June 2021 – Half Yearly Summary

We are half-way through 2021 already! Incredible how fast time seems to go sometimes, and with a new financial year upon the horizon and all that, I thought it would be a good chance to see how the last six months has been for me. I often like to look back to see where I have come from and compare it to where I am today because it really provides with the motivation to continue on this path.

Another side benefit to looking back, is that I can have a good look at my expenses to make sure they are kept under control. I currently look at it on a month-to-month basis but looking over it at a longer period of time definitely provides some much-needed perspective. It also gives me the opportunity to review my investments to ensure they are performing as I would like, or at least see if there are any causes for concern.

This is one of the times that keeping detailed track of all income/expenses really becomes handy, providing this sort of information is relatively easy as it is all documented, just needs to be bundled together.

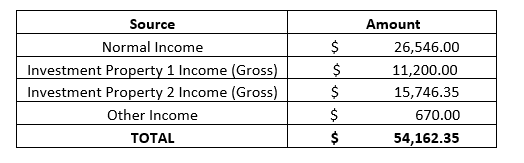

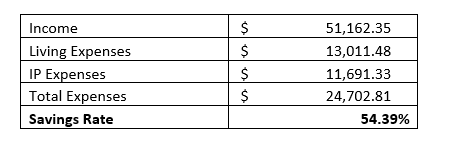

Income

I have been lucky so far in that my investment properties have been continuously tenanted for the past 6 months. Also, my “other income” is typically from my side hustle, but I have not been dedicating too much time on that the past few months, so that is why that number is relatively low. I will mention that I do not really do my side hustle to gain additional income, but more for enjoyment as a hobby. Once I do reach FIRE, then I may look at doing it more as I will have more time on my hands and could make better use of the additional income.

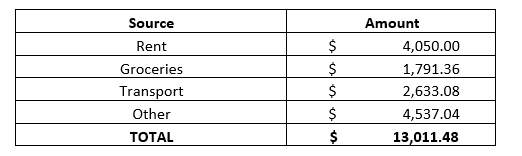

Living Expenses

My spreadsheet does break down the “Other” category into several other smaller categories, but for the purposes of this I wanted to target the “Big 3” expenses of Rent, Groceries and Transport as they typically make up the bulk of living expenses. This is the case here as well where they make up 65% of my living expenses for the first six months of 2021.

At the moment with my FIRE number of $1,000,000 (outside of Super), I can have confidence that I will be able to live sufficiently. Using the 4% rule, it would allow me $40,000 per year to live on, or $20,000 for six months. Although, for now I am renting and I do not plan to in the future, I will assume maintenance and all costs with a fully owned PPOR would be roughly the same. That would still provide me with an additional $7,000 over the six months if I were to continue living at the same standard I am now.

Typically, the $40,000 would not include large one-off purchases (like a car for instance), but I could be reasonably confident that with the additional $7,000 every six months, I would be able to “save up” enough to purchase these large one-off purchases.

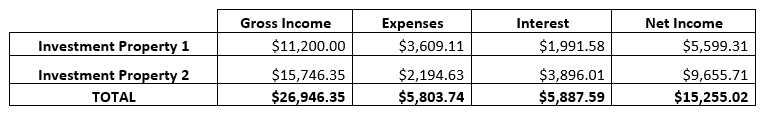

Investment Property Expenses

Whenever I like to estimate the net yield of an investment property, I typically take the gross yield and halve it, and normally I would end up in the ballpark. As you can see it seems to be roughly true with my two investment properties over the past 6 months. Of course, it is important to take certain things into consideration (strata for instance), as they can have significant impacts on the return for the properties.

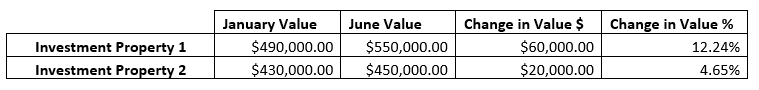

Investment Property Growth

I have to take these values with a grain of salt because I am not too sure how reliable/accurate the values are. As I have said before I use www.onthehouse.com.au to get estimated values, and while I still take the lower end of the range, there is still questions on the overall accuracy of the values. I am not too concerned however, when it does come time to sell these properties, then I will get a more reliable valuation and determine if it is right for me to sell them or not.

I have mentioned before that I would like to sell these properties prior to (or just after) reaching FIRE so I do not have the ongoing expenses to worry about.

If the values above were accurate then I would be incredibly pleased, I did not expect IP2 to have any significant returns as I was only expecting it to provide a high yield, so any capital return is a bonus. IP1 provides a good yield and seems to be providing a good return as well, keep in mind I only paid $300,000 for this property back in 2014.

Total Savings Rate

My goal at the start of the year was to have a savings rate of 40% through the year. At the moment I am well in excess of my target and sitting well over 50%. I do not foresee any significant expenses occurring over the next 6 months so hopefully I can maintain that savings rate of 50% for the entire year!

I will note I do not include dividends in my income, as they are reinvested back into shares for the time being. Once I am in FIRE I may change that as I may become more reliant on that income for my living expenses, but for now I am more than happy to let it be reinvested and compound.

All of my savings is put into shares for the time being, I have my emergency fund sitting in my offset account so all of my savings this year and going forward goes straight into investments.

