Net Worth Update – November 2021

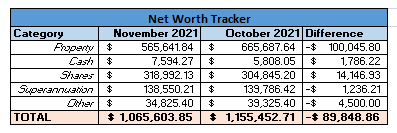

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

The price of one of my investment properties appears to fluctuate considerably on the website I use for an estimated price. I imagine this is because there are not a great deal of properties sold in this area, and there is also a wide range of price between how much a similar property (on paper) might sell for depending on the location.

So while it has dropped down by $100,000 I am not too concerned at the moment.

Cash

The main thing I did this month was I sold my second car, so that did free up some cash which I will look at being able to invest at the start of December.

Apart from that it is relatively stable.

Shares

Another good month in the shares, I am sure there will be a bit of a downturn coming in the future but that is out of my control and for the moment I will take advantage of the rising market.

Superannuation

I was surprised this did not go up like the shares did, there might be a bit of a lag in the performance and the majority of the gains in the share market was in the most recent week so it might take a little while to reflect. Still overall it has been growing strong this year.

Other

As I mentioned earlier, I sold my second car which I did have listed as an asset in my “Other” category. That is why this category has dropped $4,500.00

November 2021 Budget Summary

Income – TOTAL: $8,038.15

- Normal Income: $4,084.00

- IP Income: $3,954.15

- Other Income: $0

Expenses – TOTAL: $4,457.83

- Normal Expenses: $2,741.27

- IP Expenses (not including Interest): $597.44

- IP Interest: $1,119.12

Savings Rate – +44.54%

Good to see this month back on track after the expensive month back in October. I was worried that my month might be a bit more expensive than normal, and it was slightly, but mainly for a couple reasons:

- My house mate moved out at the start of the month so my rental costs have now doubled (although still relatively cheap)

- With the lockdown easing in Sydney I have been going out a lot more and it is definitely a drain on the wallet. It has not been too crazy but my “Entertainment” category on spending is definitely higher than it typically is.

I was happy to have my savings rate above the target of 40%, but I am still sitting at 37.89% for the year, and with only one month to go it may be too difficult to get it back up to my target of 40.00%.

I am not too discouraged by this as it is only below 40.00% because of the significantly large tax bill (which actually represents over 10% of my expenses so far this year)

I also like to track my income and compare it to my passive income, including my gains for the month.

November Normal Income – $4,084.00

November Net IP Income – $2,237.59

November Net Shares Gain – $9,646.93

November Passive Income – $11,884.52

For another month my money is earning more than I am! In fact, with only one month remaining in the year, there has only been three months where my passive income has been lower than my normal income (February, August and September)

Plan for December 2021

I will try and be more conscious of my spending on entertainment for the month, although that being said I do not want to miss out on life so I will make sure I am not being too frugal where I do not need to be.

I am looking forward to a bit of a break at the end of the year, as well as going back over the year and summarising all my expenses and see how my life has looked this year compared to previous years. I feel this is important as it really allows me to gauge how much I realistically will need to live on when I finally do pull the trigger on FIRE.

Share Purchases – December 2021

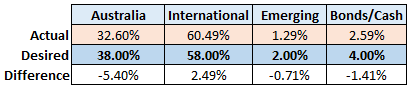

Now I need to look at my current shares allocation to determine where I will be putting my next share purchase towards.

At the moment my allocation in Australian shares is furthest below the target allocation. This month I will be looking at investing approximately $6,000.00 into VAS or A200.