How to Watch Out for Sequencing Risk – Part 1

First of all, what is sequencing risk?

Sequencing risk is the risk that the order and timing of investments are unfavourable and can lead to lower returns in the long term. In terms of FIRE, this could have significant impacts of our retirement towards the back end. Not to mention, also impact our returns on achieving our FIRE number in the first place.

Alright, so that is how it sounds in theory, but how does it look practically. Some people may be able to understand how it might work from reading about it, but personally I always like to see real numbers and graphs to really illustrate the point being made.

Example:

In this example I want to just provide a really basic example of how sequencing risk can affect a portfolio. Each simulation will be over a 10-year period with the following designations:

- Simulation 1: Up and Down

- Simulation 2: Down and Up

- Simulation 3: Steady

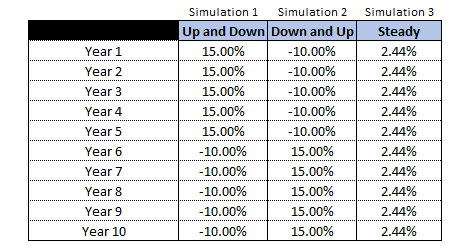

Over the 10-year period, each simulation will provide returns as per the following table:

As you can see, the simulation name relates to how each simulation will perform over the 10-year period.

Investing Lump Sum

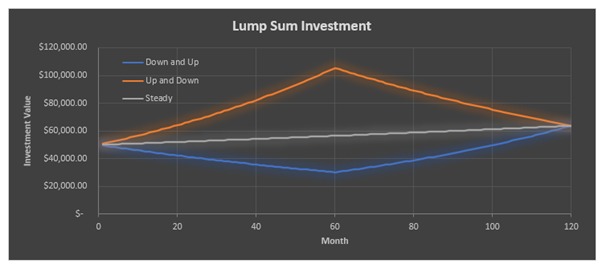

The first example will provide a simulation where we invest $50,000 as a lump sum at the start of the 10-year period and we will look at what the end return is for each simulation.

As you can imagine, Simulation 1 will increase rapidly at the start but then start to decrease after 5 years when there is a negative return. Simulation 2 will do the opposite and Simulation 3 will do something in the middle. But will the different returns provide a difference in the end result at the end of the 10-year period?

As you can see in the results above, all three simulations end up with exactly the same number at the end of the 10-year period. Each simulation will provide an investment portfolio worth just under $64,000 after the ten years.

So as you can see, there is no sequencing risk associated with lump sum investing, it does not matter if you make the gains early or late in the investment period, your return will still be the same at the end of the overall period.

Accumulation

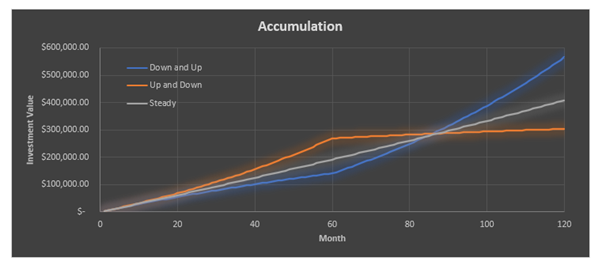

In this example, each simulation will start with $0.00, but will be investing $3,000.00 every month for a 10-year period (a total investment of $360,000).

As you can see on the following graph, the results start to become quite interesting.

Now you can see there is a significant difference between Simulation 1 and Simulation 2.

Simulation 1 finishes the period with a total investment value of just under $304,000.00 ($56,000.00 less than if the money was just left under the mattress!). But Simulation 2, even though it started with negative returns for the first 5 years of investing, finished with over $564,000.00 after 10-years.

Over $260,000 better off, investing exactly the same amount at exactly the same time, just by receiving more favourable returns. This is where you can really start to see the impact of sequencing risk when it comes to investing. When your portfolio is at it’s largest, that is when you really see significant benefits of higher returns.

