The Changing Impact of Savings Through FIRE

I have talked several times before about the importance of savings rate, about increasing this number as much as you can without compromising on your quality of life. In previous posts like THIS ONE I talked about how increasing your savings rate can really help accelerate your FIRE journey.

While all of that still remains true, in this post I want to talk about how the significance of savings actually changes through your FIRE journey. As your portfolio increases, slowly but surely, your portfolio starts to do the majority of the heavy lifting, and over time, your individual contributions will become less significant in the growth of your portfolio.

Example 1

If you start with $0.00 and are able to contribute $5,000 per month, earning a 7.00% per annum return compounded monthly, then after 12 months you would have the following:

Total Portfolio Value = $62,293

Total Contributed = $60,000

Total Gains = $2,293

Now $2,293.00 is nothing to be sneezed at and it is great to get that passive money working for you, but now let’s look at a different situation.

Example 2

If you start with $500,000 and are able to contribute $5,000 per month, earning a 7.00% per annum return compounded monthly, then after 12 months you would have the following:

Total Portfolio Value = $595,328.95

Total Contributed = $60,000.00

Total Gains = $35,328.95

Now you can really see our money working for us, it is over half of what we are contributing ourselves. Over time, there is definite potential for the gains received from your investments to regularly overtake what you are contributing. That means your money is working harder than you, and you actually earn more passively, doing nothing, compared to working your usual job.

Impact of Reducing FIRE Duration

I now want to look at how increasing (or decreasing) our savings can impact how long it will take us to reach our FIRE. I will make it dependent on our initial portfolio value and look at the remaining duration to reach our FIRE number.

Inputs

FIRE Number: $1,000,000.00

Base Monthly Savings: $5,000.00

Investment Return: 7.00% Per Annum

With the above inputs, I will model in a spreadsheet and track the days it will take to reach that FIRE target. Duration will be based on the following two elements:

- Starting Point (relatively to FIRE Target)

- Savings Amount (-50%, -25%, 0%, +25% or 50% of the Base Monthly Savings)

Results

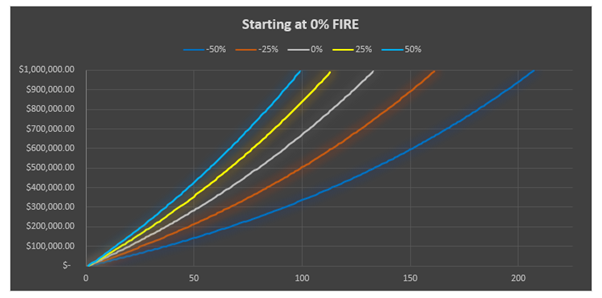

Starting at 0% FIRE

This graph shows us starting at $0.00 and our path to creating $1,000,000 of wealth.

-50% ($2,500) monthly contributions will take us over 200 months and +50% ($7,500) contributions will take us just on 100 months to reach our target.

Although it is a significant increase in the amount of savings, it is a significant reduction in our duration to reaching FIRE, almost 10 years faster if we can increase our contributions.

Even the difference between contributing $2,500 per month and $3,750 (-25%) still provides almost 4 years shorter duration to reaching our FIRE Target.

Now let’s look at simulations where we are already along our FIRE journey.

