October 2021 – Net Worth Update

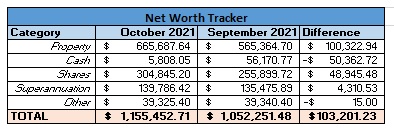

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

Property was the big mover this month with a whopping $100,000 improvement in value. This was due to the property valuation of Investment Property 1 increasing by this amount over the past month according to www.onthehouse.com.au. I do not take too much notice of this number, and I assume it only went up so much in such a short period of time because there were probably some recent high-end sales in the area driving up the price artificially.

There is every chance that it could drop back down to what it was by the time end of next month rolls around.

Cash

This portion has dropped significantly as I was in the process of moving money from my offset account into shares, and while I took the snapshot last month it was sitting in my bank account. I have now invested all the money I aimed to invest so I now aim to keep cash around the $3,000 mark (or there abouts).

I did have a tax bill of around $6,500 this month to pay which did not help the performance either. On top of this I also had to pay for car registration, insurance. As well as a new passport and some additional funds to sort out my US Taxes. Overall, it was a relatively expensive month when it comes to life admin. I am sure my savings rate will be in the negative again!

Shares

Shares were pretty decent this month, I deposited a large chunk of cash after moving it from my offset, but on top that there were also some decent capital gains incurred as well.

Very excited to reach a new milestone, with the $300,000 mark crossed over! Hopefully the shares keep performing well to keep above this mark. Always nice to have a new achievement to keep the motivation going!

Superannuation

As expected, with the rise in shares there has also been a nice rise in the superannuation balance.

Other

Not much of a change here

October 2021 Budget Summary

Income – TOTAL: $8,044.10

- Normal Income: $4,084.00

- IP Income: $3,960.10

- Other Income: $0

Expenses – TOTAL: $11,042.85

- Normal Expenses: $9,475.09

- IP Expenses (not including Interest): $549.05

- IP Interest: $1,018.71

Savings Rate – -37.28%

Another not so great month when it comes to my savings rate. A long way negative! Twice in three months now. The $6,500 tax bill definitely did the heavy lifting, without it, the savings rate would have been over 40.00% – thankfully I do not have to pay that again this year.

This has dropped my savings rate for the year down to 37.29%! The first time I have been below my target of 40.00%. Looks like I have some work to do to try and get back to my target rate for the year. Thankfully I do not think I have any significant expenses between now and the end of the year so it should be able to be achieved.

I also like to track my income and compare it to my passive income, including my gains for the month.

October Normal Income – $4,084.00

October Net IP Income – $2,392.34

October Net Shares Gain – $15,945.48

October Passive Income – $18,337.82

So, while my savings rate was in the negative this week, the return on my shares were quite extraordinary. There were some nice dividends paid out which definitely helped. Overall it looks like quite a productive month!

Plan for November 2021

I do not believe I have anything too much between now and the end of the year. I might have some additional expenses to do with my US Tax Return, but it should be relatively minimal. Apart from that it will just be steady as it goes.

I was talking to a friend recently about some potential side hustle we might have going on, I mentioned it briefly once before but it did go on the back burner during the lockdown. Now that it is over, discussions have started up again. Nothing too much to talk about yet but potentially something down the line to actively increase the wealth.

Share Purchases – November 2021

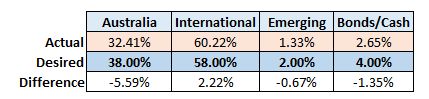

A new section I will add in going forward is where I will be purchasing shares going forward, the table below shows the breakdown of my shares against the target portfolio.

At the moment my allocation in Australian shares is furthest below the target allocation. This month I will be looking at investing approximately $4,000.00 into VAS or A200.