There will always be ups and downs when you are investing, and there can always be long periods of downturns, you just need to hope (or plan so) they do not happen as you reach the end of your accumulation.

Now to look at the final piece of the puzzle, what about when we are in the withdrawal stage of our life.

Withdrawal

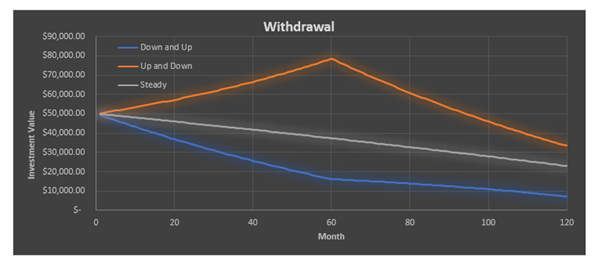

In this example, each simulation will start with $50,000 invested, and will be withdrawing $300 per month with no money at all being added into our investments.

You can see in the results below, they really highlight the potential for sequencing risk when we do reach the withdrawal phase.

Again, you can really see the difference that investing under favourable conditions can have over time. Although it is different in this aspect, with Simulation 1 now performing considerably better than Simulation 2 over the same period.

At the end of the 10-year period Simulation 1 ends up with just under $34,000.00 while Simulation 2 ends up with just over $7,000.00! It is really interesting, through no fault of your own, you could end up with just a fraction of the same portfolio if you were just able to invest during more favourable conditions.

So, what do these last two scenarios tell you? Well, basically, in favourable conditions, you want to have as much money as possible in your investments to take advantage of the returns. That would be, at the end of your accumulation phase and at the start of your withdrawal phase.

Now, I haven’t modelled a scenario where accumulation and withdrawal is combined, but you can imagine from looking at the above two graphs that if you were to start withdrawal after years of accumulation, in the middle of a period with strong returns, it would be a perfect storm for creating and maintaining your wealth. Conversely, if you started retirement in the middle of a downturn/correction it could be disastrous.

So How Do We Mitigate the Risk?

As with all investments, there is going to be risk. Successful investing is all about mitigating risks. There are a few ways we can mitigate sequencing risk, namely the following:

- Diversification: If we spread our investments across a lot of different areas then it makes it a lot more unlikely to be hit with such a significant downturn at any point in time, let alone when we choose to retire. Some diversification will help mitigate the risk and avoid downturns in individual sectors, but sometimes there is no avoiding a whole market downturn (e.g. GFC, COVID etc)

- Work Longer: I believe this might be the best way of dealing with sequencing risk as it is at least fully within our control. Sequencing risk is most crucial if there is a downturn in our investment portfolio within the first 5 years of us beginning to withdrawal our funds. This works in our favour because typically, we would have been working relatively recently. Hopefully, we would still be relatively young, and the information we learnt from our years of already working are still relevant.

Also, I should stress that if I was approaching my FIRE date, and there had been a couple of down years in terms of my investments, I would most likely keep working to try and ride out the downturn as much as possible. You really want to leave on a high and if that means working an extra couple of years just to have that added security some 30 years down the track then it would definitely be worth it.

- Be Flexible: This is another big one, FIRE cannot be a strict practice. You need to be flexible with your approach, look at the market and adjust your life accordingly. If the market is on a downward trend, then you might need to push back your FIRE date. If you are retired already, and markets are heading downwards, maybe you need to cut your costs, or start looking for some side money to provide some income so you do not need to sell down your assets to survive.

Conclusion

In a future post I want to explore sequencing risk a bit further and look into real life scenarios with real returns. I also want to look at how investing with favourable conditions could potentially bring FIRE dates forward. And how unfavourable conditions can really hurt you not only reaching FIRE in the first place, but then running out of money within your retirement.

But for now I will leave this post here, I think sequencing risk is a really interesting topic and definitely needs to be taken into consideration when pursuing the FIRE life.