March 2022 – Net Worth Update

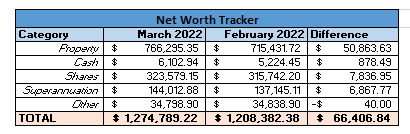

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

Using the same website, IP1 value went up an additional $50,000. To be honest the minimum value on the website is actually $50,000 HIGHER than what I have used to determine my net value. I think believe it is still a bit optimistic.

Cash

Cash has also been relatively stable for the month. I will look at putting some money into my superannuation this month.

Shares

Shares were pretty decent the last month, there was a large drop on the day I got these values, this was due to announcement of dividends so these drops will be recuperated in the near future. I am still not sure what the future will show but I am in it for the long term so it is not an issue with the month to month changes.

Superannuation

Another solid month for Superannuation, I was surprised because I thought there would be a drop like there was in the share market, but I am not complaining. As I mentioned before I am going to look at boosting my superannuation with some non-compulsory contributions which should help reduce my tax bill.

Other

Minimal change

Something amazing actually happened this month, I reached my FIRE number!? How did that happen so fast? Well, I won’t get too excited at the moment. First of all, it is all numbers on paper, I do not know how much I would actually get for my IPs so the numbers might be significantly inflated. Not to mention there will be some significant costs associated with selling, so the actual dollar value after selling may be a lot less than what I have on the spreadsheet.

Secondly, and more importantly, part of my FIRE plan is to retire with a house owned outright, which I do not have. Between now and my FIRE date, it is great that I have the necessary amount invested, but now I just need to build enough to be able to purchase a place and then look to pay it off as quickly as possible. All will happen in good time however.

March 2022 Budget Summary

Income – TOTAL: $10,601.31

- Normal Income: $5,105.00

- IP Net Income: $5,496.31

- Other Income: $0

Expenses – TOTAL: $2,819.57

- Normal Expenses: $2,819.57

Savings Rate – +73.40%

My income was significantly higher this month for a couple of reasons. Firstly, there was an extra week in March, so I had 5 weeks of payslips instead of the normal 4. Secondly, one of my IP rents was delayed so instead of receiving it at the end of February, I received it at the start of March, which temporarily inflated the income received.

Overall, my expenses were quite high, I had an expensive month mainly due to a couple large expenses which bumped up the number. The main one being registration for soccer this season. There were also some going out expenses which added up over the month.

March Normal Income – $5,105.00

March Net IP Income – $4,523.44

March Net Shares Gain – $3,336.95

March Passive Income – $7,860.39

This was finally a decent month for shares, and my passive income surpassed my normal income for the first time this year.

Plan for April 2022

I had a look at purchasing power for a property and unfortunately it was not really an option unless I was to sell one of both of my IPs. At the moment I am not prepared to do that so I might put that on the backburner for the time being. I did make a spreadsheet to compare buying/renting over the next 5 years and it was not much of a financial difference, and I am happy enough renting for the time being so not really much of a concern.

Share Purchases – March 2022

I will look at putting approximately $5,000.00 into my Superannuation so I do not intend on purchasing any shares this month.

2022 Goal Tracking

A new addition to my monthly summaries is tracking against my goals to hopefully have some accountability to ensure I do get there.

- Invest $30,000.00 into my share portfolio by the end of 2022

Currently achieved $11,500 out of the $30,000 goal!

- Invest an additional $10,000 into superannuation by end of financial year

Currently $0 out of $10,000 of this goal!

- Finish 2022 with a savings rate of 50%

Current savings rate of 60.94%

- Read and Review 12 Financial Books in 2022

Currently have read and reviewed 2 books

- Read 20 non-financial books in 2022

Currently have read 3 books non-financial related