Pearler – a FIRE Investors Dream?

Disclaimer: I am in no way affiliated with Pearler and this post has no financial benefit to me from Pearler in any way.

What is Pearler?

Pearler is an online broker for long-term Aussie investors, founded by 3 friends from Sydney in 2018 after we got fed up with only having two bad options to refer our friends to when they wanted to start investing – confusing trading platforms or expensive micro-investment apps.

Just like other brokers, Pearler allows investors to invest directly into any Aussie or US stocks and ETFs. But where we differ is that instead of designing our platform around the buying and selling (‘trading’) experience, we’ve built Pearler from the ground up to focus on the thing that matters most – helping people achieve their long-term financial goals.

To do this we’ve got features like Goals and Autoinvest, which together allow you to set a goal (e.g. Financial Independence), then automate your investing strategy to achieve it and track your progress along the way.

We’ve also embedded community elements in our platform – we make it easy for our investors to compare and share their portfolios with friends, family and ‘Finfluencers’, or see what the most popular stocks and ETFs for a specific goal are, for example.

Our goal is to make it incredibly easy for every Aussie to invest in shares the right way – incremental amounts in diversified portfolios, for the long-term.

The above is straight from Kurt, one of the co-founders of Pearler. And in my experience what they provide is just about spot on with what Kurt has talked about in his above statement.

What Makes Pearler Different?

Pearler has been built with the long-term investor in mind, and in particular, the people seeking financial independence. There are a lot of features which do set it apart from existing brokerage platforms. In this post I will mostly be comparing them to SelfWealth (that is the platform I use, again, there is no affiliation between SelfWealth and myself) because I believe they are the top two brokerage platforms for people within the FIRE community.

Almost all other brokerage platforms are built with a trader in mind, after all, that is how they make their money. Pearler is instead targeting long-term investors, and as this meets most within the FIRE community, it makes sense that it has been targeted towards people on their path towards FIRE.

Brokerage Fees

Pearler has the following brokerage fees:

$9.50 flat fee for trades less than $17,000

0.05% of Trade value for trades greater than $17,000

This is comparable to SelfWealth which has a flat fee of $9.50 per trade. Although if you were investing amounts greater than $17,000, you would be financially better off investing through SelfWealth, I believe for the majority of people who are regularly investing towards FIRE, their trade amounts will be significantly less than $17,000.

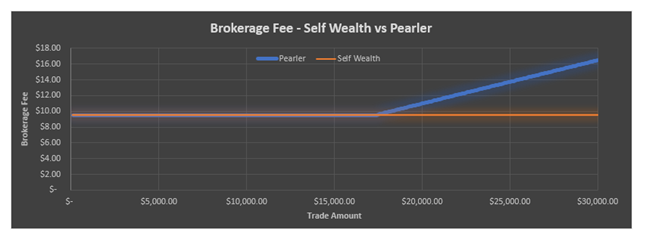

Below is a graph which shows the cost of the brokerage based on the trade value.

As you can see, even if the trade value is $30,000 – the brokerage fee is still only $16.50. This is a very reasonable number and I do not see it as a deterrent between picking SelfWealth over Pearler.

FREE Brokerage

This one is definitely a bit of a game changer, because Pearler actually offers free brokerage on certain ETFs provided within their platform. The only provision is that you have to hold the ETF for greater than 12 months. Again, for the long-term investor, this should not be an issue at all.

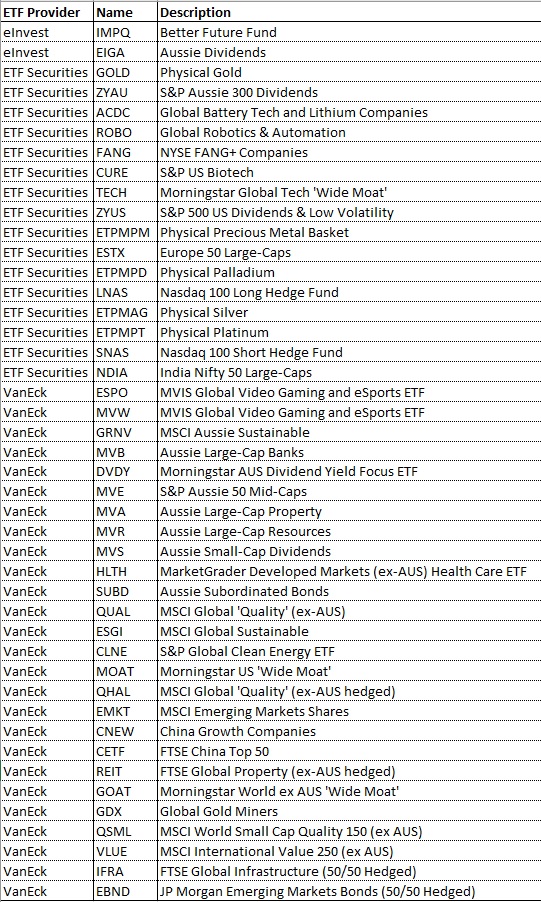

Currently, the full list of ETFs which have free brokerage is below:

