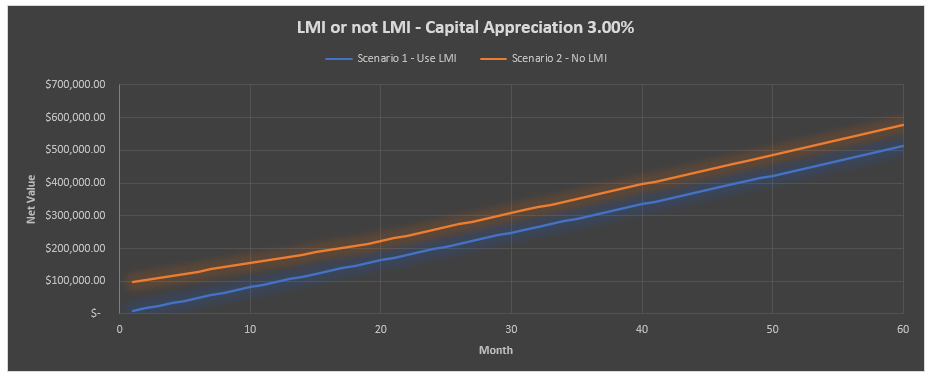

Below is a graph of the net value of each Scenario from above.

The above graph shows there is a slight advantage to using LMI compared to not using LMI. Although it might look like the graphs are running parallel once Scenario 2 does purchase the property (after 14 months), there is a slight widening of the gap.

At the end of the 5-year simulation we have the following net value from each simulation:

Scenario 1: $418,968.00

Scenario 2: $413,390.00

Although Scenario 1 does start out initially lower than Scenario 2 (given the LMI), it quickly overtakes it as the property value appreciates.

Now I want to look at how changing the capital appreciation will affect our results.

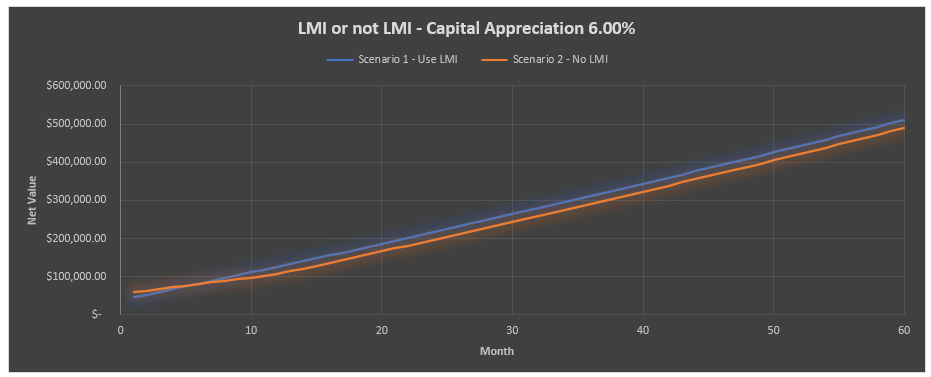

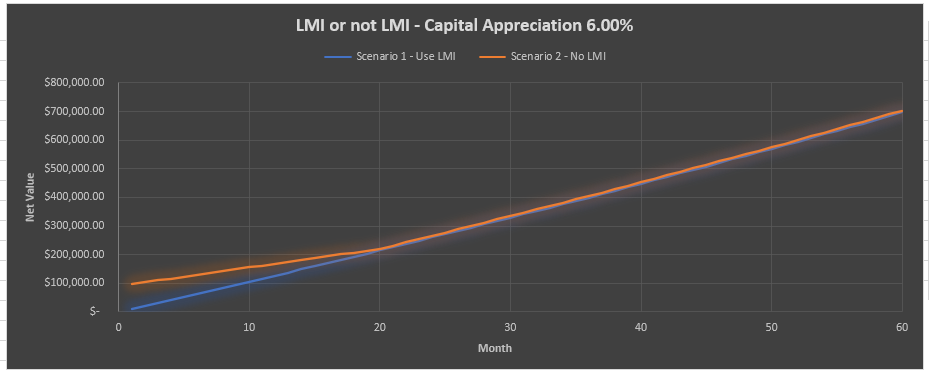

Modify Capital Appreciation to 6.00% per annum

As you can see from the above graph, it does seem to follow a similar trajectory, but the gap is wider at the end of the 5-year period, and although it is difficult to tell the gap is slowly widening.

