Stock Picking – September 2021

September 2021 – Individual Stock Selection

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

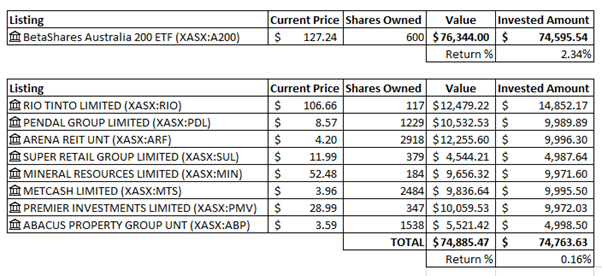

Current Performance

Shares Owned – As of 15/9/2021

117 Units of RIO – Current Price: $106.66

646 Units of PDL – Current Price: $8.57

2,918 Units of ARF – Current Price: $4.20

379 Units of SUL – Current Price: $11.99

184 Units of MIN – Current Price: $52.48

1,222 Units of MTS – Current Price: $3.96

175 Units of PMV – Current Price: $28.99

1,538 Units of ABP – Current Price: $3.59

This gives us a total value of $59,590.36 and our investment amount has been $59,783.52.

Baseline Comparison – As Of 14/9/2021

483 Shares of A200 – Current Price: $127.24

This gives us a total value of $6,456.92 and our investment amount has been $59.708.46

Active Return: 0.20%

Passive Return: 2.93%

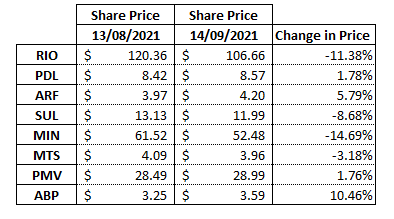

I was surprised to see the active return still in the positive as I thought it was a really bad month for some of the listings, going through them individually over the past month we can see the following:

As you can see there were some pretty significant losses in RIO, SUL and MIN over the past month. One positive is that there is a substantial dividend due for RIO later in September which will definitely be a welcome boost.

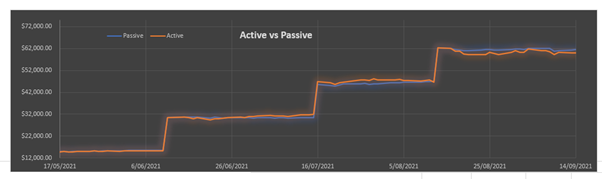

Graph Comparison

Each portfolio has been tracking relatively closely throughout the exercise so far although Passive investing has shown some slightly higher gains of late.

Checking Existing Holdings

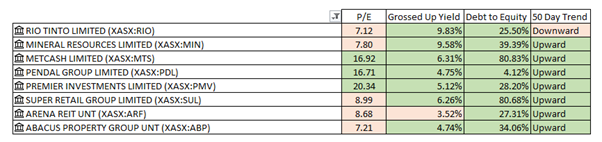

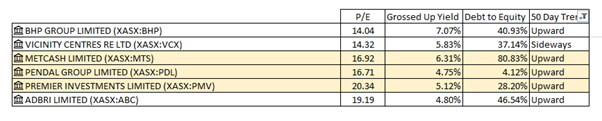

Firstly, I want to check existing holdings to make sure they still meet the determined criteria:

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

Above is a table summary of the required criteria.

There are quite a few that do not meet the P/E criteria, and ARF does not currently meet the grossed-up yield criteria.

Also, RIO does not currently meet the criteria for being in an upward trend, after the dividend is received later in the month, if it has not improved in price, I might look at offloading the stock.

Also, I know I mentioned that SUL and MIN also went down for the month, but both are still in an overall upward trend, but if the drop in price continues it may change the overall trend.

September 2021 Selection

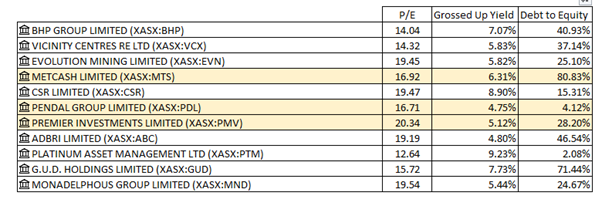

After going through the first three criteria, the following listings within the ASX200 meet the requirements.

