Stock Picking – August 2021

Each month I will be hypothetically picking individual shares to invest with using a pre-determined criteria outlined in this POST.

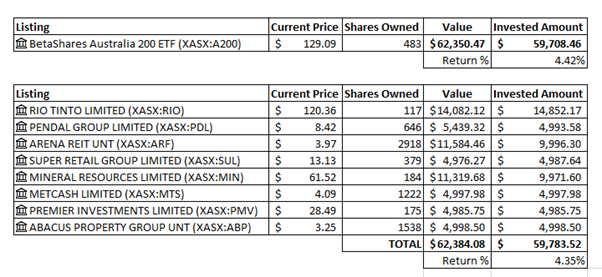

Current Performance

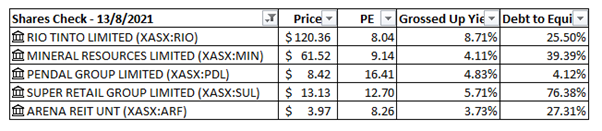

Shares Owned – As of 13/8/2021

79 Units of RIO – Current Price: $120.36

646 Units of PDL – Current Price: $8.42

1515 Units of ARF – Current Price: $3.97

379 Units of SUL – Current Price: $13.13

101 Units of MIN – Current Price: $61.52

This gives us a total value of $47,401.85 and our initial investment was $44,801.29.

DRP Summary

15 shares for ARF were purchased using DRP on 5/8/2021 (these are included in the above)

Baseline Comparison – As Of 13/8/2021

367 Shares of A200 – Current Price: $129.09

This gives us a total value of $47,376.03 and our initial investment was $44,734.02.

DRP Summary

1 share for A200 was purchased using DRP on 16/7/2021 (this is included in the above)

Active Return: 5.80%

Passive Return: 5.91%

There has been some slight movement in our active portfolio this month and no longer is it ahead of the passive return, although it is still very close. I will also mention that there was a very large dividend announced for RIO to be paid out on 23/9/2021. This saw a drop in the share price of $9.00 (almost 7.00% of the share price), this number is slightly more than the payout of $7.50 per share.

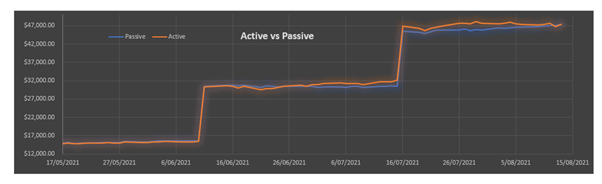

Graph Comparison

Each portfolio has been tracking relatively closely throughout the exercise so far, although prior to the drop in the RIO price due to the dividend announcement the passive return was a fair bit less than the active return at the same time.

Checking Existing Holdings

Firstly, I want to check existing holdings to make sure they still meet the determined criteria:

