Renting Vs Buying

This seems to be a question asked every other day on any financial or property forum, is it better to rent or buy. And every time it is asked you hear the same arguments from both sides:

Property People – “you have to buy, rent is just dead money, think of the growth”

Rent People – “you would be stupid to buy, it is too expensive, save money and rent”

It seems the arguments could go for days on end with no clear result on who is right and who is wrong. And that is because there is no one answer, each person is different, and they will have different needs and situations. For some people buying is a better option, and for others renting might be a better option.

There are also a couple of myths that need to be dispelled before jumping in too far into the argument, the main ones are the following:

- Property is too expensive to buy

- Property prices always go up

As we go through the pros and cons of each option, we will also show that the above are not always true.

Advantages of Renting

- Renting is typically cheaper than owning a property. Especially if you live in a major city where rental yields are typically quite low. I will go through the full costs later in a numerical comparison for each situation.

- Taking on any debt is not fun, and mortgage debt is most likely the biggest you will ever take on in your life. Avoiding it can be an advantage (although some might argue that taking on debt for a property is actually an advantage, more on this later)

- Because you are saving money by not buying, your investment portfolio is growing nicely, instead of relying on capital growth, you are able to tap into the additional financial benefit a lot easier

- You can move a lot easier if you want to, once the lease is up it is no issue to move to a new rental property, if you move into a place and soon find out you are not happy in the area you can just up and move. A lot more difficult if you buy a place. Also, with prices changing by suburb, you can keep your eye on cheaper areas over the years of renting and move when needed to keep your costs down.

- More predictable expenses allowing you to budget a lot easier without having to worry about large unexpected maintenance or repair costs.

- Flexibility to downsize in the future, if you live with your family and over the years they move out, it is easy to move to a smaller more manageable place when you no longer need the extra bedrooms

- You do not need the large cash savings for a deposit, you can effectively start renting right away without needing to spend months/years saving. Not to mention stamp duty and purchasing costs

- Because of the flexibility, you can try different areas before you buy something more permanent. You can see if you like the area, the city, the lifestyle. If it doesn’t suit you then it is no issue to move and try somewhere else.

Advantages of Buying

- Owning a home allows for more modifying the property to suit your needs. You do not need to ask the landlord to paint rooms, hang pictures, have pets etc.

- You do not have to be worried about the landlord forcing you to move if they decide to sell the property or suddenly take it off the rental market

- A mortgage is a great way to be forced to save, you are locked in to making these repayments every month (or fortnightly, whatever you choose to do) and each repayment is putting more equity into your home

- Owning and living in your own PPOR will allow you to avoid Capital Gains Tax if you do decide to sell down the line. This could be a significant advantage down the line

- Once the mortgage is paid off, you effectively have no more living expenses (apart from rates, insurance, maintenance and repairs) but your overall expenses will drop significantly when the mortgage stops.

- There is an intangible benefit that comes with living in the same home, having your family grow up in it with all the memories. This can happen with a rental but is much more common in an owned property

- Typically it is a good long term investment, even if there are short term price reductions in the market, overall in the long term (20 years and more) you SHOULD see a substantial increase in your property value over time.

A lot of the disadvantages for each option are basically the inverse of the advantages of the alternate option so I do not really need to get into them. But as you can see each option has merit. What I like to typically do next is to at least look at the financial impact of each option. There are a lot of variables that need to be taken into account but with some assumptions we should be able to get a decent picture on what the differences might look like.

What do I do ?

For what it is worth, I currently rent where I am living. I moved to this area in North West Sydney just over 12 months ago, and I was not sure if I would like the area or not so I decided that renting would be a good option to test the area to see if I did enjoy it here or not. As it happens, I do enjoy it here, but will I buy a property here? Well, at the moment I do not believe so.

The next property I buy is the one I plan on retiring in, and currently I do not plan on retiring in Sydney. Mainly because the house prices are expensive, and because I will be retired, I do not need to be close to work so there is no real reason for me to stay in Sydney. I have not decided where I want to buy yet but I have some time left to figure that out.

I have lived in my own PPOR before (twice actually) and it definitely has it’s benefits. One place I was able to carry out all the renovations I wanted to suit what I wanted and it was really great. In the long term I definitely do plan on buying and living in a PPOR, but for the mean time I am definitely happy renting.

Financial Comparison

For this example, I will compare the following two scenarios:

- Buy a PPOR (any additional money after property expenses to be invested into shares)

- Rent and Invest in shares

Common Inputs

- Initial Savings: $100,000

- Weekly Savings: $800.00 (this does not include any rent)

- Return from Shares: 7.00% per annum

- Marginal Tax Rate: 45.00% (this will come into play for CGT implications)

PPOR Inputs

- House Price: $650,000

- Stamp Duty: $25,000 (plenty of online calculators available to check, this number is for a property in NSW)

- Purchasing Costs: $2,000 (including conveyancing and mortgage fees)

- Land Rates: $300.00 per quarter

- Water Rates: $250.00 per quarter

- Maintenance and Repairs: $2,000 per annum

- Home and Contents Insurance: $1,500 per annum

- Capital Appreciation of Property: 2.50% (this is the most important number when it comes to financial comparisons)

- Additional Repayments: $500.00 per month

- Selling Fees: 3.00% of property value (required to calculate the ‘liquid’ value of the asset

- Interest Rate: 2.50% per annum

Rental Inputs

- Rent Paid: $500.00 per week (this represents a 4.00% yield for a $650,000 property)

- Tenant Insurance: $600 per annum (not compulsory but if you have valuable items it is worth looking into)

- Rental Appreciation: 2.50% per annum (price of rent growth over time)

I should also mention that if you were continuing to rent instead of buying a property, then you typically might be able to rent a property that would be cheaper to rent than the equivalent rental value of a property you might buy. I will show you later but the amount of rent paid is very sensitive and can really determine how much your investment portfolio can grow over time.

