May 2021 Net Worth Update

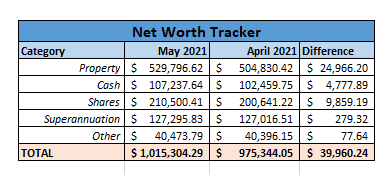

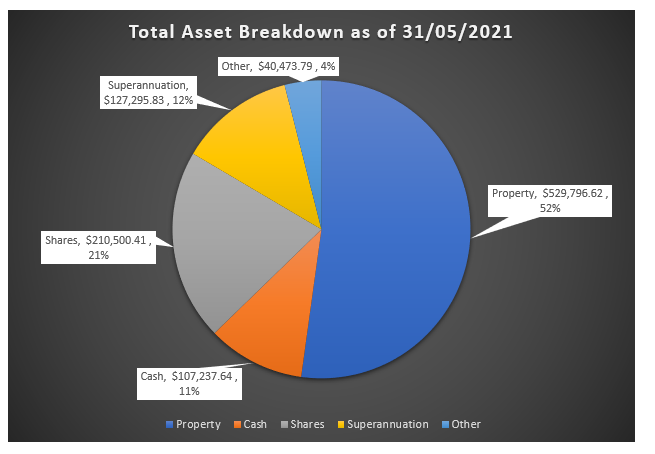

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

As you can see there is a big change in this category, an almost $25,000 improvement compared to last month. I use the website onthehouse.com.au to obtain the value of my investment properties. There was a significant increase in the value of each of my properties which has caused this increase. The increase would have been even higher, but I had to withdraw money out of my offset account to pay for my US Taxes.

I did a post HERE about reaching my first $1,000,000, which was incredibly exciting! They must have changed the prices again of the houses however, as one of my investment properties values actually decreased by $50,000 (still up $50,000 from last month). Anyway, I really do not read too much into these prices, they are only estimates and I do not believe they are that accurate, but it is better than nothing.

Cash

My cash allocation has improved by almost $5,000. As mentioned above this is due to withdrawing money out of my offset account to pay my US Taxes. I took out a bit more than I needed to pay, hence why this number has gone up slightly. It will go back into my offset account shortly.

Shares

At the start of the month I purchased a parcel of shares worth $5,500 and throughout the month there has been some significant gains in the stock market as well which has seen this number increase significantly.

Superannuation

This has gone up slightly, not as much as I was hoping for seeing as the gains that was realised in my shares for the month. I will have a look at my superannuation some time in June to have a look at what I am currently invested in. Overall I am still happy with my superannuation provider (CBus)

Other

Minimal change from previous month

May 2021 Budget Summary

Income – TOTAL: $9,127.15

- Normal Income: $4,084.00

- IP Income: $4,262.10

- Other Income: $0.00

Expenses – TOTAL: $5,049.72

- Normal Expenses: $3,280.15

- IP Expenses (not including Interest): $662.45

- IP Interest: $1,107.12

Savings Rate – 39.5%

This has been my lowest savings rate of the year! Even still, I am pretty happy to be close to 40% given my relatively low income. My normal expenses was significantly higher this month because I paid for a hotel and car hire for my trip to Perth coming up at the end of June. On top of this, I also had to pay registration and CTP insurance for one of my cars (as well as the mechanic for a service and safety check). Overall, it was quite an expensive month for me.

I like to look back at my FIRE number and determine if it is enough to live off, at the moment I want to have $1,000,000 outside of my Superannuation in income producing assets before I pull the trigger on the RE part. I will also plan on having my PPOR completely paid off (just need to buy one first). With a FIRE number of $1,000,000 it would allow me $40,000 per annum to live off, which is about $3,300 per month. This month, even in a more expensive than typical month, I still spent less than this amount. Not to mention that includes paying rent which will not be a thing when I do retire (although home owning costs are still substantial). Anyway, it looks like $40,000 per annum should be relatively achievable to meet my lifestyle.

In the end my overall savings rate for the year is at 52.00%, so I am very happy to keep this number above 50.00%. I will continue to work hard towards the end of the year to keep it above that mark.

I also like to track my income and compare it to my passive income, including my gains for the month.

May Normal Income – $4,084.00

May Net IP Income – $2,293.53

May Net Shares Gain – $4,589.22

Total Passive Income – $7,081.75

Again, my passive income has easily surpassed my normal income which is tremendous news. I have my money working almost as twice as hard as I am! And over time this number will only continue to grow (hopefully).

Plan for June 2021

Finally getting my US Tax Bill paid was definitely a relief, it had been nagging at me for a few months now and keen to get that weight off my shoulders.

For the next few weeks I need to transfer all my money in US Bank accounts back to Australia and really set myself up for the next few years. Once I have the money transferred I will load up my Offset account, which will double as a deposit for my future PPOR which I am looking at purchasing towards the end of the year. With the rest I will put it all into the shares and really start to build my portfolio. I envisage that my portfolio will look significantly simpler and more streamline, which is what I am looking for!