Learn to Cook and Buy a House!

Alright, so the headline of this post might be a bit extreme, but just hear me out because the logic is sound…sort of.

So where I work there is a designated lunch time and everyone stops, eats their lunch and then goes back to work. There is only about 7 of us, it is not a big company, but I noticed early on that everyone else buys their lunch. I was the only one who brought their own lunch in from home every day. Occasionally one or two of the others might bring in some leftovers from home, but predominately they are spending money on buying lunch every day.

This got me thinking, I wonder how much money this could end up costing them, and I wonder how much money I am saving by making my own lunch every day. I should specify that I do not make my lunch every day, rather, each Sunday I will do a big cook, enough for five meals, freeze them and take one out each day for my lunch. And it normally doubles as my dinner for Sunday night as well, so it is not too much extra effort. The only draw back is having to eat the same meal 6 days in a row (let me tell you sometimes by Friday it can be a bit tiresome)

So anyway, got a bit side-tracked there, so let’s get down to some numbers and see how much money can be saved by cooking my own meals.

How much does it cost me to make my own meals? Well each week it varies depending on what I decide to make. But I would say a standard amount would be $20 (which is not too bad considering it is normally at least 6 meals)

So how much does everyone else pay for their lunches each day? Well again it varies, but for the sake of these numbers we can assume they spend $20 per day on their lunch, so that adds up to $100 per week.

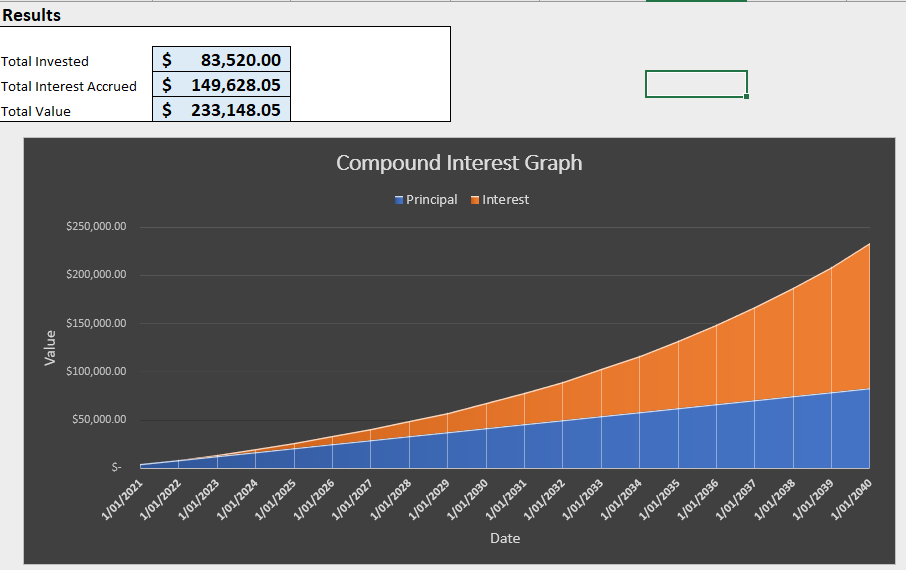

So by making my own lunches I am able to save $80 per week. Alright, well instead of just letting this money sit around in my bank account why don’t we invest it and see what sort of returns we can get. It might take some time to get anything substantial so how about we go over a period of 20 years with a return of 9% (alright so it might ambitious, but this is a bit of an extreme example so may as well go all out!)

So $80.00 invested per week, with a 9.00% per annum return over 20 years – thanks to the wonder of compound interest will turn into over $233,000! Amazing! $233,000 and all you have to do is spend an hour or so every week making your own lunch!

Now just imagine how much money people waste smoking cigarettes – probably could buy a mansion with that sort of coin (alright so I couldn’t help myself, people smoking a pack a day can save over $1,000,000 over 20 years – so your choice is either a nice house for the rest of your life, or lung cancer and bad teeth? Doesn’t seem like a difficult decision)

Anyway, I got side-tracked…again. Back to just making my own lunches. So what could we get with $233,000 in terms of a house. Alright so maybe we cannot buy a place in Sydney or Melbourne, or Brisbane, Adelaide or Perth for that matter. But if we look a further afield we can find a perfectly nice property in Launceston, Tasmania. In fact, while having a quick look as I write this post (on 26/1/2021) I found a perfectly quaint property for sale for $239,000 (so a little bit more but it is in the ballpark)

Alright, so maybe I did not take into account capital growth of the property over time, and I am sure this same property will cost more than $239,000 in 2040 (although it is Tasmania and prices may be a bit stagnant down there). But I also did not take into account any inflation of the lunches over the time, so I think it just about evens out. And really, this is just an extreme example to illustrate how frugal saving can really have significant impacts in the long run.

So in conclusion, the whole point of this post is not to necessarily start cooking your own lunches so you can buy your own house. But more importantly, look at where you can cut costs in your regular spending, and also to illustrate how significant these seemingly insignificant expenses can be over time. In a future post I will explore some other ways on how you can easily save more money and how it can help you reach FIRE.