Stock Picking – October 2021

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

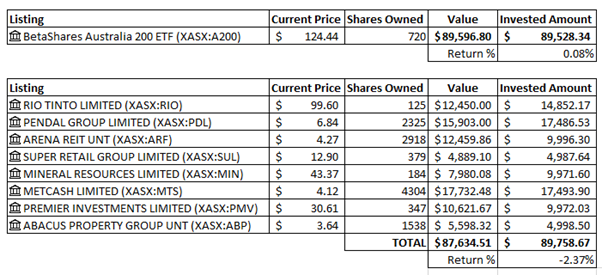

Current Performance

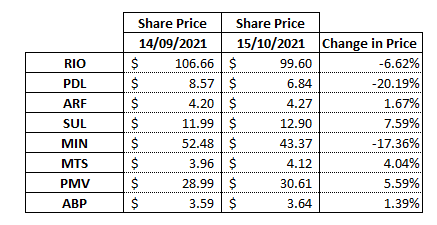

Shares Owned – As of 15/10/2021

125 Units of RIO – Current Price: $99.60

1,229 Units of PDL – Current Price: $6.84

2,918 Units of ARF – Current Price: $4.27

379 Units of SUL – Current Price: $12.90

184 Units of MIN – Current Price: $43.37

2,484 Units of MTS – Current Price: $4.12

347 Units of PMV – Current Price: $30.61

1,538 Units of ABP – Current Price: 3.64

This gives us a total value of $72,639.47 and our investment amount has been $74,763.63.

Baseline Comparison – As Of 14/9/2021

600 Shares of A200 – Current Price: $124.44

This gives us a total value of $74,644.00 and our investment amount has been $74,595.54

Active Return: -2.84%

Passive Return: 0.09%

There has still been a particularly bad month, especially for resource stocks (mainly RIO and MIN), there were some dividends paid out for RIO which did help, but not enough to still show a dramatic dip in some prices of individual stocks. PDL also showed a dramatic drop which was quite disappointing:

I was hoping that RIO and MIN had already bottomed out, but appears to not be the case. I still do not want to sell any of my shares within 12 months as part of this exercise so hopefully their prices do improve.

PDL showed a dramatic decrease in price on the last day of trading. It closed at $7.78 on 14/10/2021 and then shortly after opening it was down to $6.90. There were some notifications on the 14/10/2021 and 15/10/2021 which no doubt impacted the price accordingly.

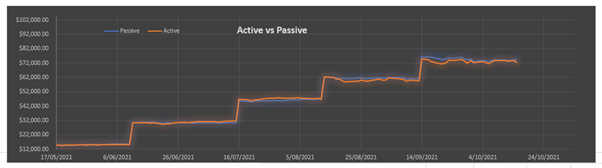

Graph Comparison

Each portfolio has been tracking relatively closely throughout the exercise so far although Passive investing has shown some slightly higher gains of late.

Checking Existing Holdings

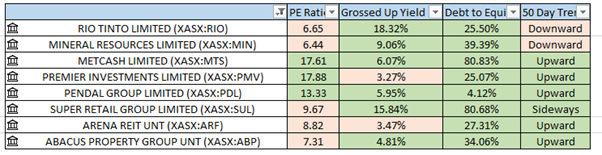

Firstly, I want to check existing holdings to make sure they still meet the determined criteria:

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

Above is a table summary of the required criteria.

There are quite a few that do not meet the P/E criteria, and ARF and PMV do not currently meet the grossed-up yield criteria.

Also, RIO and MIN do not currently meet the criteria for being in an upward trend. I will keep an eye on PDL as well as there was a dramatic drop in the price after the recent announcements so hopefully it does not turn into a long-term trend.

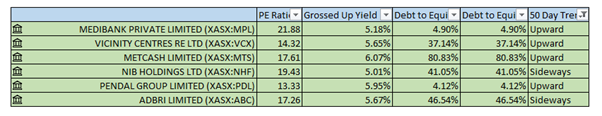

October 2021 Selection

After going through the 4 criteria, I am left with the remaining options to select. It is interesting that even in a month where the overall trend has been downward, there are still some decent performing individual stocks.

Stock Selection

This can be difficult as there are still 6 different stocks to choose from, but I guess it could almost be a part where I am spoilt for choice as they are all good quality companies with strong fundamentals.

To keep the portfolio relatively simply, I might purchase shares I already own:

- 1,820 Shares of MTS bought at $4.12 per share ($7,498.64 total)

- 1,096 Shares of PDL bought at $6.84 per share ($7,496.64 total)

Comparison Purchase

120 shares of A200 bought at $124.44 per share ($14,932.80 total)

Summary of Holdings in the following table:

I will continue doing this each month, reviewing, monitoring, and hypothetically purchasing more shares. I am not sure if this will provide any sort of benefit in terms of a better return compared to just investing passively, but it does not take too long and if it does provide good returns, it might be an interesting opportunity.