In total, there are 44 ETFs which you can invest in with no brokerage fees at all. Although it does appear that most of the ETFs are a bit more ‘exotic’ than most of the ETFs that FIRE investors tend to invest in. There are definitely some ETFs that an investor might have as a satellite investment away from their core portfolio. For example, I do hear a lot of people talk about investing in ACDC as part of their portfolio, so with Pearler you have the option to invest in this ETF with zero brokerage.

I will note, that if you do sell all, or part of, these ETFs within 12 months of purchasing then you will incur a brokerage fee of $19.00 (a buy and sell trade).

VGS vs QUAL

I had not really looked at what ETFs that VanEck provides before, and while researching Pearler and the free ETFs it has available, the ETF QUAL stuck out to me. It looked to me to be similar to Vanguards VGS (which is an ETF that I currently have as a significant portion of my portfolio).

According to the VanEck website, QUAL is intending to capture the performance of quality stocks selected from the Parent Index, MSCI World ex Australia, by identifying companies with high quality scores based on three key fundamental factors: high return on equity; stable year-on-year earnings growth; and low financial leverage.

It appears there is a bit of active selection, rather than just a complete passive index fund, as they do factor in performance of the companies, and not just based on Cap weighting (like VGS would do).

Also, it should be noted that QUAL only has 300 holdings, compared to 1,500 of VGS, so there will be a much higher weighting of individual holdings that are part of QUAL compared to VGS.

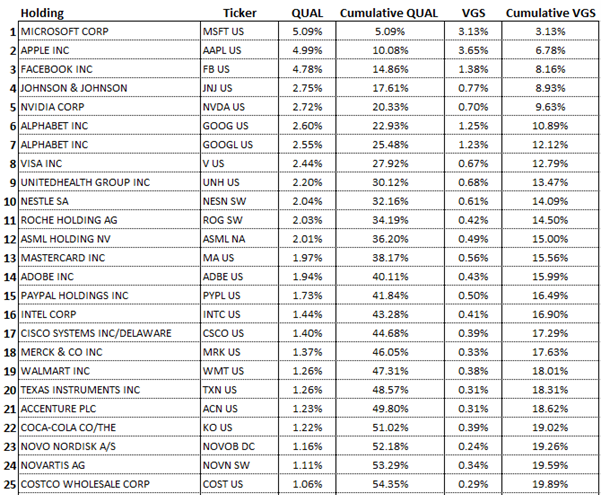

I have gone through the holdings of QUAL and VGS as of 19/6/2021 and as you can imagine, there are a lot of similar companies with the more significant weightings. However, there does appear to be some notable exceptions in QUAL, that I can only assume did not meet the requirements to be deemed a ‘quality’ company.

Below is a table showing the top 25 holdings of QUAL, with the weighting of QUAL and the corresponding weighting that same holding has in VGS.

A couple of the notable exceptions in QUAL, that appear in VGS are Amazon, Tesla, Disney and Netflix. There are plenty of other ones obviously, but these ones stood out to me as I was quite surprised these companies did not make the cut to get into QUAL. I am quite curious about what the actual criteria is to be deemed suitable for QUAL. Although, to be honest I am not completely surprised with Tesla as I would assume they have deemed it significantly overpriced at the moment based on fundamentals.

Overall, you can see the top 25 companies in QUAL makes up a significant portion of the entire ETF. Comparatively, the top 25 companies of VGS are 24.52% (the number is different to the above due to the companies that were not in QUAL). It makes sense given that VGS compromises of 5x the number of individual holdings, but it still shows how much less diversified QUAL is compared to VGS.

In fact, the top 50 companies in QUAL makes up over 70% of the entire weighting, that is quite a top-heavy ETF in my opinion. But I will also note that an ETF like VAS has the top 40 companies make up over 70% of the entire ETF as well.

I have gone a bit off topic in this post and have gone to talk about an individual ETF, but I just thought it might be worth mentioning that you are able to purchase an “almost” similar ETF to VGS with QUAL, with zero brokerage.

Auto Deposit and Auto Invest

These are the two biggest features which I believe are the real game changer when it comes to Pearler. As far as I am aware, the only other broker that allows for auto investing in Commsec Pocket, and no other broker allows auto deposits.

