Stock Selection – June 2021

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

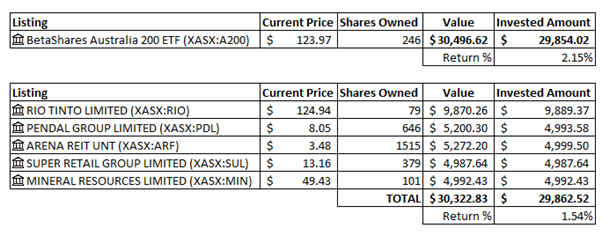

Current Performance

Shares Owned

39 Units of RIO – Current Price: $124.94

646 Units of PDL – Current Price: $8.05

1515 Units of ARF – Current Price: $3.48

This gives us a total value of $15,345.16 and our initial investment was $14,884.85.

Baseline Comparison

126 Shares of A200 – Current Price: $123.97

This gives us a total value of $15,620.22 and our initial investment was $14,977.62.

Active Return: 3.09%

Passive Return: 4.29%

Currently our active share investment is behind passively investing in an Index based ETF. However, this is still a long-term investment and 1 month of results is not long enough to determine any significant results.

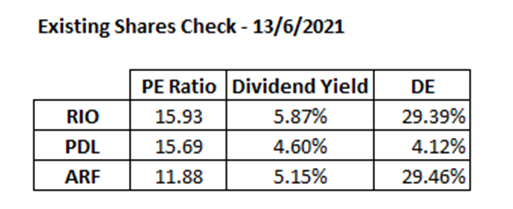

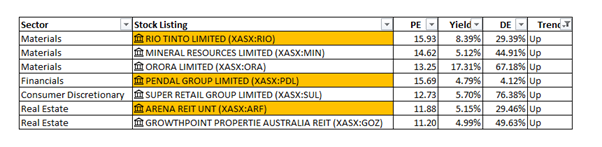

Checking Existing Holdings

Firstly, I want to check existing holdings to make sure they still meet the determined criteria:

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

The above table shows that the three share still meet the first three criteria.