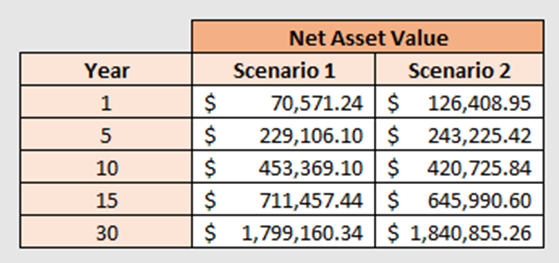

Results

Results after 1 Year

Remember we started off with a net asset value of $100,000 as this was our initial savings

Scenario 1) – Net Value: $70,571.24

Scenario 2) – Net Value: $121,052.83

As you can see, renting is a clear winner, and the main reason for this is because of stamp duty and purchasing costs. Before you even start you are already $27,000 behind. The rest of the loss is eaten up in hypothetical selling fees. Remember this is the liquid value assuming the property was sold.

Over the following years you will see the power of capital growth and leverage to see a significant growth in the net asset value of Scenario 1.

Results after 5 Years

Scenario 1) – Net Value: $229,106.10

Scenario 2) – Net Value: $211,739.56

Now the power of leveraging has really kicked in and the property growth has started to become significant. Over 5 years the property value has gone from $650,000 up to almost $720,000. The growth figure of 2.50% is really crucial here as it will greatly affect this number and the overall net asset value for Scenario 1.

Results after 10 Years

Scenario 1) – Net Value: $453,369.10

Scenario 2) – Net Value: $343.035.71

The difference between each scenario has grown to over $110,000! And that is all down to the power of leveraging. I won’t go into the details, but after 30 years using the same parameters the difference between Scenario 1 and Scenario 2 is almost $550,000! Even though most of this asset value is tied up in your house, it is still a nice buffer to have. Not to mention that after 30 years you no longer have to pay any more mortgage repayments (actually with the extra repayments of $500 per month the property is actually paid off after 23 years)

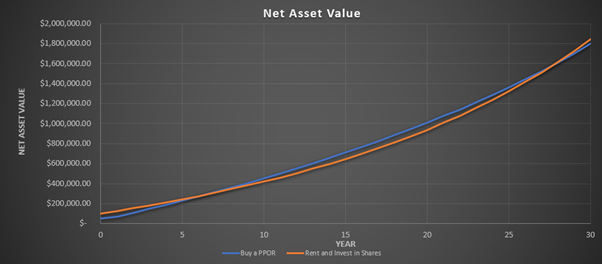

But remember I told you how sensitive your rent paid was? Well let’s use all the same inputs but change the rent paid in Scenario 2 from $500 per week down to $400 per week. I won’t go through everything in detail but the results are as follows:

As you can see now all of a sudden the renting option becomes more financially viable. I did mention how sensitive that rental figure really was, but it made almost a $600,000 difference over the 30 years!

Now a $400 per week rent for a $650,000 property would represent around a 3.2% yield, which actually is not too unreasonable for Sydney, but I believe a rental yield of 4.00% would be more realistic for a property worth $650,000. But as I said if you were willing to live in slightly lower standard property while renting, it really can pay massive dividends (pun intended) down the line.

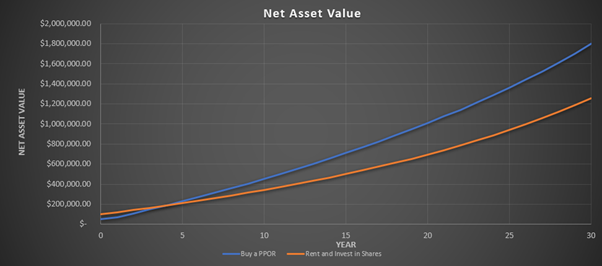

Below are graphical representations of each situation:

A – Rent initially at $500 per week

B – Rent initially at $400 per week

Conclusion

As you can see from the different results, there is a reason why there is no definitive answer. Even look at the black and white world of figures, there is still no standout winner. Depending on your individual circumstances you may be financially better off renting or buying.

That does not even take into account non-financial benefits, emotions always play a big part in financial decisions, and renting verse buying is no different. Some people want a place to call their own, some people want the flexibility to move regularly. There really is no one answer that suits everyone.

I just hope that this post is able to highlight the advantages of both buying and renting, as well as the financial implications of each option.

I have made a graph where you can input your own parameters and at least see which option is most financially beneficial to you. The spreadsheet also includes the option to rent and investing in an IP. I did not get into that aspect in this post but I will cover that in a future post, and the inputs associated are hopefully self-explanatory.

The spreadsheet is located HERE