How Market Makers Make ETFs Work

The other day I was pondering something about how the value of ETFs actually work and how it is able to relate to the value of the underlying assets that are held within the ETF.

It made sense to me that the value of the ETF would reflect the value of the underlying assets, but I was struggling to understand how the actual mechanics of it would work.

I was going to ask the question on Reddit, but amazingly somebody had already asked the same question on the same day as I was going to ask. It is quite common to find a similar question some time in the past, but on the same day is pretty rare. Interesting that somebody had exactly the same thoughts I was having at the same time.

Anyway, the magic all comes down to something called a “Market Maker”

Breakdown of a Market Maker (MM)

A market maker is an individual participant or member firm of an exchange that buys and sells securities for its own account.

Market makers provide the market with liquidity and depth while profiting from the difference in the bid-ask spread.

Brokerage houses are the most common types of market markers, providing purchase and sale solutions for investors.

MM Role in ETFs

The above is simple enough for individual securities, but it becomes more complicated for ETFs.

Market makers create ETF units by delivering a basket of underlying securities to the ETF provider in exchange for a block of units of the ETF with the same market value. These newly created ETF units represent an inventory that can be sold on the stock exchange to investors. When the market maker runs out of units (because the investing public has purchased them all), they simply repeat the process, beginning with purchasing and delivering additional securities.

This creation process can be reversed into a redemption process, whereby the market maker exchanges ETF units with the ETF provider, for an equivalent basket of underlying securities from the ETF. This sometimes occurs if many investors in an ETF choose to sell their investments at the same time.

Creations and redemptions allow the ETF to be in equilibrium, which means the number of units demanded by the marketplace approximates the number of units supplied – which ensures that an ETF’s market price and net asset value (NAV) are closely linked.

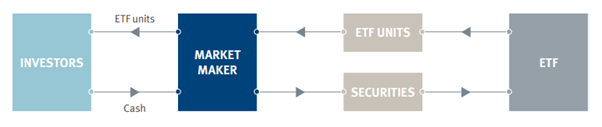

Chart of MM Role in ETFs

The above chart shows that the Market Maker purchases the underlying securities of the ETF, and in exchange for these securities they receive ETF units.

They then use these ETF units to buy/sell with investors (like you and me).

For example, if there was an ETF which considered of Companies ABC, MNO and XYZ at equal portions. MM would purchase each of these listings, and then trade with the ETF provider for ETF Units. It would then have these ETF Units to trade with investors.

Buying and Selling Units to Investors

Market makers are tasked with providing ETF liquidity to a given market. They do so by providing units for sale on the stock exchange at asking prices, and then posting bid prices they will purchase units at, for investors wishing to sell. The bids and asks are themselves calculated based upon the underlying asset values, and the costs and fees associated with buying or selling all of the underlying securities inside the ETF.

A valuable partnership

The market maker fulfills other important roles in addition to providing liquidity and maintaining market equilibrium – they also help to ensure the market price of each ETF unit reflects the value of its underlying securities intraday. This is where I was most curious if there were instances when an ETF was either over or undervalued depending on the value of the underlying assets.

There are often multiple market participants with bids and offers on an ETF in the marketplace. Each market participant wants the opportunity to match buyers and sellers, and this competition drives them to post their very best bids and asking prices. Thus spreads not only reflect the market conditions (liquidity, etc.) of the underlying asset class, but can be improved even more than underlying asset class characteristics if there are multiple competing market makers providing liquidity on a given ETF.

Why is it important to understand the market maker’s role?

The three-way partnership is valuable to all parties: the ETF provider, the investor and the market maker. Not only do market makers play a key role in the creation and redemption process for ETF units, but they also provide vital liquidity and proactive oversight for ETFs, ensuring the price investors pay to buy or receive when selling is fair and reflective of the value of the ETF’s underlying securities.

The majority of this information has come from the following sources

https://www.rbcgam.com/documents/en/articles/what-is-the-role-of-the-market-maker-for-etfs.pdf