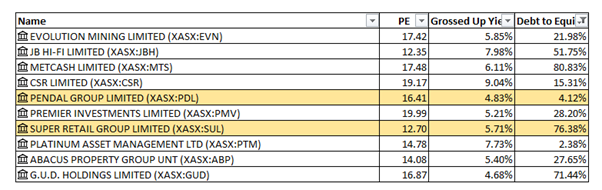

1st Criteria: PE Ratio between 11 and 22

2nd Criteria: Grossed Up Yield over 4.50%

3rd Criteria: Maximum Debt to Equity Ratio less than 100%

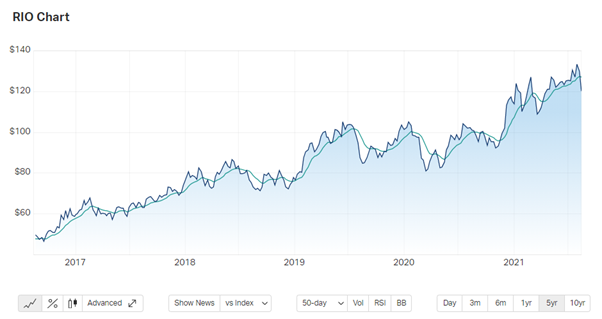

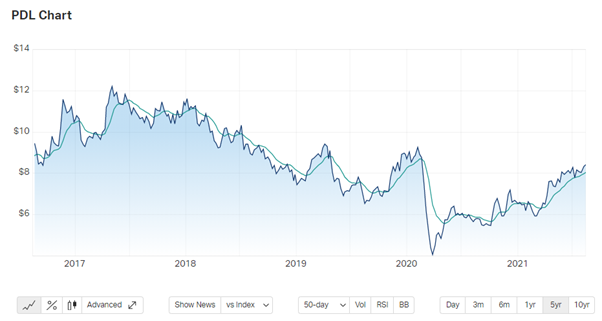

4th Criteria: 50-day SMA on a five-year chart showing the price not in a downtrend

I am not sure if it is something to do with the new financial year, but there are now quite a few issues with the shares meeting the requirements.

RIO, MIN and ARF all do not meet the 1st Criteria (although they are not too far away)

MIN and ARF do not meet the 2nd Criteria

I will not be selling any shares if I have owned them for less than 12 months, but I will keep an eye on these particular share and hope they do improve by next time.

The results for the 4th Criteria are shown below:

All the currently owned shares meet the 4th Criteria.

August 2021 Selection

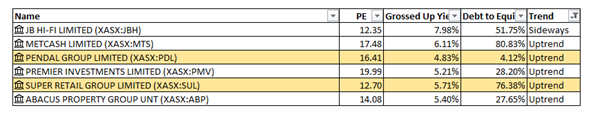

After going through the first three criteria, the following listings within the ASX200 meet the requirements.

It is a relatively quick way to narrow the 200 or so listings on the ASX200 down to 10 companies using those three criteria. The final criterion for each listing is shown below.

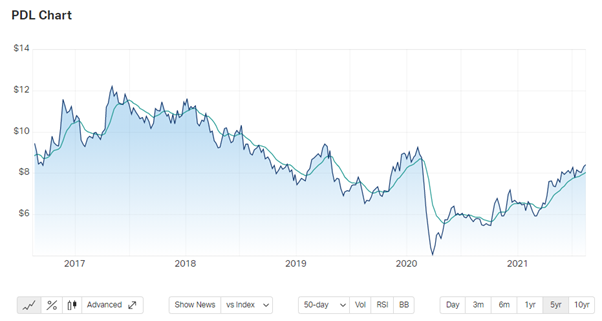

PDL was confirmed in our existing holdings to still meet the criteria, as you can see it is still in an uptrend.

SUL looks to be in a solid uptrend at the moment. Last month there was the hint of a downtrend right at the end, but it picked up and continued in a positive direction.

