The Power of Saving and Compound Interest

It was Albert Einstein who famously said that compound interest is the most powerful force in the universe. He said, “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Now I am not sure if Einstein was into the FIRE life, but he was on to something. Fortunately, it doesn’t take someone with a genius mind like Einstein to be able to see for themselves just how powerful compound interest can be. In fact, I would say compound interest is the dominant factor that allows people to reach FIRE in their life. It really is that powerful.

The only downside with compound interest, is that it takes time to show how effective it can be, it can take a lot of time. So that is why my approach is two pronged, and it is not viable to rely completely on compound interest to get me where I want to be.

Unfortunately, the other prong in my method is the not so sexy word called saving. Definitely no rocket science about it, just basic putting money away constantly over a period of time and getting an investment return. It is not exciting, but at least it is not difficult.

So there it is, the secret to FIRE in a simple formula –

Savings + Investment Return + Time = FIRE

The best part is how simple it really is, none of these factors require a PhD to be able to understand, none of these concepts need to be studied at length to solve the mysteries of the universe.

But….just because it is simple does not mean it is not 100% effective.

Whenever I am looking at calculations, whether they be simple or complex, I like to look at which part of the formula has the biggest impact on the overall result. You could call it a bit of a sensitivity analysis, if I change one number slightly, how big an impact will it have and that will determine how accurate I need to be in terms of my inputs.

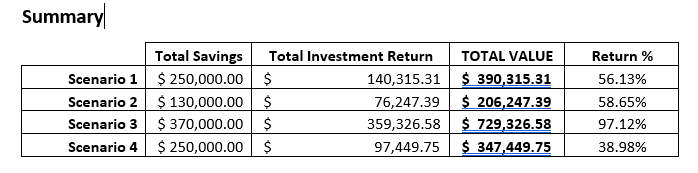

So I will go through a couple of scenarios and see what sort of results I am able to come up with:

Scenario 1)

Initial Savings: $10,000

Monthly Savings: $2,000 per month

Investment Return: 8.00% per annum (compounded monthly)

Duration: 10 years

RESULT:

Total Savings Invested: $250,000

Total Investment Return: $140,315.31

TOTAL VALUE: $390,315.31 (56% return on investment over 10 years)

I will use that as my base scenario, and adjust each factor from there to determine how much of an impact it will have on the final result.

Scenario 2)

Initial Savings: $10,000

Monthly Savings: $1,000 per month (reduced from previously)

Investment Return: 8.00% per annum (compounded monthly)

Duration: 10 years

RESULT:

Total Savings Invested: $130,000

Total Investment Return: $76,247.39

TOTAL VALUE: $206,247.39 (59% return on investment over 10 years)

As you can see, when you halve the savings invested, you just about halve the investment return as well.

Scenario 3)

Initial Savings: $10,000

Monthly Savings: $2,000 per month

Investment Return: 8.00% per annum (compounded monthly)

Duration: 15 years (increased another 5 years)

RESULT:

Total Savings Invested: $370,000

Total Investment Return: $359,326.58

TOTAL VALUE: $729,326.58 (97% return on investment over 15 years)

As you increase the time you start to see an exponential increase in the investment return. This highlights the power of compound interest.

Scenario 4)

Initial Savings: $10,000

Monthly Savings: $2,000 per month

Investment Return: 6.00% per annum (reduced – compounded monthly)

Duration: 10 years

RESULT:

Total Savings Invested: $250,000

Total Investment Return: $97,449.75

TOTAL VALUE: $347,449.75 (39% return on investment over 10 years)

What just a 2% drop in investment return, there is a loss of over $40,000 over 10 years! Even seemingly small changes in percentages are magnified over time so it is important to ensure you get the best return possible. Given the unpredictability of the stock market, it is not possible to predict which index funds will perform best in the future, but there is something that you can control that will impact your investment return: fees. I will talk about this in a future blog post.

As you can see, each factor in the formula plays a vital role in achieving FIRE, you cannot get there if you are missing one of the three, so that is why it is so important to make sure you understand the importance of each factor.

Savings + Investment Return + Time = FIRE

In my opinion, I believe the most important one out of the three is Time. I am not discounting the importance of Savings and Investment Return, but I will show you an example where it can show you just how much easier it can be if you use time to your advantage.

I remember reading this example in The Barefoot Investor – By Scott Pape. This is definitely a good book to read when you are starting out, it explains just about everything you need to know in a simple and easy to understand format. Anyway, this example really stuck out to me and I believe it is something that can be useful for anyone else to see.

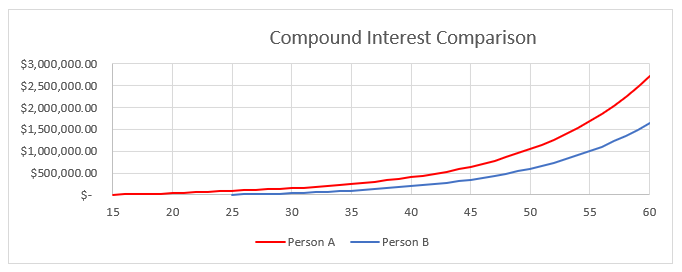

Person A: From age 15, they are able to invest $5,000 per year for 10 years until they are 24 – and assume they earn a return of 10% per annum.

Person B: From age 25, they are able to invest $5,000 per year until they reach the age of 60. Again they earn a return of 10% per annum

Person A: Invests a total of $50,000

Person B: Invests a total of $180,000

So looking at those numbers, it wouldn’t really seem even possible that Person A could end up with more money than Person B when they reach the age of 60.

But have a look at the Total Value of each Person over time

It is not even close! Person A has a total value of over $2.7 million compared to Person B who has a total value of almost $1.65 million. That is over $1,000,000 additional for Person A, and they put in just over a quarter of the initial investment!

This example really blew my mind when I saw it, I thought I knew about the power of compound interest before, but when you see it in black and white, the numbers do not lie and it really is incredible.

What the graph also shows is just how important time is when it comes to compound interest, it does not happen quickly, you will not get rich overnight, but given significant time (15+ years) you can see your investments really start to accelerate, and it ends up catapulting you into significant wealth.

So in summary, there is no secret tricks involved in achieving FIRE, it really is as simple as the following formula:

Savings + Investment Return + Time = FIRE

I have uploaded a compound interest spreadsheet to my spreadsheets tab located HERE, alternatively there is a great compound interest calculator located on the government Money Smart website located HERE