Investing for “Gifts”

I believe that one of the most important advantages of educating yourself about finances, is the ability to pass that knowledge on to the next generation. You will see it a lot of the time for people within the FIRE community that they only wish they knew about it sooner, or they knew about index investing while they were still in high school.

It is a common desire to start younger, and of course it makes sense given that time is such a major factor when it comes to compound interest. Unfortunately, while it is such a major factor, it is not something that is within our control, we do not have access to a time machine (not yet anyway – and even if we did have access to a time machine, I doubt that investing in indexes is what would we choose if we could know the future).

The next best thing we can do is at least pass this information on to the next generation, in a hope that they will be able to start at a nice early age, to give them as much power as possible to build their own financial independence.

I read a book a while ago which I talked about HERE which is a good read if you were hoping to build financial independence within your children.

In this post however, I want to look at something slightly different and how I want to use investing as a gift for my nieces and nephew (at the moment, I do not have any children of my own).

Gifts for Little Ones

Every time a birthday seems to come around for children, they seem to be completely showered in gifts, and especially at a young age, these presents they will soon outgrow, and they will fall by the wayside.

I have since decided to take a different approach for their gifts, and when their birthdays do roll around, I give them nothing! Alright, so that is not completely true, I may not give them anything on their birthday, but instead I will invest on their behalf, letting the investing grow and compound over time until it becomes a significant (hopefully) amount by their 18th Birthday.

Education With The Gift

I must say that the gift of money alone is not really going to accomplish anything, it needs to be coupled with education on where the money came from and how they can use the same principals themselves for building their own wealth.

At this stage, my nieces and nephew are a bit too young to have a meaningful conversation about investing with (my oldest Niece is only 11), so I will hold off on that discussion for a few more years yet, but that does not mean I still cannot have their final gift working away in the background.

Disclaimer

I should say now that I am not investing separately for these children, first of all because I did not begin investing in index funds 11 years ago, but I can “simulate” what the results would have been with stock price and dividend history. And as I am only investing smaller amounts which brokerage would eat into, it would be more financially beneficial if I just “allocated” them a portion of my own portfolio.

Once they do reach 18, I will then gift them the value of their “simulated portfolio” in cash, without having to really sell any of my own shares.

Investment Process

I will use the VAS Index for their investing, mainly because it has been around since 2009 and I am able to look up historical prices and dividends since my oldest niece was born, rather than some of the newer ETFs which did not start until much later.

Every birthday, I will deposit $100.00 into their “simulated portfolio”, buying as many shares as I can, dividends will then be collected, and new shares will be purchased whenever possible.

Through the 18 years, each of my nieces and nephew will have $1,800.00 deposited into their account through their lifetime until they reach their 18th Birthday, where hopefully their investments have performed well and should produce a nice amount of cash.

Results so Far

I currently have 5 nieces and 1 nephew, oldest being 11 and the youngest being 5, so already there has been a limited amount of time to see some current results.

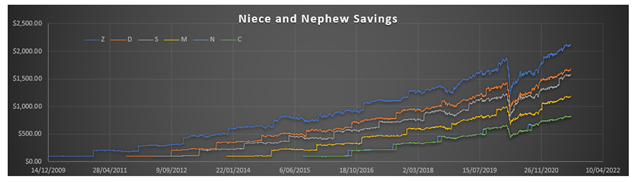

Below is a graph which shows the growth of the individual simulated portfolios over time:

N and C were born a couple of weeks apart, so it is hard to distinguish between the different lines on the graph unfortunately.

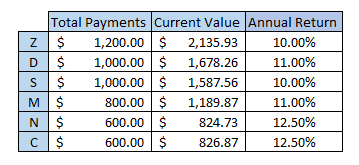

A table of the results is shown below:

The annual return is somewhat estimated using the compound interest calculator on the Moneysmart website.

Forecasting

If the trend follows and an average return on 10.00% per annum is achieved, then after 18 years, $1,800 will be invested and it will have a value of $4,560.00.

I know when I turned 18, I definitely would have liked a gift of $4,500.00 coming from my uncle!

Conclusion

The important part will really be the education factor, I may even give them the option if they wanted to keep the money invested and they can see it grow (but now in their own investment account), or if they wanted to cash out now. I hope they pick the former because it would have been nice to have a small nest egg to start compounding when I was only 18.

I will also have to think about how I plan on having that conversation with them, I still have a few years left before they will probably be old enough to get the most out of it, but it is definitely an important factor to be worried about. I also need to realise that the impact from the uncle will be relatively small, and what they learn from their parents (my brothers and sisters) will overall be a lot more important in the long term regarding their financial knowledge.

I just hope my nieces and nephew like graphs and data as much as I do!