Stock Picking – December 2021

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

Current Performance

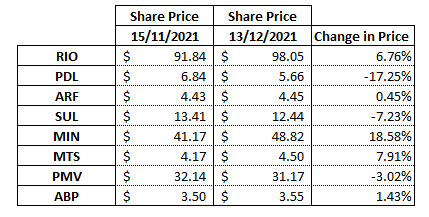

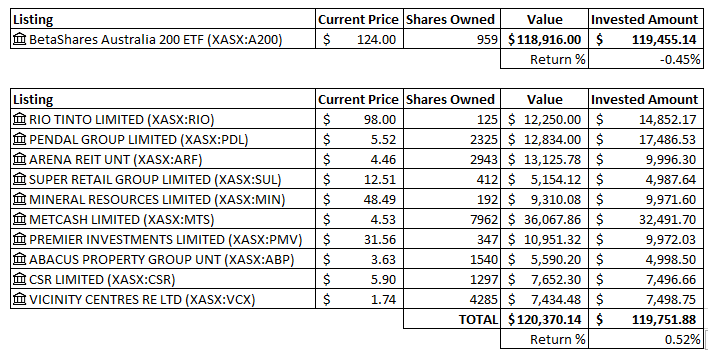

Shares Owned – As of 14/12/2021

125 Units of RIO – Current Price: $98.05

2,325 Units of PDL – Current Price: $5.66

2,943 Units of ARF – Current Price: $4.45

412 Units of SUL – Current Price: $12.44

192 Units of MIN – Current Price: $48.82

7,962 Units of MTS – Current Price: $4.50

347 Units of PMV – Current Price: $31.17

1,540 Units of ABP – Current Price: 3.55

This gives us a total value of $105,122.81 and our investment amount has been $104,756.47.

Baseline Comparison – As Of 14/12/2021

839 Shares of A200 – Current Price: $124.44

This gives us a total value of $105,210.60 and our investment amount has been $104,522.34

Active Return: +0.35%

Passive Return: +0.66%

I will start out by saying that I had actually missed some dividends that would have been paid out on my active share purchases, so my previous months were off slightly, but the numbers above are accurate and include all dividends that would have been reinvested.

There have been some decent gains over the past couple of weeks with my active investments, which were falling well behind the passive investments but now they are currently sitting almost equal.

RIO and MIN were the big gains for the past month, which I was hoping would happen for a while now. Still a long way to recover from where they were but definitely an improvement. MTS also had a particularly good month.

PDL and SUL both performed particularly poorly for the past month which is disappointing.

PDL has been particularly poor the past couple of months, where it was at $7.78 on 14/10/2021 and it is now down to $5.66 just 2 months later.

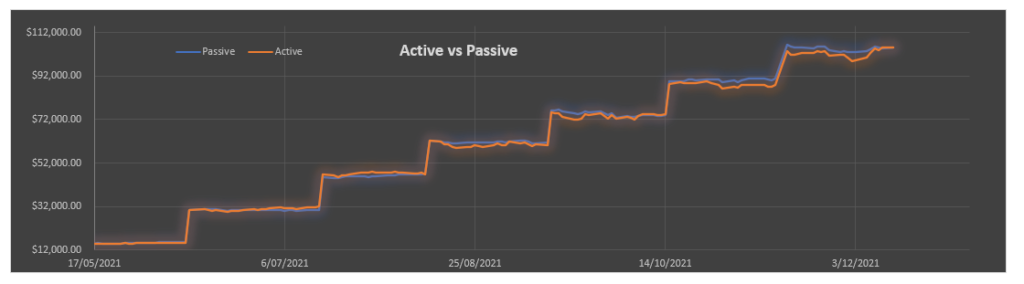

Graph Comparison

As you can see a few weeks ago there was a bit of a gap opening up between Passive and Active, but it closed relatively quickly and they are now just about on top of each other again.

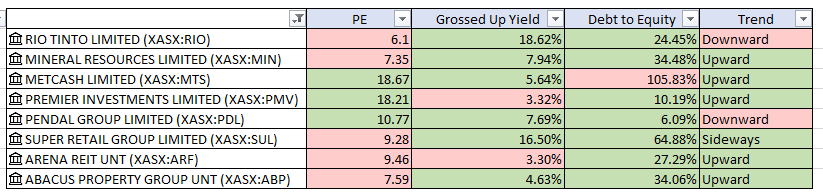

Checking Existing Holdings

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

Above is a table summary of the required criteria.

A few of the holdings seem to have slipped out of the PE criteria which I am quite surprised about to be honest. I am not too concerned about the Yield and Debt to Equity ratios, but the PE criteria is definitely surprising.

I believe RIO has hit a bit of a trough and is ready to bounce back, at least I am hoping so anyway. PDL continues to be a bit of a concern as the price seems to be in a bit of a freefall at the moment, hopefully it is able to recover soon.

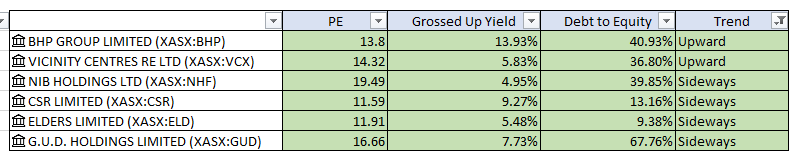

December 2021 Selection

After going through the 4 criteria, I am left with the remaining options to select. There is a lot less selection than I usually have at this stage. And there were only two holdings which had “upward” trends, typically it has been a lot more than this.

It appears we are going through a relatively flat patch in the market.

Stock Selection

I was hoping to be able to keep purchasing existing holdings, but since none of my existing ones meet the criteria, I will have to expand my holdings it appears.

I will make the following selection:

- 1,297 shares of CSR at $5.78 per share for $7,496.66

- 4,285 shares of VCX at $1.75 per share for $7,498.75

I chose CSR because I have seen it showing up while doing my picks the last couple of months and it seems to be a fairly consistent performer. VCX has also shown to be a consistent performer, and given it is in an upward trend. I did not want to go with BHP because I already have a fairly considerable weighting of minerals with my RIO and MIN shares.

My comparison purchase will be 120 shares of A200 at $124.44 per share for $14,932.80

Summary of Holdings in the following table:

I will note that I started doing this month’s selection a couple of days ago, so there has been some price difference between now and then. It appears now that the active investment is slightly ahead of the passive investment.

I will continue doing this each month, reviewing, monitoring, and hypothetically purchasing more shares. I am not sure if this will provide any sort of benefit in terms of a better return compared to just investing passively, but it does not take too long and if it does provide good returns, it might be an interesting opportunity.