How to Keep Property Investing Profitable

Property Ownership is an Australian tradition, and property investing is a common occurrence. Approximately 20% of Australian households have at least one investment property. There are countless books on the topic, and every financial guru seems to have their two cents to say about the wonders of property investment.

So why is there such a fascination with property investing? Well to be honest I do not know, property investing definitely has benefits for people if they choose to have it as part of their investment portfolio. But it also comes with significant negatives. In a separate post I will talk more in detail about Property vs Shares investing, but for this post, I want to just focus on something I figured out the other day.

I currently own 2 investment properties in Australia (apparently that puts me as part of the 2.0% Australians who own more than 1 investment properties). When you start investing in property, you can soon see why it can become increasingly difficult to own more than one. In fact, there are less than 100,000 people in Australia who own 4 or more investment properties, to be honest that almost gives me motivation to purchase another two more, just for the bragging rights. I will be the envy of everyone at the backyard BBQ when the conversation skews towards property.

Actually, that last part is not true at all, in fact, the other day I was running the numbers to see if it was worthwhile to sell my Investment Properties and purchase shares instead. I wanted to see which option would be more profitable. Also, when I do eventually reach my FIRE, I am not sure if I want the hassle of owning Investment Properties anymore. So, I made a bit of a spreadsheet to compare the following scenarios:

- Keep Investment Properties

- Sell Investment Properties and Purchase Shares

After forecasting 10 years each scenario, I was somewhat surprised to see what shares was ahead, and significantly ahead. I was a little surprised because as I show in this POST, my rate of return for my Investment Property has been around 21% since I have owned it (adjusting for times when it was my PPOR as well).

So, I was curious about why the returns would suddenly diminish so significantly that shares would overtake it so easily. Now I would still make money out of the Investment Property, it was not losing me money (fortunately it is positively geared), but the returns would be greater if I were investing in ETFs instead.

Now I had two questions to ask myself:

- Why had the return of my property been so great?

- Why weren’t the forecasted returns of my property so great?

Why had the return of my property been so great?

There have been a few different reasons why the returns have been so substantial so far, the main ones were the following:

- There was a bit of a boom in property prices in the area, so the capital growth has been significant.

- The property was able to be renovated at a relatively low cost (with myself doing most of the work) and still able to add significant value.

So, both of these contributed into a large capital growth over the period, which has resulted in significant returns while I have owned it.

Why weren’t the forecasted returns of my property so great?

This is where things do get a little bit interesting, and where I sort of had an epiphany on how to keep property investment returns so high over time. Or at least explain why the returns do compound as well at the same rate as shares investment.

I only assumed a relatively low capital growth of around 3.00% per annum, I do not believe the area my property is in will have significantly higher growth than this, so I believe it to be reasonable.

If I had an LVR of 80%, for a neutrally geared property (where the rent received covers ALL expenses associated with the property), a 3% growth would equate to a 15% return for the year.

For example, if I invested $100,000 as a deposit for a $500,000 property (ignoring stamp duty and purchasing costs for simplicity), my LVR would be 80% ($400,000 loan for a $500,000 value property). After 1 year with a 3% growth, the property would then be valued at $515,000. So my Net Value is now $115,000, or, a profit of $15,000 (ignoring selling costs for simplicity) – to give a return of 15% for the year.

BUT….this is where I realised why there was such a drop in return over time, the LVR of my property is no longer at 80%, in fact it is closer to 50%. So now my 3% return only turns into a 6% return for the year, and every year the LVR continues to get lower, so the return lower as well.

If I was able to refinance the property and maintain an 80% LVR (or 90% even), and I could either invest in another property or into shares, then the returns would back up around that 15% level. Unfortunately, this is not an option, because of a thing called serviceability. Even though my property is positively geared, the bank only takes so much rent into account and they need to take my income into account to make sure I can pay off the loan. If I did have a high income (around $150k +) then it would not be an issue, but on my median income it is simply not an option.

So that is the trick to keeping property investing profitable, you need to keep that LVR as high as possible to be able to take advantage of any growth, no matter how small, it is magnified by this LVR.

But hold on! Do not get excited, LVR is a double-edged sword, gains are magnified, but so are losses. So, increasing your LVR to try and maximise profits also leaves you exposed to potential magnified losses. In the end it all comes down to your own risk appetite and how confident you are in your property not losing value over time.

Calculations

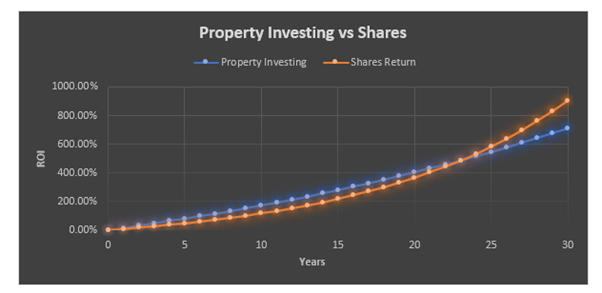

I have also made a basic graph which illustrates over time how there is almost a stagnation in returns from investment property compared with shares investing. This has assumed that there has been no refinancing, interest only repayments and the property is neutrally geared. I have also made the other following assumptions:

- $500,000 property value

- 3% per annum capital appreciation

- $100,000 deposit

- 8% per annum return from share market

As you can see in the graph, property is ahead for a long time, but the growth is a lot more linear compared to Share Investing which is exponential. After 30 years, the LVR is less than 33% (even though the principal at the start of the loan is the same as at the end)

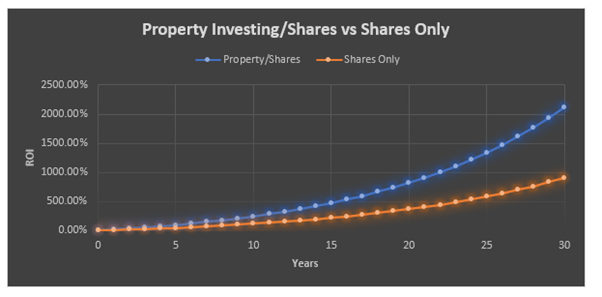

Now I wanted to look at what happened if LVR was maintained at 80% for the full 30-year period. I will also invest the additional equity into shares and receives an 8.00% per annum return. Have a look at the graph of Property/Shares vs Shares Only.

Incredible, by reinvesting the equity, and maintaining the LVR of 80% through the 30 years. The returns are more than double than just investing in Shares.

Again, I must stress, this only looks so impressive because of the 3% per annum capital growth. If this number reduces down to 1.5% per annum (which is a possibility), then you break even when compared to shares investment.

Also, I must mention that to be able to do this you need to be able to maintain serviceability of the loan. By the end of the 30-year period, the loan amount becomes $970,000 for a property worth $1,200,000. A lot of this will depend on a bank continuing to loan you the money. Finally, I have also assumed that the property has remained neutrally geared throughout, so rental income would need to increase proportionally to cover increased loan repayments.

Conclusion

This may have been common sense to others, but I found it interesting to look at. Especially with the graphs to illustrate the point. Once again, there is definitely money to made with property investing, but it can take significantly more risk compared with Shares (due to the debt factor).

If you have a high income, and can service the increasing loan amount, then maybe looking at refinancing your loans and maintaining a high LVR might be beneficial for you to increase your returns with property investing.

Personally, I am happy that at least now I understand why I do not make as much from property investing as I used to. I am aware of the reasons behind it, and for my situation, I am not interested (or able to) increase the loan amounts to maximise the LVR to what they need to be to provide the strong returns. I have done very well out of my property investments so far, but in the future I will be looking at selling them as I do not think I want them as part of my investment portfolio in retirement.