My Future FIRE Situation

It is all well and good to have your FIRE number, mine is currently $1,250,000 for instance, but there is so much more that might be a part of your FIRE situation when you do finally do pull the trigger and at least declare yourself FI, or even RE.

Sometimes your FIRE situation might be easy to determine, because all you want is to build your investment portfolio to a certain amount and that is all you are basing it on. There is no other significant lifestyle requirement you want to achieve prior to reaching FIRE. That is fine of course, and it will make your plan a whole lot easier.

In this post I want to go through what my situation is like NOW, and what I want it to look like when I do reach FIRE. I will say upfront though, that life is always full of unexpected surprises, so it is important to be flexible. Not to mention that desires may change over time, so although this is what I want in my FIRE now, I do not know if that is what I will want in a year’s time.

The biggest one for me, is that I want to own my own PPOR outright when I do reach FIRE. I am currently renting and while that is fine for my life at the moment, when I do reach FIRE, I currently plan on owning my own PPOR outright (or at least very close to it).

Current Situation – As of March 2021

- Currently renting in greater Sydney

- Investment Property 1:

- – Value: $500,000.00

- – Loan Amount: $243,000.00

- Investment Property 2:

- – Value: $430,000.00

- – Loan Amount: $278,000.00

- Offset Account: $95,000.00

- Share Portfolio: $187,000.00

- Cash Savings: $75,000 (currently in US)

- Other Assets: $30,000

- Superannuation Account: $120,000

- Monthly Savings: $4,000 (this includes rental income from my IPs after all expenses have been taken out)

Desired Situation – Date December 2028

- Owning a PPOR – not sure where abouts

- Cash Savings: $40,000.00

- Share Portfolio: $960,000.00

- Superannuation: $250,000.00

So that is what I want, a much simpler portfolio without having to be concerned with IPs, even though they are positively geared and generating me money.

Now the trick is figuring out how to get from A to B as quickly as possible.

I need to break the above down into separate steps to see if I can get to the end result as efficiently as possible, and at least make sure everything is taken into account. Although each step is working in the same direction, in the end they can work independently of each other.

Step 1: Owning a PPOR

The main reason I want to own a PPOR in retirement is because in the long run I believe it will be more cost effective than renting.

Now, I do not plan on living in Sydney in retirement for the simple fact that housing is too expensive. And since I will not be working any more, I have no significant reason for needing to live in Sydney. It is true that my family do currently live in Sydney, but this may change in the future anyway and given I will have a lot of spare time on my hands (hopefully) I should be able to visit regularly anyway.

So where do I want to live? I have looked at a few places (Adelaide greater area, Perth greater area, Sunshine Coast, Tasmania etc) and all are viable options. I am not a picky person and have no specific area that I want to live in. I do have a couple of requirements in my future place though:

- Needs to be a free-standing house (or at least something without strata / body corporation fees)

- Minimum 600m2 land (I do not want to live on a tiny patch of land)

- Minimum 3 bedroom

- Minimum 2 bathroom

- Granny Flat / Self Contained Studio as part of the property (I want to be able to rent out the unit on Air BnB as extra income, and also a place for guests to stay if they do come visit)

With these parameters, in those locations I mentioned above I have seen places available for around $400,000.00 so I want to try and aim to purchase a place around that price tag if possible.

I have also run through the following two scenarios in a spreadsheet:

- Buy a place now and treat as an IP, pay off until retirement

- Save up until retirement and buy a place outright

It turned out that Option 1) was a better option financially speaking. And I have no issue with owning IPs, and although I know it can run into an issue with bad tenants, I am fine with taking on that risk.

Currently, my plan is to purchase my future PPOR around the start of 2022, and I will pay additional repayments to pay off the PPOR significantly ahead of a 30-year loan period. I also want a place to be at least neutrally geared from the start.