It is a relatively quick way to narrow the 200 or so listings on the ASX200 down to 11 companies using those three criteria. The final criterion for each listing is shown below.

ABC looks to in an upward trend

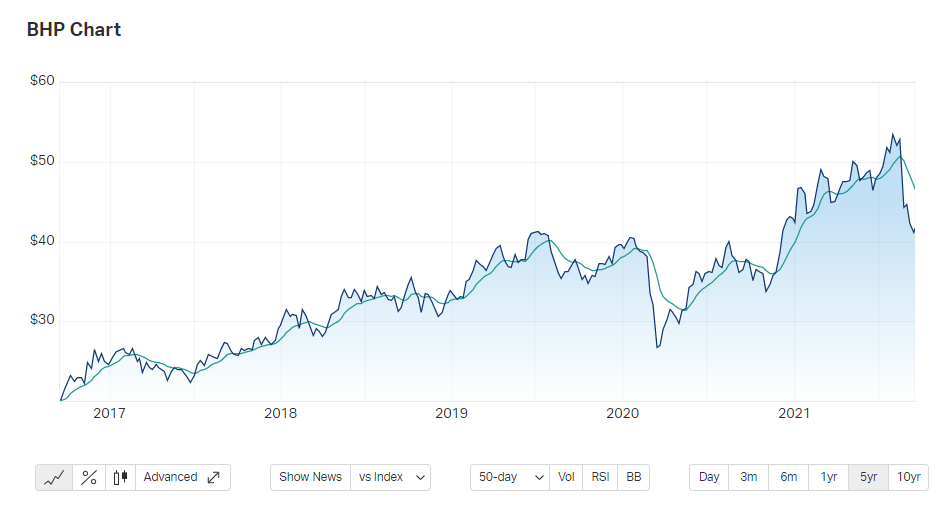

BHP is currently in a downward trend (similar to RIO)

