My Aus Investment Property Returns

Recently I did a post about the true costs associated with investment properties. I believe it is important to completely understand the full undertaking of an investment before you hit that purchase button.

I have noticed that a lot of people within the FIRE community, as soon as they see all these additional costs that need to be factored in, suddenly write it off completely as an investment and instead go back to ETFs and Index Funds. This is completely understandable, and it is not just the financial implications of investing in property, the investment is significantly more active than investing in equities and again this can be a major turn off for some people. A lot of people want to just put there money somewhere, let it grow, and take it out some time down the future, if this is what you are looking to do, then investing in property is not for you.

In my previous post about Investment Property, I touched on the importance of capital growth and this number is the make or break of a successful investment or not. Without knowing anything about the other costs associated with a property, if you can expect somewhere around 2.50% capital growth, then it should be what I would consider a decent investment (but you could probably get similar returns in share markets), anything less I would consider poor and anything greater I would consider to be a good to great investment. The capital growth number is so sensitive, even a small change, due to leverage, is magnified to provide significantly different returns.

Again, I will use my real-life example of my first Investment Property I bought in Australia (although it did use to be my PPOR for a period of time). Now I still do own this property, so any potential value I do have is only an estimate, but using www.onthehouse.com.au it can at least provide an estimate. If you were determined to know a more realistic property value, you can talk to local real estate agents who should be happy to carry out a valuation for you, but for now since I am not selling anytime soon, I can just use the estimate from the website.

Calculate Upfront Costs

First, I need to calculate the total upfront cost I have put into my property:

Deposit: $46,198.00

Stamp Duty: $8,957.50 (even though this was initially a PPOR I was ineligible for FHBG)

Purchasing Costs: $1,500 (conveyancer, bank fees)

Renovations: $25,000

TOTAL: $81,655.50

So now I have that number, I can use it to determine what sort of return in terms of a percentage I have received from this property.

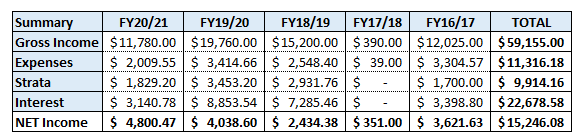

As from the previous post, below is a summary of the returns I have made from rental income over the duration it has been an Investment Property.

I have owned the property for a total of 2,435 days, and it has been an investment property for a total of 1,073 days of this time. This will be important later as I will need to apportion what percentage of capital gains has been made during the time as an IP or a PPOR.

Currently it has been an IP for 44% of the time I have owned it.

I am not going to include any of the costs incurred while it was my PPOR, including mortgage or interest payments as I do not believe it would provide a true reflection of costs associated with an IP. The only cost I will include is the cost of renovations carried out while it was my PPOR, as this would have greatly impacted the value of the property.

Also, I have only included the interest portion of my loan repayments, even though the loan is P+I, my reasoning for this is because the principal portion of the repayments is paying down the loan and will be included in the final calculations when I look at removing the mortgage amount as a liability.

Calculating Capital Gain

Current Property Value: $500,000 (the range on the website was $500,000 – $550,000 but I prefer to go with the conservative value)

Original Property Value: $298,500.00

Capital Gain = $201,500.00

As discussed previously, given I did live in this property for 56% of the time, to apportion how much can be allocated to capital gain during the time as an IP I need to do a further calculation:

$201,500.00 x 0.44 = $88,660.00

Given I will meet the requirements to be CGT exempt if I was to sell this property right now, I will not include any tax required to be paid on this amount. I do plan on selling this property in the future, and I will make sure I take into consideration any CGT requirements and make sure I am CGT exempt when I do come to sell it.

I will use this number to provide a “theoretical” house value to calculate the NET Return later.

Theoretical House Value = $298,500.00 + $88,600 = $387,160

Selling Costs

To appropriately calculate the liquid value of a property, it is important to take into consideration the selling costs associated with listing a property. These costs are typically made up of real estate and banking fees.

This is another number which does scare of people from the idea of property investing. For the purposes of my calculations, I will assume selling costs of 2.50% of the selling price will be incurred when I do come to sell it.

$500,000.00 x 2.50% = $12,500.00

Calculating NET Value

Passive Income Return: $15,246.08

Theoretical House Value: $387,160.00

Outstanding Loan: $244,968.11 (the original loan was for $252,302.00 but it was also refinanced in mid-2020)

Selling Costs: $12,500

NET Value: $387,160 + $15,246.08 – $244,968.11 – $12,500.00 = $144,937.97

So my total NET Value $144,937.97 after an original investment of $81,655.50 – this gives me a return of $63,282.47

Calculating Rate of Return

Using a compound interest formula, but rearranged to be able to calculate the Rate based on the following inputs:

Final Value: $144,937.97

Original Value: $81,655.50

Time: 2.93 Years (1,073 / 365.25)

Rate: Around 19.7% per annum

Disclaimer

That sort of return is incredible, but there are a few things that need to be taken into consideration before running off and buying an investment property:

- I carried out a lot of the renovations myself, so this saved significantly on costs as I only had to pay for materials for the majority of the work.

- Carrying out renovations is a great way to increase the value of a property, but you need to understand how much you plan on putting into a property and how much you expect the return to be. I was lucky in my property in that it was a lot of superficial work needed to modernise the property a lot which was effective in increasing the property value without adding a significant expense.

- Not having to pay CGT makes a huge difference, it will not work for everyone, but if you are able to live in a property for long enough to receive CGT exemption then I strongly recommend it.

Conclusion

I provided this example not as a way to show off (well maybe a little bit) but just to illustrate and explain how property investment can work out well and pay really nice returns if you make a good purchase, in a solid area with decent capital growth. There is still a lot of risk involved, and with property that risk is magnified as typically there will be leverage involved.

If you were able to leverage share investment to the same extent that you can with property, then you would open a whole new world of advantages for investing in shares.

In another post I will go more in depth about advantages and disadvantages of investing in property and the share market. Each side definitely has a lot of Pros and Cons and at the end of the day, you need to decide what is right for you at your point in life and what you need to meet your goals.

In my past I have had a lot of success with property (not only with this property, but also have a look at my US Property experience in this post) and I think I will continue to keep some form of property as part of my portfolio, although at this stage I am not sure exactly how much.

I have mentioned in other posts that I do have a second investment property in Australia, the only reason I did not include the numbers for that property in this post is because I have only owned it for 6 months (as of January 2021) and I believe it is too early to tell any significance from the numbers so far achieved.