The One, Two, Three or Four Fund Portfolio

There is regularly a question posted on forums about “is this portfolio the right one” or something similar. It is a really tricky question to answer because at the end of the day there is no “right” portfolio breakdown, and you just need to do whatever suits you depending on your own goals and targets.

I have my own target allocations, and it works for me, but I would not necessarily recommend it to anyone else unless they wanted the same outcome that I was looking for.

With all that being said, for people just starting out with the world of investing, when you are unsure of what you want your portfolio to look like in the long term, I believe there is still some basic portfolios where you really cannot go too far wrong.

If all you are after is a decent, balanced portfolio that is broad ranged and has a wide diversity, then the following recommendations might be for you. Even if you used these suggestions as your “core” portfolio and then added some more exotic ETFs or individual shares for your “satellite” portion then that would also be an option.

I will stress that I am not necessarily advocating for anyone to necessarily follow the advice, just putting it out there as an option for people if they were looking to simplify their investment portfolio.

One Fund Portfolio

DHHF/VDHG

DHHF (from BetaShares) and VDHG (from Vanguard) are two wonderfully diverse ETFs which provide a wide range of diversity all on their own. If you really wanted to simplify your investment portfolio, you could literally just pick one of these funds and regularly invest in it and you would still be able to obtain a decent return

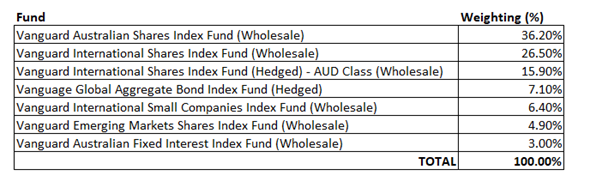

VDHG Breakdown

I have gone into more of a detailed breakdown of what encompasses VDHG in this POST

It is also worth noting that the MER of VDHG is currently at 0.27% per annum.

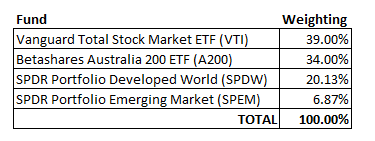

DHHF Breakdown

Quick breakdown of the individual ETF holdings that make up DHHF

VTI – Consists of over 4,000 holdings of a wide range of US listings from large, mid and small cap equity diversified across growth and value styles.

A200 – Consists of the Top 200 holdings on the ASX

SPDW – Consists of almost 2,500 holdings from international companies from developed countries (except the US)

SPEM – Consists of almost 3,000 holdings from international companies from emerging markets (predominately China, Taiwan and India)

Overall, there is almost 10,000 individual listings that make up DHHF (it should be noted that there is some overlap with A200 and SPDW however)

DHHF has a MER of 0.19%

DHHF vs VDHG

I will not go into any significant detail here, but the main difference between DHHF and VDHG is that DHHF has no bond or defensive asset holding, compared to the 10% that VDHG has. Apart from that, both ETFs both offer excellent diversity across most countries in the world with small, mid and large cap businesses.

Two Fund Portfolio

An example of a two-fund portfolio that might work for you and works for a lot of people is just to use VAS and VGS.

VAS – Consists of the Top 300 holdings on the ASX – MER of 0.10%

VGS – Consists of 1,500 worldwide companies (not including Australia) – MER of 0.18%

The only issue with VGS is that it is missing emerging markets (that was covered by SPEM or VGE) and it is also missing small cap businesses (which could be covered by VISM)

You are also missing out on defensive assets if you did want bonds as part of your portfolio.

But you are able to have whatever weighting you want between Australia and Global Markets if you keep only VAS and VGS in your portfolio.

Three Fund Portfolio

If you wanted to add in some defensive assets, then your three-fund portfolio could look like this

VAS – Consists of the Top 300 holdings on the ASX – MER of 0.10%

VGS – Consists of 1,500 worldwide companies (not including Australia) – MER of 0.18%

VAF – Australian Fixed Interest Bond – MER of 0.15%

While adding a bond ETF might not suit you if you were after high growth, it is definitely an option, and you are always able to play with the individual weightings as much as you can to obtain something that you are comfortable with.

Four Fund Portfolio

With an additional fund you are able to add in Emerging Markets (you could also add in Small Cap if you wanted to, but I think Emerging Markets would be more likely to provide additional diversity).

Your Four-Fund Portfolio will now look like this:

VAS – Consists of the Top 300 holdings on the ASX – MER of 0.10%

VGS – Consists of 1,500 worldwide companies (not including Australia) – MER of 0.18%

VAF – Australian Fixed Interest Bond – MER of 0.15%

VGE – Consists of over 5,000 holdings from emerging markets – MER of 0.48%

The above four-fund portfolio will provide you with enough diversity to be able to have a well-balanced portfolio that should provide you decent returns in the long term.

Conclusion

The above post is just a recommendation of how you are able to build an investment portfolio that will be simple and still perform well. You do not need to add a high number of ETFs of individual holdings to be able to obtain a decent performance.

At the very least, if you are only new to investing and are not sure exactly what will suit you, then at least using something like the above while you do your research and figure out what is right for you will most likely be a benefit in the long-term.