How I Track My Finances

I track my finances for the following reasons:

- It keeps me accountable

- It keeps me motivated

- It helps me plan and forecast

- It helps me improve

There are probably other reasons as well, but the above are the main ones, I will explain how my finance tracking is able to do the above.

Keeps me Accountable

By tracking my finances, keeping track of every expense I make, it really lets me see the effect of my financial decision making. It can be easy to make rash financial decisions if there is no accountability, but if I make a financial decision without much thinking then I know that down the line I will have to update my spreadsheet with that decision. It means that I have to think twice when I do make that decision and gives me some foresight when I am in that situation.

Keeps me Motivated

I have found that motivation is a difficult thing to maintain along the FIRE journey. At the start everything is new and exciting, motivation is high and you make all these big cost savings and set everything up for the next few years. But then after a few months/years of being on the journey, it can be difficult to stay motivated. Tracking my finances allows me to see every little bit of progress that I am making, so even when I might not feel like I am getting anywhere, I know that on my spreadsheet I am making those small gains each and every day.

Helps me Plan and Forecast

Trying to come up with a FIRE number can be a tricky thing to do. How much do you need to live off per year? Without tracking my finances, I would only be able to give a rough ballpark figure. Considering this number could be a significant part of my life, I want to be able to make sure there is some logic behind that number. By tracking my finances, I know exactly how much I typically spend in a 12-month period, and by making the changes between my current lifestyle and the lifestyle I want in retirement, I am able to come up with a realistic FIRE number.

Not only that, but when it comes to planning and forecasting my saving until I reach that FIRE number, by tracking my finances all along the way I can accurately see in black and white how much I have been saving up until now. I can use these numbers to help plan for the future so I can forecast when I expect to reach a certain milestone.

It Helps Me Improve

Right at the start, when I made the decision to improve my financial decision, it was easy to make relatively small changes to my lifestyle/expenses and create significant financial impacts. Once the low hanging fruit was taken care off, it took a bit more investigative work to be able to determine where further improvements could be made. By tracking my finances I was able to see where my money was going, and I could determine what I could live without and where my money would be better served if I was able to save it instead.

My Finance Tracker

The above explains the main reasons on why I choose to track my finances, but now I want to talk about HOW I actually do it. There is any number of ways to track finances, and there is no right or wrong answer, it is simply a matter of what works best for you in your situation.

Given my liking for Microsoft Excel I have built my own spreadsheet which I use to track just about all my financial matters. The only thing my spreadsheet does not really track is my share investments, and that is because I just use Sharesight to track that for me. Maybe down the line I will add a tab to my spreadsheet to incorporate my share investments, but for now I am pretty happy with what Sharesight is doing so I am happy to leave it as that for now.

My spreadsheet comprises of the following tabs:

- 2021 Cost Tracking

- 2020 Cost Tracking

- 2019 Cost Tracking

- Asset Value

- Data

- 2018/19 Tax Return

- 2019/20 Tax Return

As you can imagine, I will soon need to create a new tab for 2020/21 Tax Return, and in 6 months-time I will need to start a new tab for 2022 Cost Tracking.

I used to have a spreadsheet which was not broken down by years like this one is, but my lifestyle would change significantly from year to year, so my budgets would need to be adjusted to be able to keep it accurate. I found that by adding a new tab for every year was the best way to manage this, it also prevents the individual sheet from becoming too much of a behemoth.

2021 Cost Tracking

This is the tab I use most of the time throughout the year, in this tab I input all my income and expenses. Each income/expense is categorised depending on where it came from or what it is spent on. For instance, expenses will be categorised Rent, Car Costs, Groceries etc, and income will be categorised as Work, Rental Income etc.

I normally update this about once a month, so I go through my online banking and input all my income/expenses and it will take me about 15 minutes or so. This is why I do like to pay for everything with a card instead of cash, as it provides a digital receipt so I can see it easily in the future.

I know one of the hints for cutting back on spending is to pay for everything with cash, and while I can see why this has merit, for me I am already able to tie “imaginary money” from my card to “real money” so what I do works for me.

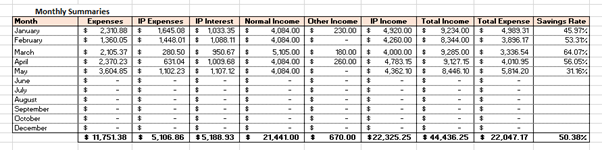

I track my investment property expenses separately, including interest repayments, so that I am able to quickly and easily put together my tax return at the end of the year.