Property Purchasing Details:

- Property Value: $400,000.00

- Deposit Amount: $100,000.00

- Stamp Duty: $14,000 (it does vary by State, but this seems to be a fairly common number)

- Purchasing Costs: $3,000

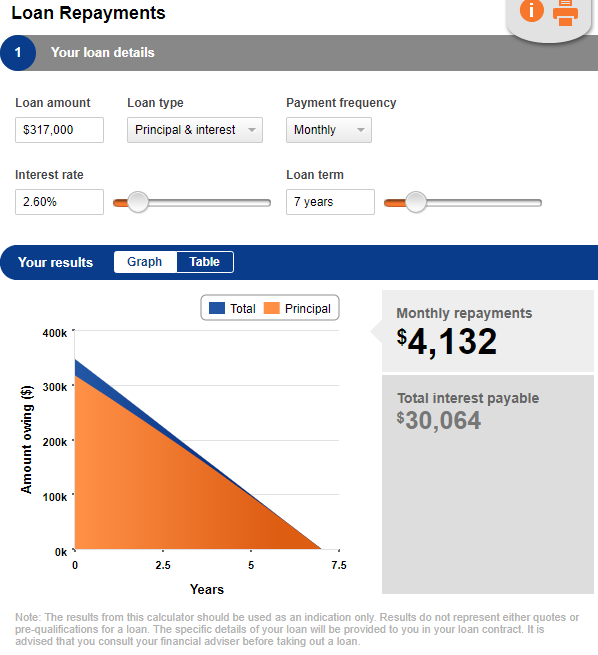

- Loan Amount: $317,000.00

- Interest Rate: 2.60% (it will be an investment loan and I will need an offset so cannot fix)

- Gross Weekly Rent: $500 per week (with a self-contained studio as well I should be able to receive more rent)

- Net Weekly Rent: $300 per week (after all property expenses have been taken out – does not include loan repayments)

Loan Calculations:

- Minimum Monthly Loan Repayment: $1,270.00

- Monthly Net Rent Received: $1,300.00

- Extra Monthly Repayment: $2,800.00

- Loan Term: 7 Years

If I purchase the property in January 2022, I should just about have it paid off by December 2028.

Figure 1: taken from easystreet.com.au

Summary:

Step 1 is now complete, and I should have my PPOR paid off by around December 2028 – now I just need to make sure that all my other FIRE achievements can be made based around the numbers I have remaining.

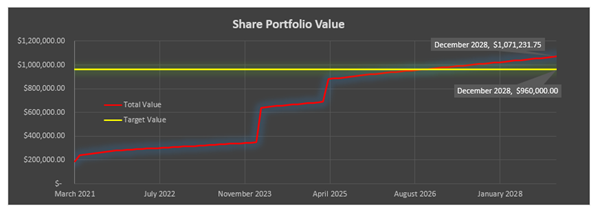

Step 2: Share Portfolio of $960,000.00

This is a big one, I need to increase my portfolio from $187,000 to $960,000 over hopefully 7 short years. That is an increase of $773,000.00. And I know that compound interest can definitely work wonders, let’s just hope it can work on my side here.

I do have a few tricks up my sleeve however, mainly I do plan on selling both of my IPs which should release significant amounts of equity. Not to mention I will be moving my US savings into my share portfolio in the near future as well.

Monthly Savings from Income:

From March 2021 – December 2021: $4,000 per month

From January 2021 – February 2026: $1,200 per month (remember a lot of my monthly savings will be going to pay off my future PPOR)

March 2026 – December 2028: $0 to be put into share portfolio (the $1,200 is to be put into cash savings to allow for my $40,000 buffer in the first year)

Equity from Investment Properties:

Investment Property 1

I will aim to sell this property in early 2024, as it was initially my PPOR and I will be exempt from Capital Gain tax up until this date. If I assume a 3% capital appreciation between now and then I hope the property will be worth around $540,000 by this date.