EVN is in a downtrend at the moment

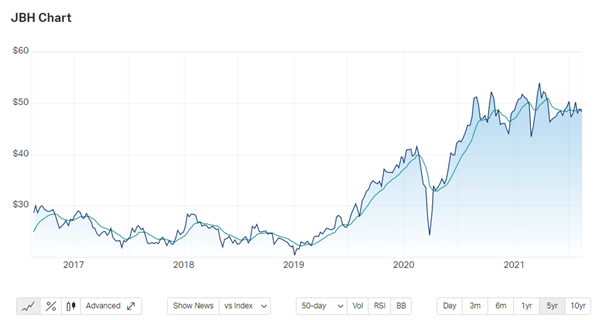

JBH is in a sideways trend at the moment

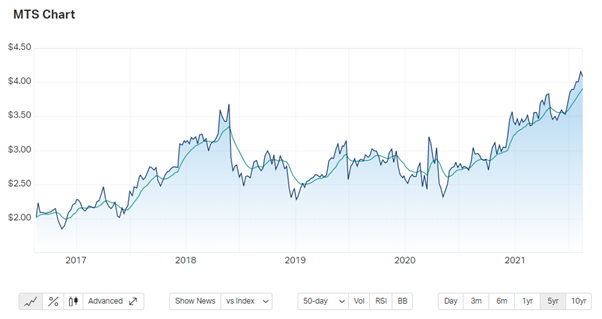

MTS is currently in a solid uptrend

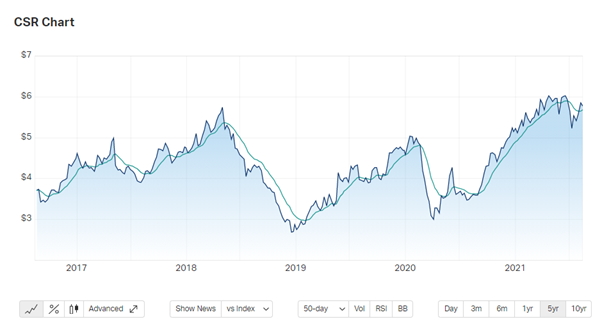

CSR is mostly in an uptrend but there is a slight dip just recently, I would not allow this to meet my criteria.

PMV is a bit up and down lately, but overall appears to be in a uptrend currently

PTM is in a downtrend currently

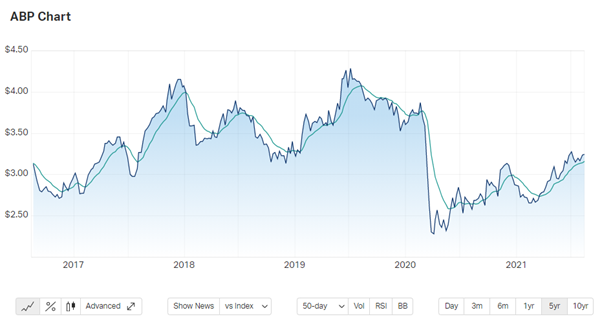

ABP is in a uptrend since the start of the year

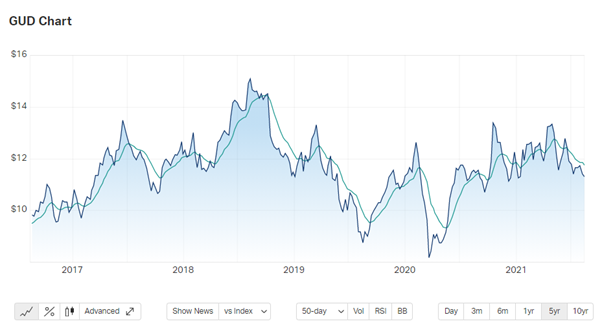

GUD is in a downtrend at the moment, this would not meet my criteria.

Trend Summary

I have been able to eliminate the following Listings based on the trend:

- EVN

- CSR

- PTM

- GUD

I am now left with the following (the highlighted listings are the ones I currently hold already).

Stock Selection

This can be difficult as there are still 6 different stocks to choose from, but I guess it could almost be a part where I am spoilt for choice as they are all good quality companies with strong fundamentals.

I will select the following, mostly to add some diversity to my current portfolio:

- 1,222 Shares of MTS bought at $4.09 per share ($4,997.98 total)

- 175 Shares of PMV bought at $28.49 per share ($4,985.75 total)

- 1,538 Shares of ABP bought at $3.25 per share ($4,998.50 total)

Comparison Purchase

116 shares of A200 bought at $129.09 per share ($14,974.44 total)

Summary of Holdings in the following table:

I will continue doing this each month, reviewing, monitoring, and hypothetically purchasing more shares. I am not sure if this will provide any sort of benefit in terms of a better return compared to just investing passively, but it does not take too long and if it does provide good returns, it might be an interesting opportunity.

I will limit the overall number of individual shares to 10, I think trying to keep track of any more than that will become overly cumbersome, especially since this is only a hypothetical exercise!