February 2021 – Net Worth Update

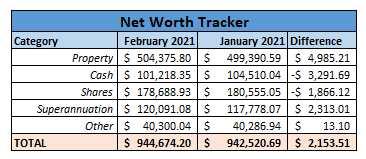

As part of my FIRE blog I will be tracking my total net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

My Net property value increased by almost $5,000 over the past month for two reasons:

- I moved $5,000 from my Cash account into my offset account

Cash

My Cash account went down by just over $3,000 over the past month. This occurred for the following reasons

- AUD/USD Exchange Rate went down slightly to impact the value of my US funds

- I moved some money into my Offset account

Shares

My share portfolio has decreased by almost $2,000 over the past month. I had not bought any shares over this period (my last purchase was right at the end of January and I am planning one for early March). The drop in value is due to a slight downturn in the market

Superannuation

Slight rise over the time period which was nice, as well as regular contributions

Other

Minimal change from previous month

February 2021 Budget Summary

Income – TOTAL: $8,344.00

- Normal Income: $4,084.00

- IP Income: $4,260.00

- Other Income: $0.00

Expenses – TOTAL: $3,890.28

- Normal Expenses: $1,354.16

- IP Expenses (not including Interest): $1448.01

- IP Interest: $1,088.11

Savings Rate – 53.38%

I am very happy with a savings rate over 50%, my goal for the year is to maintain a savings rate over 40%, and currently I am sitting at 50.52% so I am delighted for the time being.

Plan for March 2021

I was meant to get my US Tax Bill this month, but had some slight complications with the tax accountant, but that has all been resolved so it looks like I will have a bit of a tax bill coming up for March 2021.