March 2021 – Net Worth Update

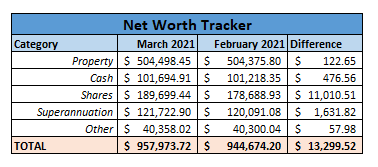

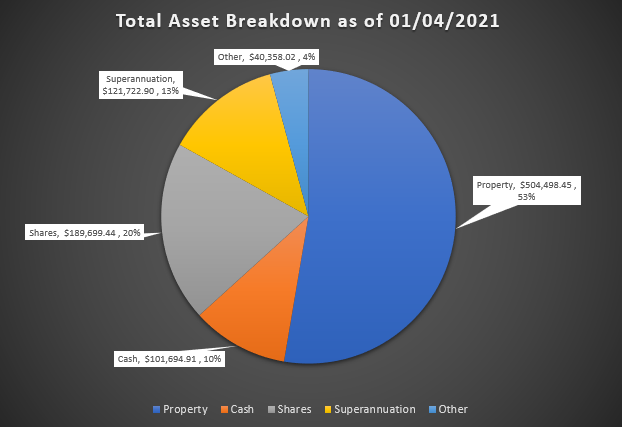

As part of my FIRE blog I will be tracking my total net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

My net property value remained basically unchanged for the month.

Cash

My cash allocation remained relatively unchanged for the month.

Shares

My biggest improvement for the month was in Shares, where some really impressive gains were made. I did deposit an additional $4,500 as part of my regular investing, but there was still a gain of over $5,500!

Superannuation

Slight rise over the time period, which was nice, as well as regular contributions.

Other

Minimal change from previous month

March 2021 Budget Summary

Income – TOTAL: $9,285.00

- Normal Income: $5,105.00

- IP Income: $4,000.00

- Other Income: $180.00

Expenses – TOTAL: $3,384.54

- Normal Expenses: $2,153.37

- IP Expenses (not including Interest): $280.50

- IP Interest: $950.67

Savings Rate – 63.55%

I was actually really surprised to have a savings rate over 50.00% for the month, let along over 60%! I thought after booking flights to Perth that it would have a big impact on this number. I was lucky however that my investment properties had relatively low expenses for the month which makes the numbers look really impressive.

My current savings rate for the overall year in 2021 is currently sitting at 54.32% which I am extremely pleased about. I do not have an exceptionally high income and to be able to maintain a savings rate over 50% I am quite proud of.

Plan for April 2021

I am still struggling to pay my US Tax Bill, you wouldn’t think that it would be so hard to give the IRS a large chunk of money but apparently it is. Anyway, fingers crossed it will happen this month, I will have a better look at it after the Easter break anyway.

I will have to book accommodation and a rental car for my Perth trip coming up in June as well, so this will add some extra expense. The reason I am travelling to Perth is to check out the property market and to see if I like the area to live in potentially for my retirement, I have never been there before but the property looks really cheap and I haven’t had a holiday for a long time so might be nice to get away. Hopefully COVID doesn’t ruin the plan.