The Full Cost of Spending Today

When people first start looking to take control of their finances, one of the first things they will do is try and cut costs. This makes sense because it is something that is 100% within their control, and for the majority of people, there is a significant improvement people can do when it comes to their budgets.

At the start of reducing spending, it is important to tackle the big-ticket items first (accommodation, transport and food), but then once this has been looked at, you need to start looking at some of the smaller expenses to see where you can further cut down on your costs.

It can be easy to look at regular expenses on your budget and ignore them because they seem relatively small, $5 here, $10 there. It is nothing significant, so why not? Why shouldn’t I indulge myself for that coffee every morning. I deserve to buy myself a nice lunch every weekend.

And I stress, if you want to spend the money on something that makes you happy (and is legal), then by all means, go for it. I am going to be the last person to stop you from doing so, we all have non-essential expenses in our lives that we justify for our own wellbeing. For me, the cost of my cats is somewhat expensive, approximately $100 a month after food, litter, vet bills, toys etc. These are not essential expenses (I mean I didn’t have to get the cats), but I choose to spend the money because the joy they bring my life is worth the expense.

All I am trying to get across is to completely understand the impacts of these expenses in the long term. Once you have this information on hand and you can see the repercussions of your actions, you can either accept the results, or decide maybe the expense is not justified.

Where Am I Going With This?

I am bringing this all back to our old friend Compound Interest, over time, we will see even insignificant sums of money turn into somewhat large amounts in the long term.

In fact, over a 30-year period with 6% per annum returns (I will use a lower return because I want this to refer to today’s dollars, so I will take out inflation). Each $1.00 you save, will turn itself into $6.00 after 30 years. All of a sudden, that $5.00 cup of coffee is now costing your future self $30.00.

What about reoccurring payments, how about we imagine we go for a $5.00 cup of coffee every day for 30 years. How much would that turn into if we had invested it instead?

The answer is almost $151,000! Incredible number, just by sacrificing a cup of coffee every day. But maybe you want to be able to justify that cup of coffee in your life? An option might be to invest in a coffee maker and instead start making your own at a fraction of the cost.

Let’s say you can end up making a cup of coffee for $1.00 per cup instead, so now it is only $4.00 per day we are saving. That ends up being $120,500 of additional investment over a 30-year period. All of a sudden, investing some money into a coffee machine and some time to make your own seems easier to justify.

This is not all about cups of coffee obviously, I just want to highlight that even relatively small expenses magnify significantly over a 30-year period thanks to the wonder of compound interest.

30 years into the future, $1.00 one off expense becomes $6.00.

30 years into the future, $1.00 daily expense becomes $30,000.00.

I hope the above statements really highlight the impact of seemingly insignificant expenses today.

There is more to this than Money

So maybe it is still related to money, but in the end we can use money to buy ourselves time. So another way to think about the true cost of spending today, is looking at how it will impact the date we reach our FIRE.

I will not go into specific examples of saving money (like I did earlier with coffee), but I implore you to have a look at your most recent expenses and see the amount on non-essentials on this list. I like to think that I myself live on the high side of frugality, but my non-essential expenses for March 2021 was still around $300.00. Most of this was due to my cats, but also groceries where sometimes I may indulge in expenses which may not be completely necessary.

Example 1

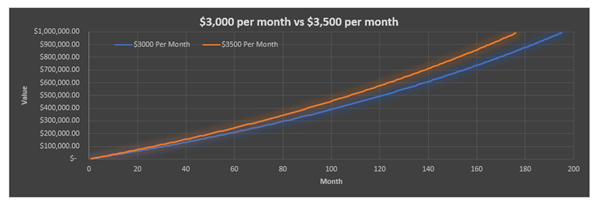

For this example, I want to assume we are starting from a net value of $0.00, and we have a FIRE number of $1,000,000 – a nice round number. Again, I will assume a 6.00% rate of return.

Without taking out non-essential expenses, we are able to contribute $3,000 per month to our investments to build our FIRE.

With the above inputs, it will take 16.42 years to reach FIRE.

Now if we reduce our non-essential spending by $500 per month, now we are able to contribute $3,500 per month to our investments to build our FIRE.

With the new numbers, it will take us only 14.83 years to reach FIRE.

We end up being able to reach FIRE over 1.5 years sooner just by reducing our non-essential expenses by $500 per month. That means an extra 1.5 years of Financial Freedom!

Example 2

You might think that you cannot find $500 per month to save, but I want to also highlight that even small changes can have significant impacts in the future. How about if we just reduce our expenses by $100 per month.

I really doubt anyone who is serious about improving their financial situation and working towards financial independence, couldn’t find an additional $100 of extra savings in their monthly budget.

$3,000 per month Savings – 16.42 years to FIRE

$3,100 per month Savings – 16.00 years to FIRE

We essentially just gave ourselves a 5-month holiday just by saving $100 per month, $25 per week, less than $7 per day.

Conclusion

I want to stress this point again; I am not suggesting that you need to give up all of your non-essential expenses if you want to pursue FIRE. I am the last person to tell someone what they should be spending money on.

All I am trying to highlight in this post is to be just conscious of the impacts of your spending today, and be aware that even seemingly small expenses made today can have significant impacts in the future.

You might not want to sacrifice any of your current spending habits, and that is perfectly find, as long as you accept the consequences of this spending.

So maybe next time you are at the shops and you see something that might only cost $15, and you do not really need it in your life, you might not even particularly want it, you just think it might come in handy and since it is “only” $15 it isn’t going to hurt anything. Just rethink this thought process and realise that due to compound interest the expense today will be significantly more in the future.