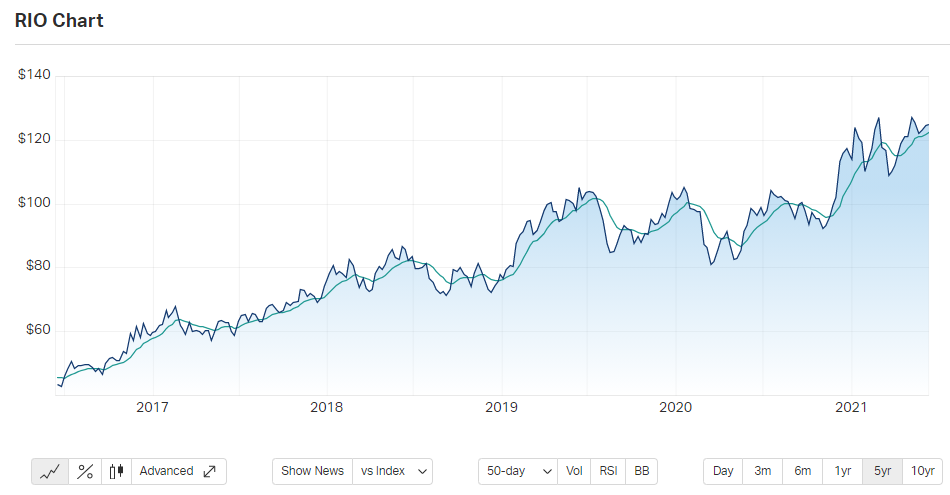

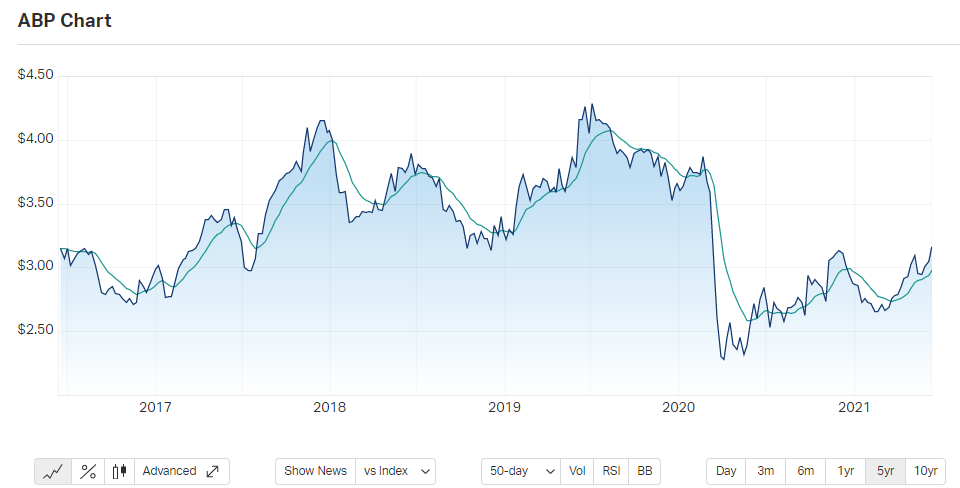

The results for the 4th Criteria are shown below:

All three stocks are still shown NOT to be in a downtrend. Therefore, they still meet the original criteria and do not need to be sold.

June 2021 Selection

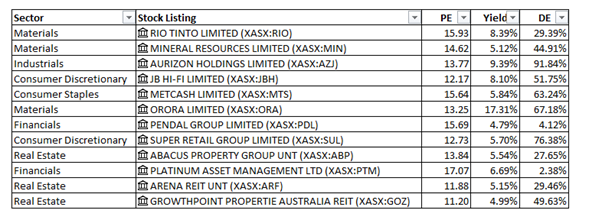

After going through the first three criteria, the following listings within the ASX200 meet the requirements.

I have also included the sector of each stock listing because that might be a consideration before selecting for diversity reasons.