Automation is a significant benefit when it comes to long-term investing, especially for FIRE, a lot of the time, the biggest losses are made when emotion comes into play. Automation takes out the emotion or the human input, allowing your own investment plan to just grow over time without letting emotion take over.

Auto Investing allows you to automatically invest in the following four ways to meet your target allocation:

- Single Share furthest below target weight

- Single share of my choice from my portfolio

- Rebalance to target weights

- Equally across target weights

The most common method is the first one, as this limits the human input of selecting a share, and minimise brokerage costs associated with rebalancing or investing equally across all ETFs.

Auto Deposits also allows an automated direct debit from your nominated bank account into your Pearler Client Trust Account (CTA).

The only issue I would have with this feature is, you have to nominate previously how much to be direct debited and how much to be automatically invested. Given the occasional unexpected costs that do arise, I am not the most flexible with my regular investments and simply just invest with whatever savings I have left over at the end of the month. So, while I believe it is a very neat feature to be able to automate this process, I am not sure exactly how well it would work for someone in my position.

I also mentioned that one of the main issues people have with long-term investing is when emotions come into play and can cause you to drift away from your investment plan. I am definitely not perfect, but overall, I believe I have stayed very close to my investing plan, so I am not sure if I would get the most out of eliminating the human input.

Sharesight Integration

This is another feature which does provide an advantage over SelfWealth, being able to automatically integrate your trades into Sharesight does make it significantly simpler. Although it is not too much work to set up the automatic emails in SelfWealth to do the same thing, it appears to be a lot smoother when it comes to Pearler. I definitely have to give them credit that this is an advantage.

Goal Tracking

This is not a feature that I believe I would use too much, but it is still nice to have it as an option. In Pearler, you are able to set up your financial goals and track them easily in one place. Personally, I have my goals on my financial tracking spreadsheet, but being linked directly to my brokerage account could definitely have benefits.

Comparing Portfolios

Again, this is not really a feature that I would use too much, but it might be handy for a beginner who is new to investing (not that I am too seasoned!) to have a look at what more experienced people are currently doing. They also have Finfluencer Portfolios, so you can see other people who are on the FI journey and what they are currently investing in. If anything, it can be nice to get some confirmation of your own investment plan.

I believe you can also share your own portfolio with friends or whoever, which again might be a feature that some people might be interested in.

Security and CHESS Sponsorship

Pearler is CHESS Sponsored, and I know that is important to some people (myself included) as it ensures that you are the legal owner of the investments and everything in tracked using my own personal HIN. This provides security in case Pearler were to collapse, as you rest easy knowing that you are still the owner of the shares instead of relying on the company to get your shares back to you.

Other Features

One more thing I really do appreciate with Pearler is their website has a few resources which helps people learn about FIRE, as well as providing calculators and other useful tools. Not to mention it does provide for FREE, a handy eBook – https://www.pearler.com/aussie-fire-ebook

The eBook is a great starting place for anyone who is interested in starting their own journey towards FIRE.

Limit Orders

This is probably my biggest gripe with Pearler, as it does not allow limit orders. This means I cannot set a purchase price when I do make a trade and instead it is just based on what the market price is at the time.

The majority of the time, this is probably not an issue as long-term investors just want to make a trade and given they are in it for the long term, the current price does not have too much relevance. But there is still potential to make a purchase at a price that is significantly higher than you would have liked.

For example, this is what happened with VGS recently on 16/6/2021.

There is a significant spike which occurred around 10am on 16/6/2021 where the price went up to $105, well above the price for the rest of the day which sat around $94.50.

The above occurrence is incredibly rare, but you could end up purchasing at a price about 10% higher than the proper ‘market’ price just because you do not have the ability to put in a limit order. It could take a signifiantly long time before the genuine price of the ETF reaches this level.

Conclusion

Overall, I think Pearler is great for the FIRE community, it is really impressive to see products developed for FIRE in mind. At the moment, I do not use Pearler myself, but after doing a bit of research into it for writing this post, I am slightly more inclined to maybe start putting some money into it. I would not be withdrawing my shares from SelfWealth and would just use both platforms concurrently.

Apparently in the future, Pearler is looking at becoming more of a financial marketplace and is looking at providing the following:

- Investments

- Loans

- Insurance

I am very excited about the idea of providing loans, because at the moment, if you are Post FIRE and retired, then it is near impossible to obtain finance because you do not have an “income”. I would hope that Pearler would take passive income into consideration and be an option to potentially obtain a mortgage while Post-FIRE. I think if they were able to do this, even with relatively high rates and large deposits required, it could be a significant game changer in the lending industry.

Pearler is a very innovative platform, I will definitely be keeping an eye on it to see what happens with it in the future.