The principal remaining on the property will be around $240,000 by around this date. After taking into account selling costs of around 2.00% ($540,000 x 2% = $10,800), I will be left with around $289,000 to put back into my share portfolio.

Investment Property 2

I will aim to sell this property in early 2025. This has always been an IP for me so I will have to pay capital gains tax on this unfortunately, but not the end of the world. Again I will assume a 3.00% capital appreciation on this property. This will mean the property will be worth around $480,000 in 2025.

This will be a capital gain of $50,000, with a 50% CGT exemption leaving $25,000 to be taxed. With a tax rate of 37.5% it will mean a tax bill of $9,375.00.

Selling costs will again be 2.00% – so that will be another $9,600.00

Principal remaining on this loan will be around $275,000.00

After taking into account all costs I will be left with around $186,000.00 to put back into my share portfolio.

US Income

At the moment I have $75,000 sitting in my US Bank Account, I still need to pay my tax bill but will hopefully be doing that this month. After that tax is paid, I will have about $50,000 remaining to be brought back to Australia. Once it is back in this country, I will be putting it back into my share portfolio.

Summary

Using a 5.00% per annum return for shares (this should consider inflation as well) it will yield the following results.

The results look to be great; I should be over $100,000 ahead of where my target was aiming to be. Hopefully, this gives me the buffer I need to be able to compensate in other areas where my criteria were not met. For example, potentially my future PPOR had issues receiving rent for some period so now I can use some additional funds from my investment portfolio to pay off the loan faster to meet the December 2028 Goal.

Step 3: Cashing Savings of $40,000.00

This is a relatively simple one, you will notice in Step 2 that I stopped contributing to my investment portfolio for the last couple of years as I approached the FIRE target. During this period I will be building up this savings to ensure I have enough expenses to last me the first year of FIRE.

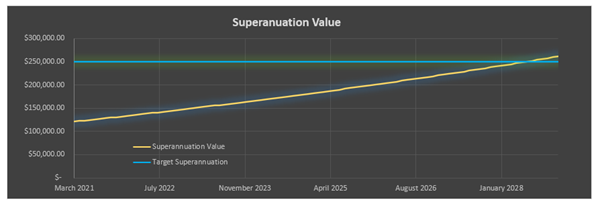

Step 4: Superannuation Balance of $250,000.00

This is the least critical of all my goals, but it would be a really good backup just in case there was a significant downturn in the Market while I was not working.

If I am able to reach FIRE by December 2028, with a superannuation balance of $250,000.00, that will give me approximately 24 years before I am able to access my superannuation. With a balance of $250,000.00 and 24 years of compound interest at 6.00% it gives me a total lump sum of over $1,000,000.00. So even if my investment portfolio only lasted me 24 years, I will at least still have this as a backup just in case I needed it to get me through the rest of my life, as well as hopefully giving me plenty to pass on to others.

My monthly contributions will be around $600 per month (I know compulsory superannuation contributions are increasing, so this will only work in my favour – but I will stick with current figures for the time being).

Monthly Contribution: $600

Interest Rate: 6.00%

With the above inputs it will yield the following results

I may be a bit too optimistic with returns of 6.00% per annum in superannuation, but if I do not quite reach $250,000 it is not the end of the world. It is just a safety net in case there is a capitulation in my other investments.

But it does show rather promising news that with just minimum contributions I should just scrape through and reach the $250,000 mark by December 2028 – with about $10,000 additional as well.

Summary

Well overall it looks like my plan has some potential, and with everything going well I should be able to reach FIRE by December 2028. I guess that means it is time for the countdown to begin!

I need to keep in mind that circumstances can change at the drop of a hat. I need to remain flexible with my approach because things will not always work out as I hope they do. But overall, I think my plan is not overly ambitious and, in some parts, does allow for some conservative estimates.

I am really excited for the next 8 years; I think it will be really exciting to see the plan come to fruition.

Great post! They sound like good goals which are achievable. It will be interesting for you to look back on this one in a few years time and see how you are tracking.