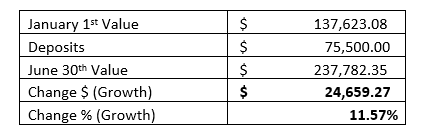

Share Market Growth

It has been another incredible performance in the share market over the past 6 months, in fact the last 6 months of 2020 and first 6 months of 2021 have been really incredible overall, a real bounce back after the Covid crash.

I am slightly concerned, being relatively new to shares (only made my first purchase in April 2020) that I may have some over-confidence in the market which might not be based in reality. I am yet to have any money go through a crash of any sort, so I am worried how I might react if that were to happen. I am under no illusion that the returns experienced over the past 6 months is what to expect going forward, but I could be in for a rude awakening when there is a significant drop in the market.

I have made some additional repayments (outside of my regular savings) when I was bringing money back from the US (approximately $35,000), but the remaining $25,500 has been from my regular savings.

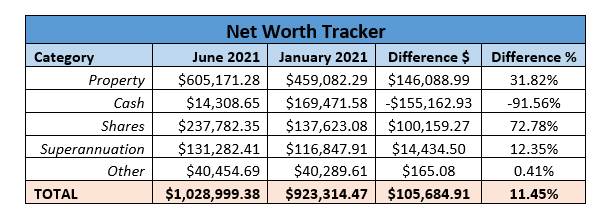

Net Worth Change

As you can see it has been a bit of a whirlwind ride with some of the categories, but it all can be explained of course.

Property: The main driver of this increase is due to two things, an $80,000 increase in the property value (as shown before), as well as an increase in the amount of I have from my offset account. I have increased the amount in my offset account as a place to store money for a future property purchase which I am still hopeful of making towards the end of the year/start of next year.

There has also been slight increase due to the reduction in principal as both of the loans I have for my Investment Properties at P+I.

Cash: At the start of the year a lot of my cash was in US Bank Accounts, and I did not want to bring it back to Australia until I had my taxes all paid. It took longer than expected but was completed just over a month ago, now I have been able to bring all the money back and start putting it into either the offset account or shares.

I still have some money left in the US Bank Account (around $12,000 AU), and will be bringing this back to Australia shortly, I am hopeful that by the end of June my cash account will be around $5,000 or so.

Shares: This has been getting a significant boost due to bringing the cash back from the US as well, and also making regular contributions. There will be approximately another lump sum of around $30,000 invested in the near future, but after that it will only be regular investments over time.

Superannuation: Basically, this has been following the stock market, great returns with just the minimum mandatory contributions. I might look into making additional contributions in the future, but not this year.

Other: This has barely changed which is fine. The bulk of this number is made up a debt that my brother owes me, which I am charging no interest on (I am a generous brother sometimes), I might have to ask him to start making repayments on it soon though I think.

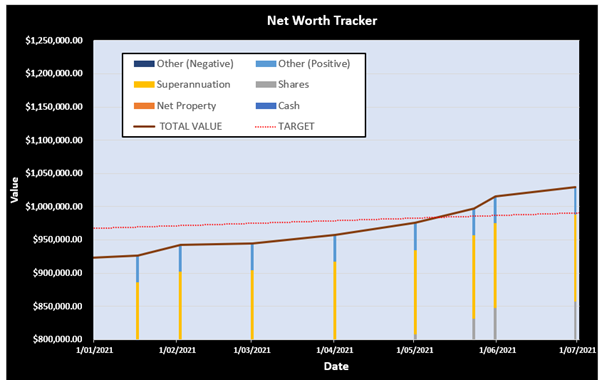

The above graph does show a nice steady increase in value. One important thing to note is I am now above the “Target” growth rate, which is my linear line to reaching a FIRE number of $1,250,000 by 5/1/2027. When I do end up buying my future PPOR, it will affect my net worth drastically if I do not include the PPOR value in my total net worth. Although the numbers on the spreadsheet might not look that good, I would at least know that the money is going to something that I will want to have in my retirement, so it is still an asset I will need to have.

Also, an achievement I am proud of over the past 6 months was to reach the $1,000,000 milestone! This was a pretty cool feeling and surprised it happened so early (I did not expect it to happen until the end of the year).

Current Passive Income

One thing I have decided to do is have a look at what my passive income would be if I were to stop working immediately. I will need to look at my income producing assets, in this case it would be my two investment properties, and my share portfolio. I will not include my superannuation as I am unable to access this for another couple of decades.

IP1 Net Income – $5,599.31 (after expenses and Interest)

IP 2 Net Income – $9,655.71 (after expenses and Interest)

Shares Portfolio Income – $4,755.65 ($237,782.35 x 2.00%)

TOTAL = $20,010.67

The above number give me roughly the income I make passively over a 6-month period.

The above indicates that I would have around $40,000 per annum as an income in 2021 dollars, which is essentially my FIRE number. However, I do need to consider that IP expenses do fluctuate considerably, and a large repair could put a significant dent in my rental property income. That is one reason why I would look at offloading the properties prior to or just after reaching FIRE.

But overall, it is pretty incredible, I could actually theoretically retire right now and based on my current spending, I would earn enough passive income to cover all my expenses (with almost $7,000 additional remaining as a buffer).