Rebalancing my Share Portfolio – October 2021

A few months ago, I came up with my desired share portfolio, and it looks like the following:

Australia Shares: 38.00%

International Shares: 56.00%

Emerging Shares: 2.00%

Bonds/Cash: 4.00%

I am in no way suggesting or recommending this share weighting for anyone, I am just saying it is what I am currently targeting.

If I had come up with this breakdown prior to buying any ETFs, it might have been easier to build a portfolio around it. Unfortunately, I chose to delve right into buying ETFs without too much thought on the overall scheme on what plan I had in place. It may not have been perfect, but I was also concerned with analysis paralysis and spending months on the sidelines without making a decision. It turned out that even though it might have been sub-optimal, it was still better than sitting out of the market until I had developed my full plan.

In the end, I have no regrets with how I have gone about purchasing shares.

With this in mind, I currently have the following ETFs in my portfolio:

A200

VAS

VDHG

VGS

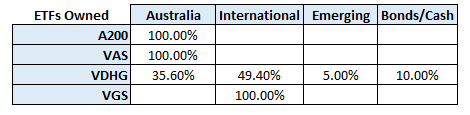

These ETFs have the following breakdown within them:

VDHG does make it slightly trickier to balance as it does have it’s own weighting, but again, it is already there and it is not the worst decision in the world as it is still somewhat close to what I want as my ideal weightings.

Current Portfolio Breakdown

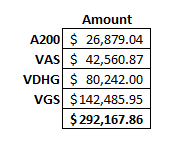

My current portfolio, as of 15/10/2021 looks like the following:

I do also have a couple of individual shares, but I will not include them in these weightings (they are relatively minor anyway so not too concerned)

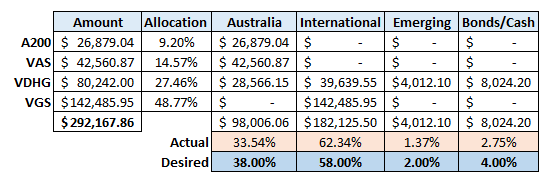

The full breakdown will not look like the following:

Looking at the actual vs desired part of the table, you can see I am not too far away from where I want to be. But I am a bit too heavy in International Shares. This is because I was not giving enough thought to my preferred balancing and simply kept buying VGS knowing I was a long way behind, and not realising that I was approaching my target allocation.

Next Steps

My next step is to buy whichever allocation is furthest below the target allocation. In this case, Australian shares is furthest below so I can buy either A200 or VAS to help boost that percentage.

I do not want to plan too far ahead because share price changes can have significant changes, so next month’s purchase will be VAS, and then after that I will reassess and go from there.

Conclusion

It is important to have a target allocation, but it does not have to be fixed and can definitely evolve over time depending on your stage in your investing career.

Again, I am not saying my allocation is perfect or it would suit anyone, but it suits me enough for what I want. I am happy with it and will be sticking with it for the meantime.