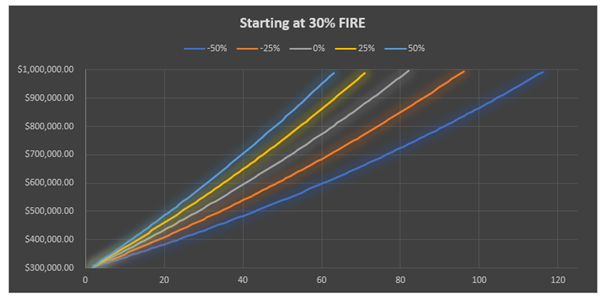

Starting at 30% FIRE

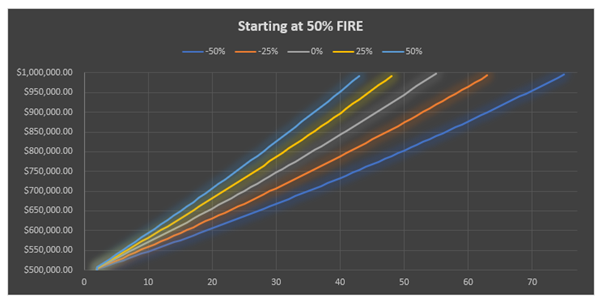

Starting at 50% FIRE

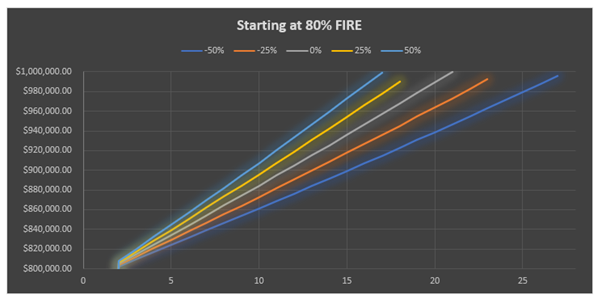

Starting at 80% FIRE

The above graphs show a significant trend, the further along the FIRE journey we are, the less impactful our savings actually becomes.

Looking at our simulation where we begin at 80% FIRE, the duration difference between -50% and +50% is just 10 months. While 10 months is not insignificant, it definitely pales in comparison to the 10 years we were talking about in the first graph.

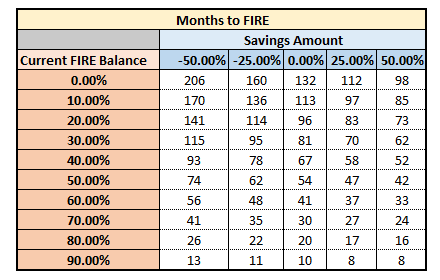

Below is a full table showing the months to FIRE for different starting points.

The above table really reinforces the point at how significant the impact is in the early stages, and how during the latter stages of your FIRE journey it becomes significantly less relevant.

Lifestyle Changes

What does all this mean then? A lot of the time, saving and scrutinising expenses is a balance, it all comes down to what are you will to sacrifice in your life for now, to help you out for your future. At the start of your FIRE journey, you can see how making significant changes in your lifestyle can pay significant dividends. As time progresses however, then you might need to reassess these decisions because they are no longer as impactful as they once were.

For example, at the start of your FIRE journey you could have justified driving an older car instead of buying a new one at a cost of $300 per month. That decision might be easy to make because you know that saving and investing that $300 per month will allow you to reduce your FIRE duration by 2 years (just making up numbers).

Over time, you have now reached 70% of your FIRE goal, you need a new car, and now you reassess your situation and realise that if you upgrade to the newer car, it will only impact your FIRE duration by 3 months, something significantly more manageable so maybe you can easily justify the extra expense.

This is just one example of where you might reduce your expenses to look towards the future, there are countless other opportunities where we could increase our quality of life, and if we were sufficiently along our FIRE journey, then it would not have significant impacts for us to reach our FIRE target.

Conclusion

The closer you get to FIRE, the easier it will become to accumulate wealth. Over time, your contributions will mean less and less. This reality allows you to really enjoy your last couple years of your FIRE journey, increasing your quality of life and letting you spend more time doing things you enjoy rather than counting pennies.

I am over the halfway point of my FIRE journey, and I can already feel the power of my investments starting to take over my monthly contributions. For the moment, I am still working hard to reduce my spending as much as possible without sacrificing my quality of life. In a couple years or so, then I should really be on the final sprint towards FIRE. I am looking forward to really being able to open up the purse strings and start doing things that I have turned down in the past because of the cost.