Stock Picking – November 2021

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

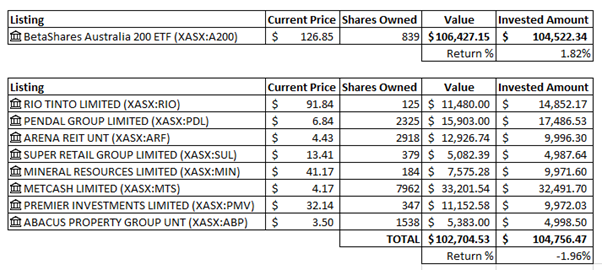

Current Performance

Shares Owned – As of 15/11/2021

125 Units of RIO – Current Price: $91.84

2,325 Units of PDL – Current Price: $6.84

2,918 Units of ARF – Current Price: $4.43

379 Units of SUL – Current Price: $13.41

184 Units of MIN – Current Price: $41.17

4,304 Units of MTS – Current Price: $4.17

347 Units of PMV – Current Price: $32.14

1,538 Units of ABP – Current Price: 350

This gives us a total value of $87,450.67 and our investment amount has been $$89,758.67.

Baseline Comparison – As Of 15/11/2021

720 Shares of A200 – Current Price: $126.85

This gives us a total value of $91,332.00 and our investment amount has been $89,528.34

Active Return: -2.57%

Passive Return: 2.01%

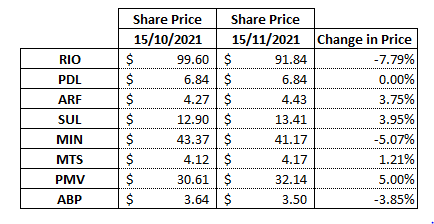

There has been another poor month particularly for RIO and MIN as the mining sector continues to take a significant hit. ABP also had a bit of a down month, but apart from that the other individual listings performed relatively well:

I was hoping that RIO and MIN had already bottomed out, but appears to not be the case. I still do not want to sell any of my shares within 12 months as part of this exercise so hopefully their prices do improve.

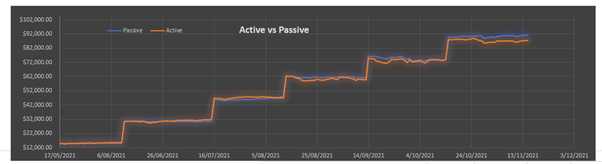

Graph Comparison

This is the first time there has been a significant gap open up between passive and active investing, with passive investing showing a much higher return at the moment.

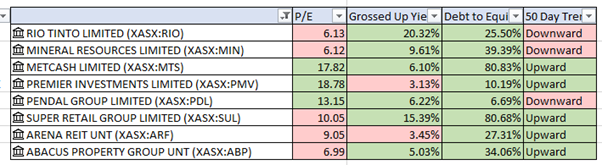

Checking Existing Holdings

Firstly, I want to check existing holdings to make sure they still meet the determined criteria:

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

Above is a table summary of the required criteria.

Each month there seems to be more and more red on this chart, I guess that would make sense as over time it is likely that listings will fall outside of the parameters. My main concern is still RIO and MIN as the materials sector seems to be hurting hard at the moment. I guess for the moment all I can do is hope they are able to recover.

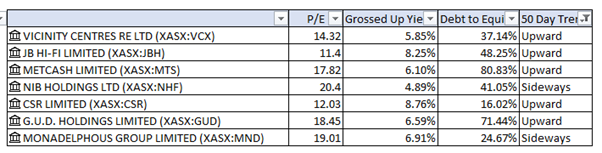

November 2021 Selection

After going through the 4 criteria, I am left with the remaining options to select.

Stock Selection

I am left with only one option of an existing stock that I already own, and as I would prefer to limit the number of holdings that I currently own (even hypothetically) I guess it means I am left with no choice but to purchase MTS.

- 3,658 Shares of MTS bought at $4.10 per share ($14,997.80 total)

Comparison Purchase

119 shares of A200 bought at $126.00 per share ($14,994.00 total)

Summary of Holdings in the following table:

I know it has been shown in studies before that passive investing typically wins out against active investing. But it is nice to see for it myself that for the time being it appears to be the case. I guess it does help reinforce the argument for passive investing. The interesting thing is that you are literally rewarded for doing less work. Passive investing requires significantly less work compared to active investing, and if the returns are not only the same, but better, it really makes the decision easier.

It is still early days however; I will continue with my little experiment to see what happens over a longer period of time.