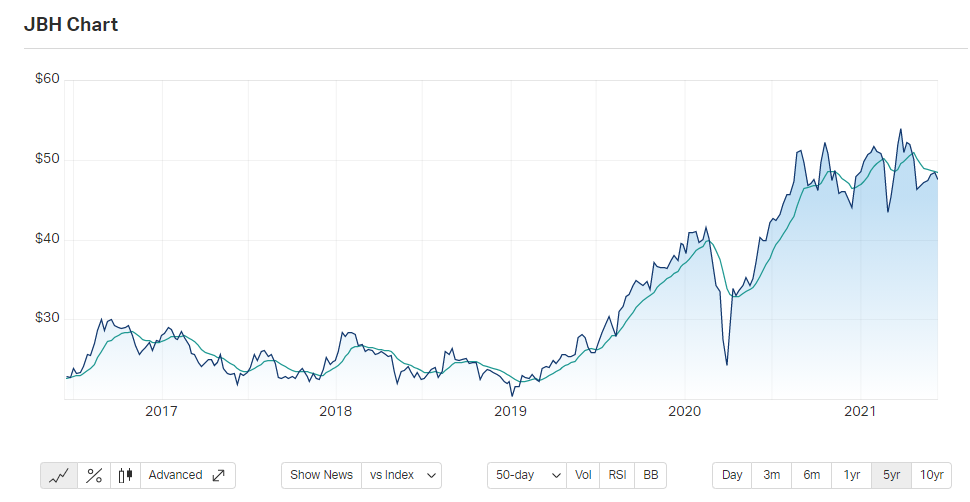

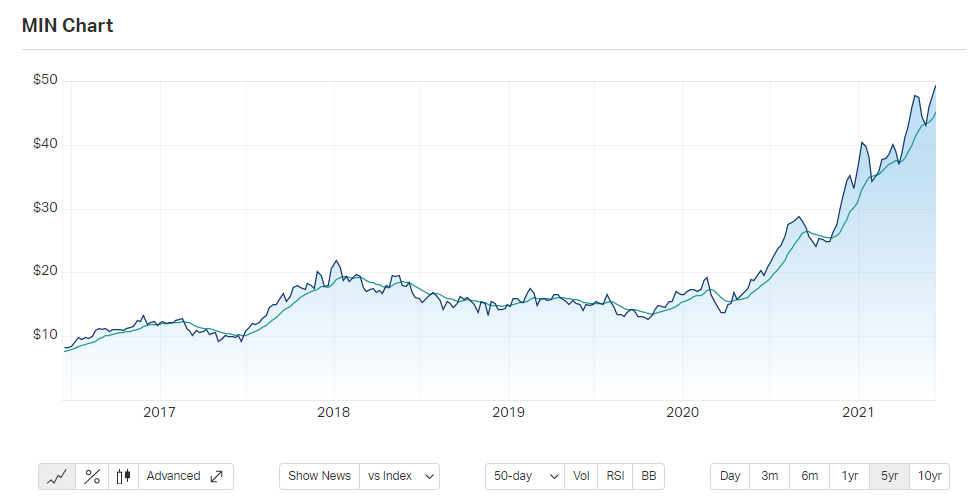

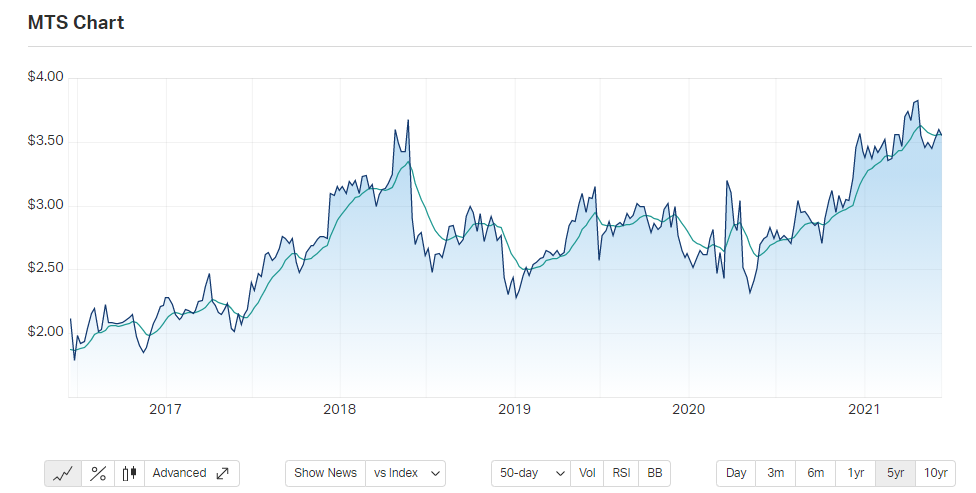

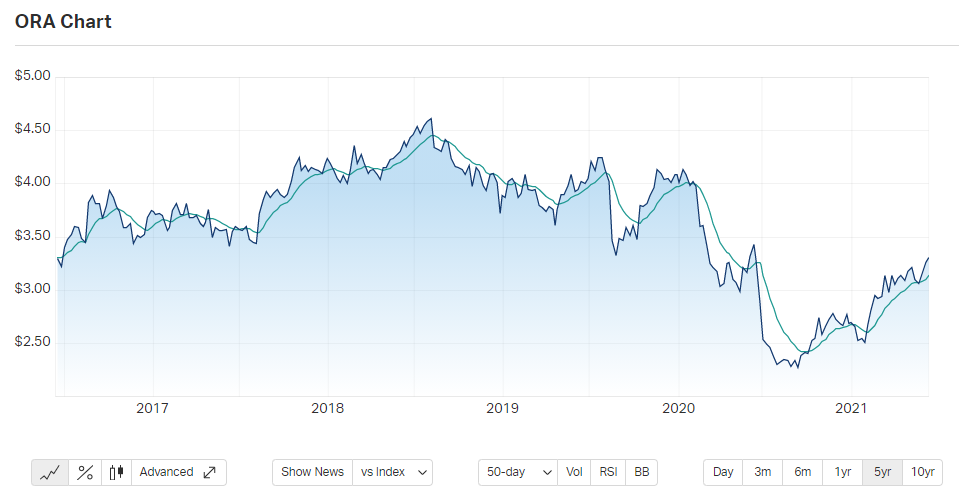

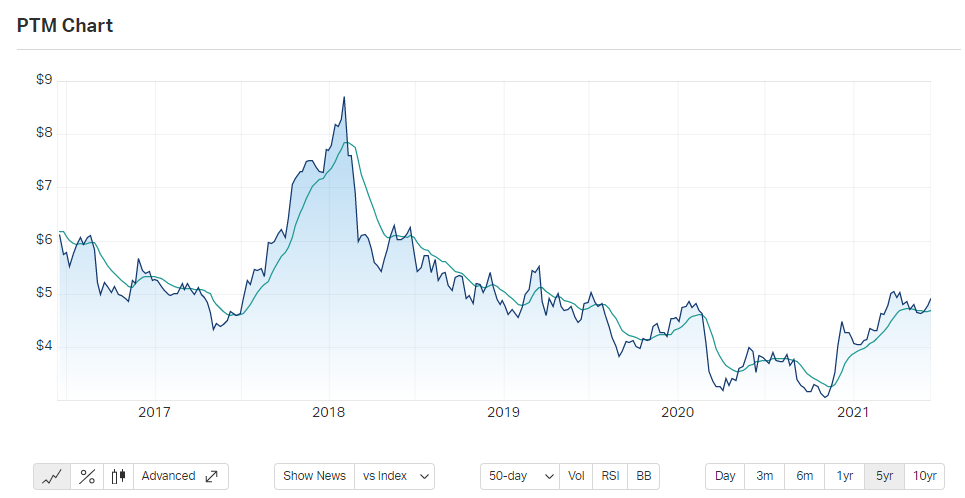

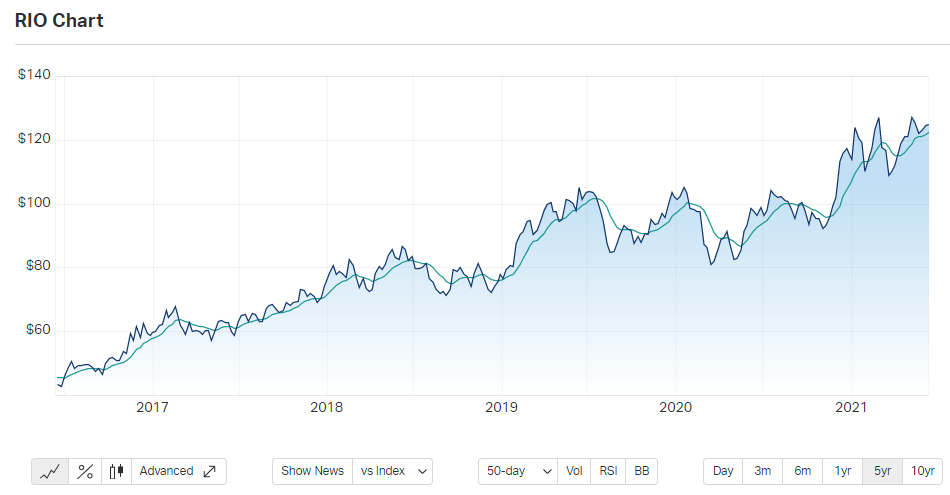

Below are the following charts as per the 4th Criteria:

Trend Summary

ABP: Upward/Sideways

ARF: Upward

AZJ: Downtrend

GOZ: Upward

JBH: Sideways

MIN: Upward

MTS: Upward/Sideways

ORA: Upward

PDL: Upward

PTM: Upward/Sideways

RIO: Upward

SUL: Upward

Based on the 4th criteria, the only listing I can eliminate is AZJ. It appears a lot of listings are in upward trends at the moment. Reminds me of the quote “in a rising tide, all ships float,” I guess this might make it easier to pick a listing as there is a good chance it will continue to rise at least in the short-medium term.

Given the number of listings meeting all the criteria, I will be a bit stricter and remove ABP, JBH, MTS and PTM as well as there was a bit of a sideways trend in their prices as well.

I am now left with the following (the highlighted listings are the ones I currently hold already).

Stock Selection

To provide some diversity, I will choose SUL as it is in a sector that I currently do not have any shares in.

- 379 Shares of SUL bought at $13.16 per share ($4,987.64 total)

I also was impressed by the chart for MIN, so that will be my second choice:

- 101 Shares of MIN bought at $49.43 per share ($4,992.43 total)

Finally, I will purchase more shares of RIO as they are still shown as a fundamentally strong share, and I believe there will be some gains in the future.

- 40 Shares of RIO bought at $124.94 per share ($4,997.60 total)

Comparison Purchase

- 120 shares of A200 bought at $123.97 per share ($14,876.40 total)

Summary of Holdings in the following table:

I believe when dividends start being received for the active investment side of things is where a significant improvement will be shown. Given I am filtering for shares that have a relatively high grossed up dividend, it should show a big jump in the returns for these shares.

I will continue doing this each month, reviewing, monitoring, and hypothetically purchasing more shares. I am not sure if this will provide any sort of benefit in terms of a better return compared to just investing passively, but it does not take too long and if it does provide good returns, it might be an interesting opportunity.