Target Allocation and Rebalancing

When I first began investing in ETFs, I will completely admit that I went in quite blindly. I had read a little bit about it (mostly from The Barefoot Investor), but I had not carried out much of my own individual research into what was involved. In the end I jumped into the deep end and threw a chunk of money into A200 (a BetaShares ETF which tracks ASX200). Although I was a bit reckless, I could have done a whole lot worse and in the end, it has worked out fairly well for me.

The only issue is, I had no real investment plan in mind, I was just wanting to get money into ETFs as quickly as possible. At the time, I was bringing money back from the US and I knew I did not want it sitting in my savings account for long periods of time, so I put it into ETFs without too much thought.

Over a few months however, I realised that I needed to set up a bit of an investment plan, at least I needed to set up target allocations in my portfolio, something that matched with my personal risk profile and what I believe would provide me with a good level of diversification.

My Target Allocation

There are many different variables that you can define stocks and allocate accordingly. Small-cap to large-cap, geographical, by sector, defensive etc, the list is quite substantial. For me however, I will just stick with allocation by geographical. I have given myself the following categories and weightings:

Australia: 32.00%

International: 66.00%

Emerging: 2.00%

I am in no ways advocating for the above target allocation, it is just for my own personal preference. Whoever reads this will no doubt have their own opinion and that is fine, but I am completely fine with my target allocation at the moment. It may change and evolve over time, especially as I do get closer to retirement, but for now I am more than happy with this arrangement.

My Current Allocation

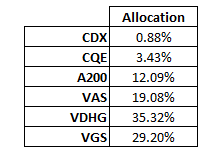

Currently I have the following:

CDX and CQE are individual Australian based stocks, the rest are ETFs between BetaShares and Vanguard.

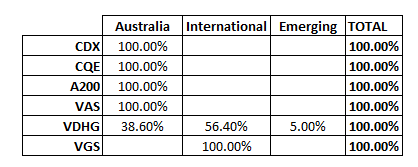

Next step is to look at these individual shares and ETFs, and see how they are allocated across my desired allocation.

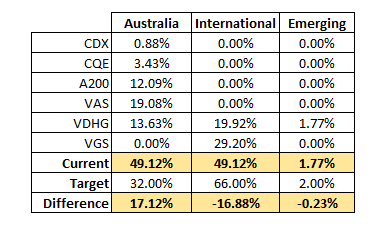

Using the above numbers, I can work out how my current allocation is, and how it compares to my target allocation. The table below shows the results:

It is a pure coincidence that Australia and International are both at 49.12% by the way. But overall you can see that my current allocation for Australia is significantly over the target, and conversely my current allocation for International is below the target.

Rebalancing Portfolio

Rebalancing is not tricky at all, you simply look at whichever allocation is furthest below the target allocation, and when you invest more funds, you choose the ETF/Stock which meets the required criteria. In my instance, next time I choose to invest more funds, I would be putting them into VGS as that is the furthest below my target allocation.

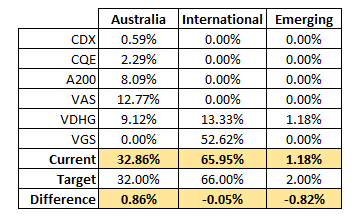

Example: If I had $110,000 to invest (large amount I know, but that is how far behind I am with my target allocation), I would deposit it into VGS. This would then give me the following allocations:

As you can see the numbers are just about in line with the target allocations. The allocation that is furthest from the target now is Emerging markets, unfortunately I do not have any ETFs in my current profile that directly target Emerging Markets, but I could always invest in something like VGE which directly invests in emerging markets to boost that allocation.

It is important to note that over time as ETFs rise and fall, the allocations will change without additional funds being invested. It is important to keep track yourself before you make a purchase to ensure it is still the one that is the furthest below the target allocation.

Summary

I have only provided an example of a target allocation that I have in my portfolio. There are limitless ways you can have an investment plan, and I am only trying to show you how to successfully rebalance a portfolio to meet a target allocation.

By creating a systematic way of rebalancing and contributing to your portfolio, you are able to remove emotion out of the investing process. It is important to trust the system you have developed for yourself, to remove the human impulse from the process.

Finally, I will say that just because you have an investment plan, that does not mean it is set in stone. Being flexible and adaptable is important because as your life and situations change, your investment plan can also change. Over time, you might find yourself gaining more knowledge (like myself for example), and if you feel that your current investment plan is no longer adequate, then it might be time to look at updating it to a more suitable plan.