Stock Picking – January 2022

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

I have started to use Sharesight to keep track of all the returns instead of just keeping track of it myself on Excel. I have done this mainly because of simplicity, as I can miss dividends if I am keeping track of it myself, and it is easier if all the calculations are done for me.

However, since I am only going to be using the free version of Sharesight, it means I am limited to 10 holdings (which will mean 9 individual holdings after the baseline scenario is held). At the moment I currently have 9 individual holdings.

Since it is only hypothetical at the moment, I am not going to spend money on Sharesight, I am only going to look at the current listings I have to determine which holding meet the criteria for me to potentially purchase more of. Although, I will also start looking at selling listings if they are no longer meeting the criteria. When this happens, then I will review all the holdings in the A200 to determine a suitable replacement.

Current Performance

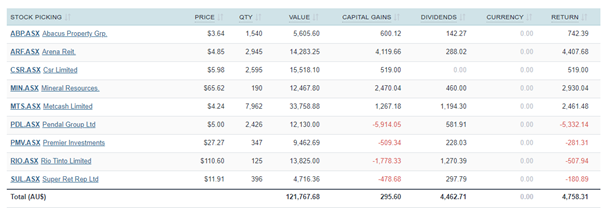

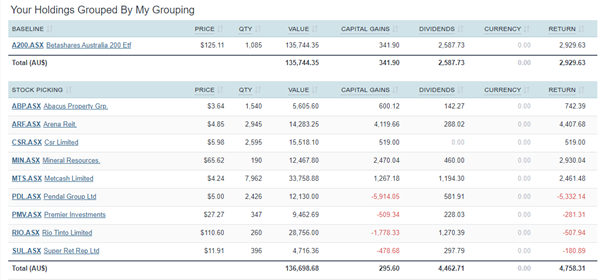

Shares Owned – As of 15/1/2022

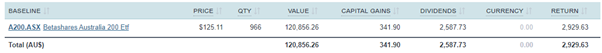

Baseline Comparison – As Of 15/1/2022

Currently Stock Picking is slightly ahead overall, but they are relatively close.

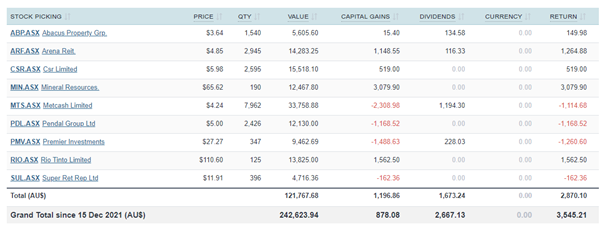

The following table shows the results over just the past month

MIN and RIO have been strong performers, finally making up some lost ground from a while ago. PDL continues to be disappointing, and PMV and MTS also had poor months.

Checking Existing Holdings

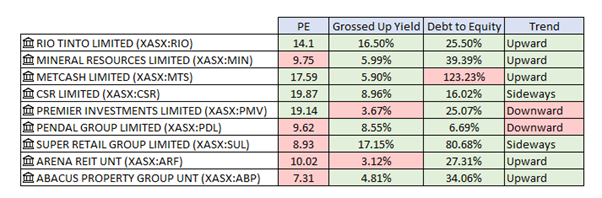

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

Above is a table summary of the required criteria.

January 2022 Selection

The only option that currently fits all the criteria out of my current holdings is RIO.

I will keep an eye on PMV and PDL over the next month, if they are still missing 2 of the required criteria, then I will sell both of these listings. ARF is also missing 2 of the required criteria, but they are not far off the required PE ratio of 11, and their price is still trending upwards at least.

Stock Selection

I will make the following selection:

- 135 shares of RIO at $110.60 per share for $14,931.00

My comparison purchase will be 119 shares of A200 at $125.11 per share for $14,888.09

Summary of Holdings in the following table:

I hope that using Sharesight will simplify things for me in the long run. It is not perfect as I cannot obtain a per annum return of each of the groups, but it is still pretty handy. If I had a paid version I could split up the portfolios and then I would be able to achieve this.

I am looking forward to testing out potential trading rather than just buying and holding as I feel this could be interesting in what the returns start to look like after a while.