The Importance of Savings Rate

One of the first things you will hear when you are looking into the world of FIRE, is the importance of savings rate. So, the first thing you might ask, well what is savings rate? Fortunately, it is straight forward to figure out –

Savings divided by Income. That’s it, that’s all there is to it. If you are able to save $10,000 and you earn $100,000 (after tax) then your savings rate will be 10%. It really is that simple.

So the next question is, what savings rate should you be aiming for? Unfortunately, that is much more difficult to figure out because ultimately, there is no right answer. It will vary from person to person, depending on how much income they make, what sort of fixed expenses they have, and even how determined they are to reach FIRE.

Typically, the higher the savings rate the quicker you will be able to progress to FIRE, obviously it still depends on your income and also what your FIRE target is, but that is the general logic anyway.

Impact of Savings Rate in terms of FIRE

Now I want to look at the impact of savings rate, and how it will impact your investment portfolio. So I want to compare different savings rates. For this I will compare in 10% increments from 10% up to 60%.

I will also only be focusing on ages between 18-40.

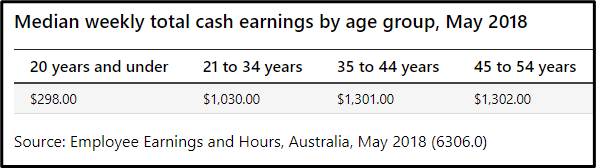

To work out the median income for each age group I will use the following table;

May be a couple of years out of date, but for the purposes of what I want to talk about here it should be sufficient.

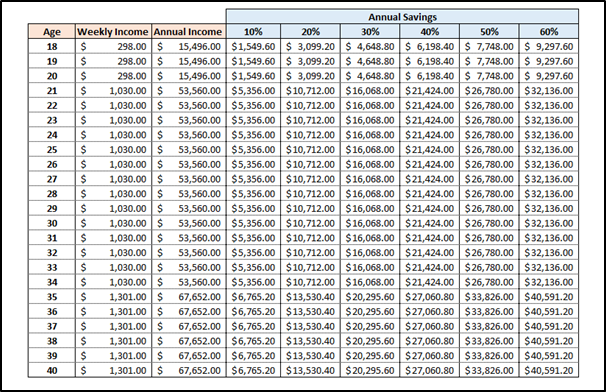

The following is a summary of the annual savings by age depending on the different savings rate;

Now, I want to look at each savings rate, to have a look at how much we have in our investment portfolio at the age of 40, 45, 50 and 60 (assuming we do not add or withdraw anything from the age of 40). I will assume an investment portfolio return of 7.00% per annum with deposits made monthly.

Results

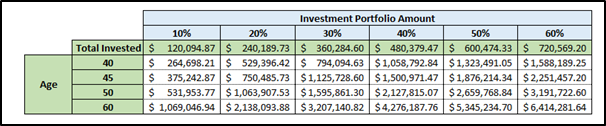

Look at the huge differences we have between the savings rate, if we can only invest 10% of our income between the ages of 18-40, then if we were on a median income for that whole time we would have $264,000 in our investment portfolio. Now this number is definitely nothing to be sneezed at, and if we had this in our portfolio at that age, then I would say we would be in a better position than the majority of people in this country.

But look what happens if we are able to push our savings rate up to 40%, then by the time we are 40, we will have over $1,000,000 in our investment portfolio. If we were happy to retire on $40,000, then we would have reached our FIRE number, we will have gained our financial independence and we could leave our job whenever we wanted to.

Let’s say we wanted to FatFIRE, we wanted a massive wad of cash, we wanted to live the highlife, we wanted an annual income of $100,000 per year to live on. That would mean we would have a FIRE number of $2,500,000. Assuming we could still only reach a savings rate of 40%, even if we CoastFIRE from age 40 to age 53, we would still reach our target. How incredible is that! It might not be as early as some people are looking at retiring, but it will be a retirement of luxury, we could still have 30 plus years of an extravagant retirement to look forward to, and we did not even need to work that hard once we hit 40 (or we did but spent every cent we earned in a flamboyant lead up to retirement).

Disclaimer

Now, I should mention, given the many variables, it is not always really about savings rate, but more about how much you are actually saving. The numbers in this are just a guide based on the median income of Australian workers. For example, it might seem impossible to have save $41,000 if you are only earning $67,000 – and you are right, it could be very difficult given your living circumstances. But we can also imagine that if someone was earning significant coin, a salary of $150,000 (after tax), then saving $41,000 for them would only be 27%, so they might have a low savings rate, but given they are still contributing a high amount to their investments, they will still do well.

How to Increase our Savings Rate

So that is all well and good to see how increasing our savings rate can really accelerate our journey into FIRE, but it does not really help us in actively increasing our savings rate so we can achieve these goals.

I won’t go into too much detail in this post, in a future post I will provide a lot more savings tips for people. But I will give a brief overview on what I believe are the best two steps to quickly cut down on your expenses.Look through your current expenses and isolate your top three expenses. Typically, this will be accommodation, transport and food – but it might be different depending on your circumstances.

Find out ways you can reduce your expenses on these top three expenses – For example:

- Accommodation – are you able to rent or live somewhere cheaper, living in a sharehouse might be an option. Or can you rent out a room where you live

- Transport – Can you ride a bike to work, can you drive a car that is cheaper to run

- Food – Eat out less, cook more at home, buy cheaper items at the grocery store

The above are only examples, and it will not be applicable to everyone because they will all have their unique situations. But the logic will be similar whatever situation, have a look at your expenses and see where you can cut costs. It might be that even the highest expense is compulsory, that is fine, move on to the next one and see where you might be able to cut costs there, and so forth.

Increasing your savings rate does not mean you need to live like a pauper, it is difficult to justify living in what feels like poverty for an extended period of time, just to be able to retire early. You might be fine eating two minute noodles every night, but I am sure your digestive system would disagree eventually. It is all about balance, you can still enjoy life while you are on the path to FIRE, but it just means at least being conscious of the financial implications of your spending, if you feel it is worth it to you to treat yourself to a night out once a week, then go for it. If you feel that maybe it would be best to limit it to once a month instead, then go for that instead. I am not here to tell anyone how to live their live, just trying to help show them the potential financial implications their decisions might have in the long run.

In another post I will also look at exploring a different to way to increasing our Savings Rate, that will be by earning more! Earning potential is quite often looked over and people instead focus on savings and investing, but earning potential is so significant that it really should be a focus for a lot of people, especially when they are young and just starting on their FIRE journey.

Conclusion

In my opinion, regular savings is the key to building your investment portfolio and eventually lead you to reaching FIRE. Every little bit you are able to save early on, multiplies significantly down the line. So while it may feel like you are only saving $100 now, it will effectively be like earning you $1,000 down the line, due to compound interest, it really is that powerful.

But again, I must stress, do not sacrifice enjoyment in your life now for the sake of what you will hope will make you happy in the future. There is a balance that can be reached between enjoying your life today and investing for the future, the biggest trick is to work out where this balance is and ensure you are content with this.