Time To Review My Superannuation

At the moment my superannuation is currently with CBus, and they have performed alright for me. The fees seemed relatively low compared to most funds out there, and their returns were decent enough, so I never really bothered to change.

I have not talked about superannuation too much on this blog, and that will change in time, but at the moment I still need to learn a whole lot more about it before I start writing about it.

Superannuation in general is not discussed enough among the greater society, I am not sure the reason why, I assume it has something to do with money that you cannot touch for a long period of time so out of sight out of mind sort of thing. It really is a shame because Superannuation really allows the average Australian to use the power of compound interest and build themselves a night nest egg for retirement.

Why Review Now?

When I first set up my Superannuation with CBus, I admit I did not look too much into the details of superfunds at the time. All I knew was that fees were retail superfunds were high, but low with industry superfunds. With that knowledge I moved my money to be with CBus. It was not the most optimum choice, but it definitely could have been a lot worse.

Over the last couple of years, I have spent a lot of work streamlining my life outside of Super, and now I feel that is under control so it is time to spend some focus onto my Superannuation. I want to see if I can optimise my super as much as possible to give me the best chance at having a nice balance by the time, I reach preservation age.

My Intentions for Super

I have talked previously about how I do not exactly plan on having to use my superannuation in the future. I am hopeful to be able to use my investments outside of Super to be able to fund my retirement. But of course, things can always go sour and having a substantial super balance will be a great backup plan just in case things do go wrong.

I aim to have a Super balance of $250,000 by the time I am 40, when I hope to FIRE. I hope that mandatory contributions will get me to this level, but I may have to make some additional contributions to get to this level. I am hoping that by the time I reach my preservation age (60) that this should be around $1,000,000, which will be a lovely backup plan.

These might be lofty aspirations, that is why I need to make sure I optimise my Super as much as possible to give me the best of achieving it.

Hidden Surprises

While I did some in depth looking into my Cbus Super, I found a few hidden surprises which were less than ideal. In my mind, I am all about reducing the amount of fees I pay (while not compromising on the return), so when I see multiple and significant fees on my super balance it was quite upsetting.

While the fees for Cbus are certainly not the highest among the superfunds (in fact they are still well below the average), there are definitely some superfunds out there with significantly cheaper fees. My goal is to find a superfund which achieves the low fees that I am looking for, without compromising on the overall return.

After all, I would rather pay 2.00% fees on a 9.00% return than pay 0.1% fees on a 6.00% return.

Cbus Fees

After trudging through the PDS for Cbus I found the following fee structure:

Investment Fee: 0.66% per annum (this is for the High Growth Option) and has the following breakdown:

- 0.31% investment management fee

- 0.08% performance related fee

- 0.13% transactional and operational costs

- 0.14% other investment costs

Borrowing Costs and Implicit Transaction Costs: 0.23% per annum (for High Growth Option) and has the following breakdown:

- 0.08% Borrowing Costs

- 0.06% Implicit Transaction Costs

- 0.09% Property Operational Costs

Administration Costs: $2 per week PLUS 0.19% per annum (up to a maximum of $1,000)

I am a little disappointed in Cbus because it is not clearly shown the entire fee amount that is required to be paid in your general PDS. The PDS only talks about an Investment Fee of 0.56% (which is the fee for the MyGrowth option) and does not mention the 0.23% borrowing costs and implicit transaction costs anywhere on the PDS.

The annual fee to manage the portfolio ends up being over 1.00% every year, so if I have a portfolio of $100,000, that means every year I am paying over $1,000 to Cbus for the privilege of using them as a provider. That number is a little too high for me.

A Better Alternative?

Looking for Reddit forums, there seems to be a lot of hype around HostPlus Superannuation for it’s low fees. I mean the Barefoot Investor plugs it, so it can’t be too much of a bad thing.

I guess it is time to have a look at their fee structure now.

HostPlus Fees

If you go with the Hostplus Balanced option, you will incur the following fees:

Investment Fee – 0.71% per annum

Administration Fee – $1.50 per week

Indirect Costs – 0.39% per annum

I will give them credit for at least being a bit more open about their fees, but the total number is still over 1.00% so more than I am looking for.