At the end of the 5-year simulation we have the following net value from each simulation:

Scenario 1: $510.678.00

Scenario 2: $489,325.00

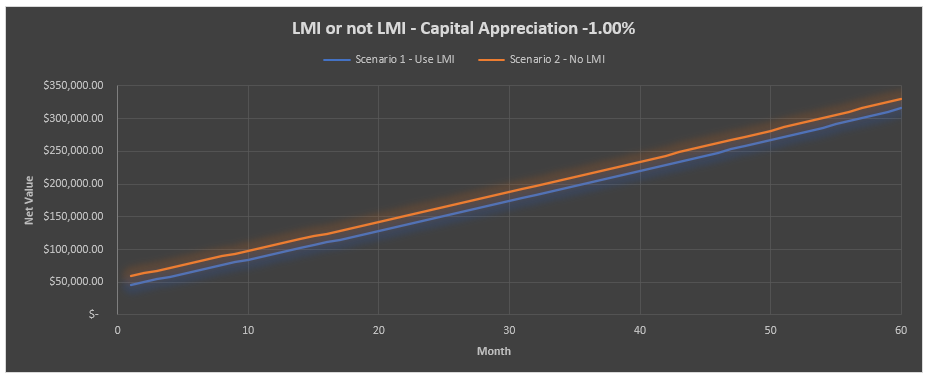

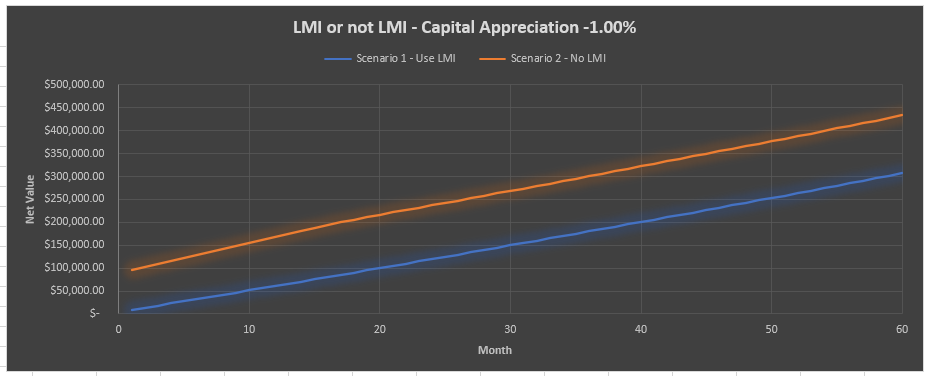

Modify Capital Appreciation to -1.00% per annum

This might look strange in Australia (where prices always go up apparently!), but it is possible of course, but what if we look at falling property prices. While it may be unlikely to have long term sustained negative property growth, if you are looking to purchase in a property market which seems artificially inflated, then it may be beneficial to hold off if you expect prices to drop.

As could be expected, in this scenario we have an advantage if we do hold off paying the LMI and instead wait until we have 80.00% LVR.

At the end of the 5-year simulation we have the following net value from each simulation:

Scenario 1: $315,610.00

Scenario 2: $330,535.00

The graph and the numbers show that the returns are still fairly similar, if there is a greater drop in the capital appreciation then the gap between the numbers will increase. But this needs to be taken with the context of how likely such a scenario might be.

Detailed Example 2

I want to compare a different example, this time with a property value of $1,000,000 and an initial LVR of 95.00%

Scenario 1) Purchase a $1,000,000 property with 95% LVR with LMI.

Scenario 2) Wait to save up deposit to purchase property with 80% LVR with no LMI.

I will use the following inputs:

Current Savings: $50,000

Weekly Savings: $1,500

Weekly Rent: $400 (this will be paid while waiting to own the property)

Weekly Home Owning Costs: $150 (this will be paid once property is owned)

Capital Appreciation: (As per the below graph and results)

Interest Rate: 2.50% per annum

LMI: $46,930 (based on 95% LVR for $1,000,000 property)

Graph Results: 3.00% Capital Appreciation

After 5 Years Scenario 1: $513,431.00

After 5 Years Scenario 2: $576,797.00

Graph Results: 6.00% Capital Appreciation

After 5 Years Scenario 1: $696,851.00

After 5 Years Scenario 2: $702.855.00

Graph Results: -1.00% Capital Appreciation

After 5 Years Scenario 1: $306,714.00

After 5 Years Scenario 2: $433,381.79

The results above really start to show an interesting picture. Now we have significant differences in value between overall return if there is a change in the capital appreciation. This is due to the increase in the property price, but more so the increase in LVR up to 95%. The LMI rate increases exponentially as the LVR increases and as you can see it almost becomes the same amount as the deposit. It is also quite interesting to note that Scenario 2 performs better financially in every simulation compared to Scenario 1.

Disclaimer

Like I said, the LMI amounts are only estimates, so please make sure if you are looking at using LMI, see your lender to determine what the actual LMI amount will be.

I have bought 3 properties in Australia and have never used LMI. The first two I was not comfortable with the extra debt and preferred to provide a 20% deposit. The last property, the bank would only lend me so much that I could only have an LVR of around 75%, so even if I wanted to use LMI, I did not have the option (unless I opted for a cheaper property).

Conclusion

It is difficult to determine if LMI is worth paying for when it comes to buying a property. In a rising market, it is almost certainly a better financial option. But you also need to realise the implications of having such a high LVR, as it could bring significant financial stress with such a high loan amount.

There is no definite answer if you should take LMI or not, but if you were looking to purchase a property then I would strongly suggest creating a spreadsheet and running simulations to determine the likely financial outcome of using LMI or not using LMI.