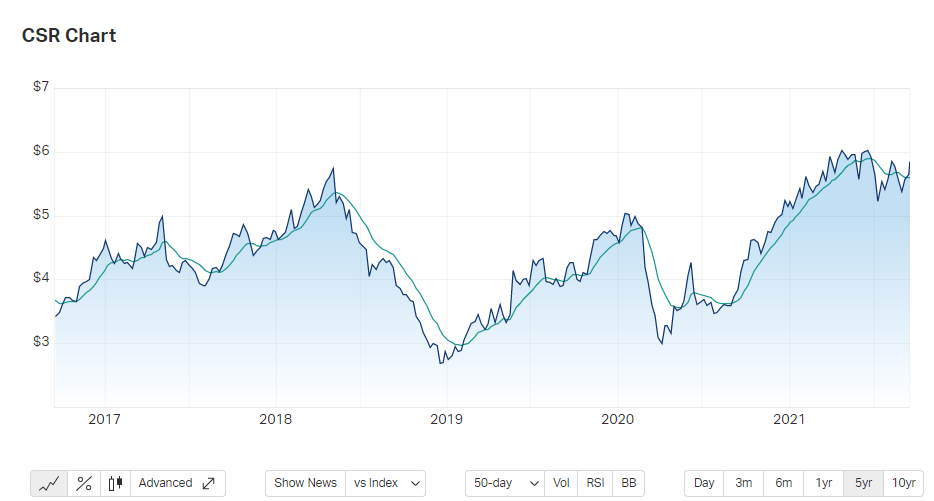

CSR is currently in a downward trend

EVN is currently in a downward trend

GUD is currently in a downward trend

MND is in a downward trend

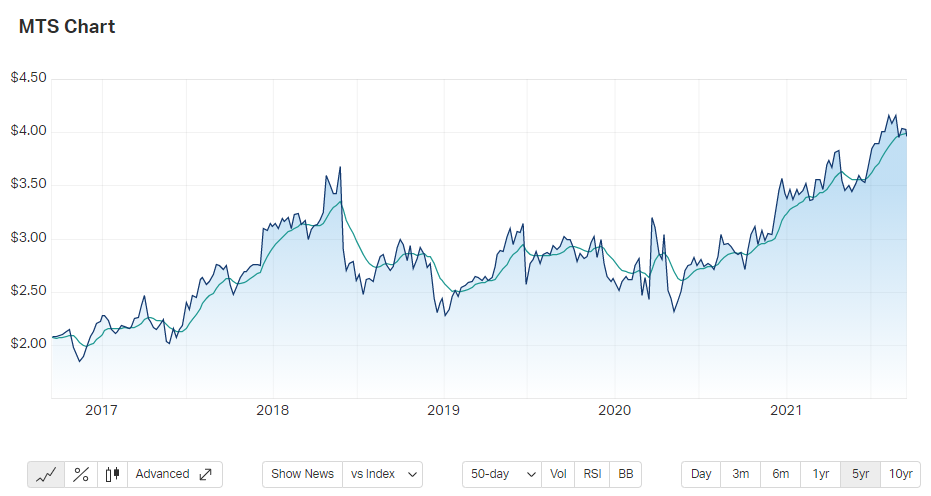

MTS is currently in an upward trend

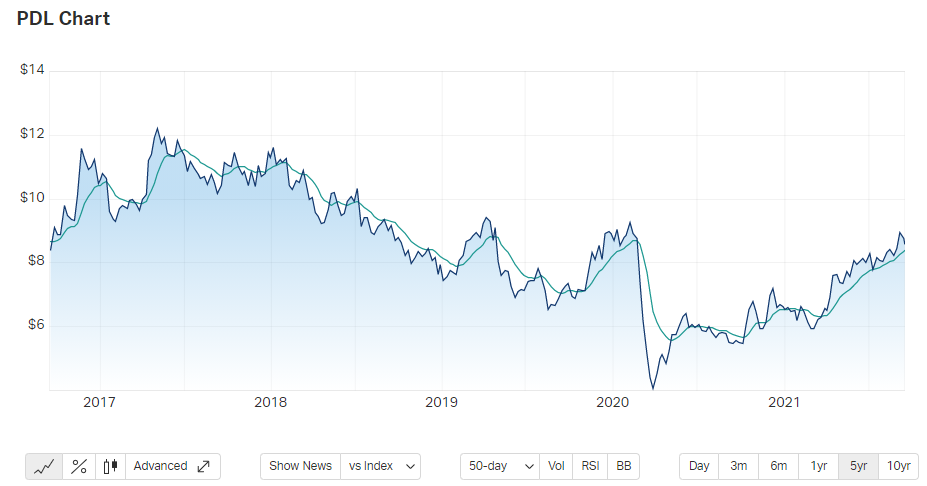

PDL is currently in an upward trend

PMV is currently in an upward trend

PTM is currently in a downward trend

VCX is currently in a sideways trend

Trend Summary

I have been able to eliminate the following Listings based on the trend:

- EVN

- CSR

- PTM

- GUD

- MDN

I am now left with the following (the highlighted listings are the ones I currently hold already).

Stock Selection

This can be difficult as there are still 6 different stocks to choose from, but I guess it could almost be a part where I am spoilt for choice as they are all good quality companies with strong fundamentals.

To keep the portfolio relatively simply, I might purchase shares I already own:

- 1,262 Shares of MTS bought at $3.96 per share ($4,997.52 total)

- 583 Shares of PDL bought at $8.57 per share ($4,996.31 total)

- 172 Shares of PMV bought at $28.99 per share ($4,986.28 total)

Comparison Purchase

117 shares of A200 bought at $127.24 per share ($14,887.08 total)

Summary of Holdings in the following table:

I will continue doing this each month, reviewing, monitoring, and hypothetically purchasing more shares. I am not sure if this will provide any sort of benefit in terms of a better return compared to just investing passively, but it does not take too long and if it does provide good returns, it might be an interesting opportunity.