Fortunately, they do have different investment options, with substantially reduced fees:

IFM – Australian Shares

Investment Fee – 0.02%

Indirect Costs – 0.01%

International Shares – Indexed

Investment Fee – 0.02%

Indirect Costs – 0.11%

These are the sort of fees I am looking for!

If I went 50/50 between the above Funds, then my total effective fee rate would be a lowly 0.08%

Now, instead of donating $1,000 per year to the superannuation fund, it now only has to be $80. That is an extra $920 in my pocket which is where I would much rather it be.

Long Term Forecast

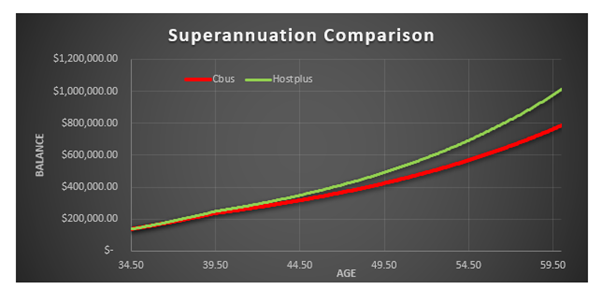

Now I will look at the impacts of each superfund from my current position until I reach my preservation age.

I will assume each fund will return an average of 7.00% per annum (I believe it is too difficult to try and predict different returns for each fund, so assuming the same return is the best way I believe to compare)

Cbus Fees

Management and Investing Fee: 0.89% per annum

Administration Fee: $2.00 per week + 0.19% per annum (maximum $1,000)

Hostplus Fees

Management and Investing Fee: 0.08% per annum

Administration Fee: $1.50 per week

Inputs

Current Super Balance: $135,000.00

Monthly Contributions: $800 (compulsory contributions only)

Years of Contributions: 5 (hoping to FIRE after this, but will still let the remaining balance compound)

Annual Return: 7.00% per annum

Insurance Costs: $150 per annum (same for both Super funds)

Results

You can see in the above graph that as I reach my preservation age, the difference is significant. The reduced fees has really started to have a massive compounding effect by this point.

The total balance at preservation age for each Superfund is the following:

Cbus: $786,000

Hostplus: $1,010.000

Over $220,000 difference! Just by swapping to a superfund with lower fees. Remember this is without making any voluntary contributions.

Think of what that $220,000 actually represents as well, in terms of the 4.00% rule, that would be an extra $8,800 per year I would be able to spend. That is the difference between mediocre and near luxury. And all I have to do is just move to a different superfund, easy as that.

Further Review

I am more than happy with the fees that Hostplus provides, so I believe in my current situation it will work for me.

However, as my super balance continues to grow it, the annual fee, while still being quite low, it may become more viable to move the funds into an SMSF.

I will assume the running costs of a SMSF is approximately $2,000 per annum. With an effective annul rate of around 0.11% (including the administration fee), this would mean I would need a balance of around $1,800,000 to become viable. This is good news because I really do not need to bother with all the work required to set up and manage my own SMSF. Although if it was a better financial option for me, then I would definitely go for that option.

Interesting to note that if I did stay with Cbus with an effective annual rate of around 1.2% per annum, then I would only need around $166,000 to become viable. If I had stayed with Cbus then I would have definitely considered moving across to a SMSF much sooner.

Conclusion

I do regret not carrying out this sort of review sooner, and mainly regret not looking into Cbus in greater detail when I did first choose to go with them. I was not thorough enough in my research initially and missed some of those “hidden fees” they appear to have.

That being said, it could have been worse, and I could have left my Super in that account for a few more years and that would have had significant impacts on my future balance, especially when I reached preservation age.

I guess in the end it is better late than never, and I definitely urge anyone reading this to review their Superannuation because there are some really cheap options out there, and it really is one of the best tools you have available to you for a successful retirement, so it definitely should not be neglected.