The tab also has several automatically filled in graphs/tables which I can use to help summarise the data:

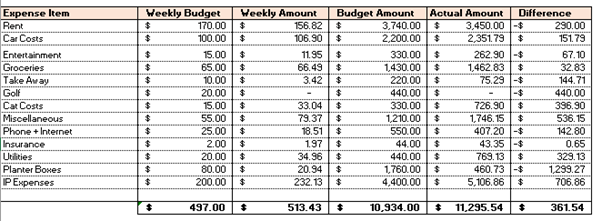

- Budget Tracking – Actual costs compared to budgeted costs

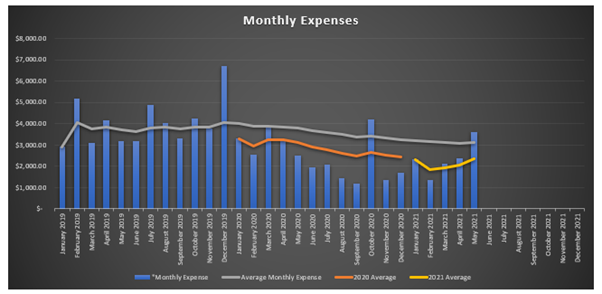

- Summary of my Monthly Expenses since I started tracking my finances in January 2019

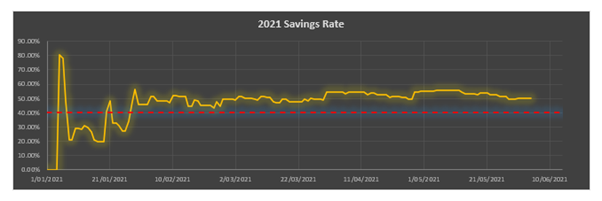

- 2021 Savings Rate over time

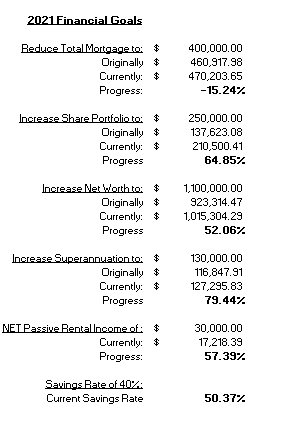

- 2021 Financial Goals Tracking and Progress

- Monthly Summary of Expenses/Income

That is the main summary of the information that is provided from my 2021 Cost Tracking Tab

2020 Cost Tracking and 2019 Cost Tracking

As you can imagine these are similar to the tabs for 2021 Cost Tracking, just for previous years. I do continuously streamline my tabs though to tell me the information that I want to know, so they will not be identical, but they serve the same purposes.

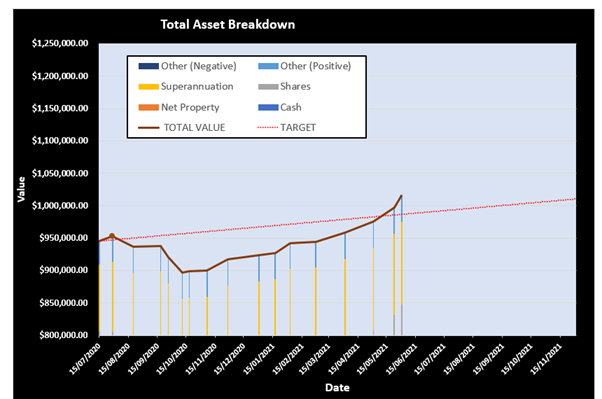

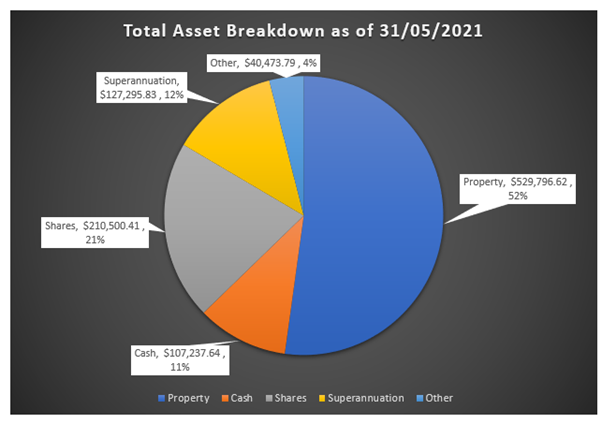

Asset Value

This is the tab where I check my Total Net Worth, every month I will go through all my assets and input their current values and it will tell me the final net worth. It also provides a line graph tracking my net worth over time, and a pie chart to tell me my asset breakdown at any point in time that I want to check.

- Total Net Worth Over Time

- Asset Breakdown

Data

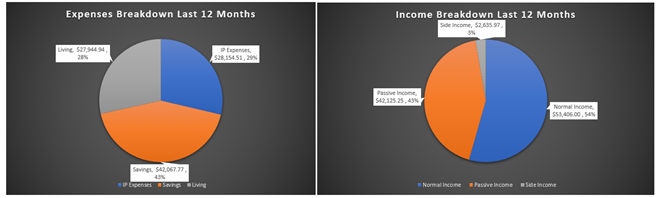

This is the tab where I do a lot of the calculations for the graphs and charts, so it is not the most interesting to look at, it is basically just a wall of numbers.

I do have a couple charts generated on this tab which will tell me my expenses breakdown of the previous 12 months, as well as the income breakdown for the previous 12 months. This is a rolling 12 months which will update as time progresses. They are only high level in terms of the breakdown they provide, but the expense breakdown particularly was useful to calculate my FIRE number.

- 12 Month Breakdowns

2018/19 Tax Return and 2019/20 Tax Return

These tabs are not interesting, as you can imagine they just provide the information for my tax returns.

Summary

That is how my finance tracking spreadsheet looks anyway. Like I said, it might not be for everyone, but it definitely works for me. The best part is, because I built it from scratch, it is easy enough for me to manipulate the data so that it can provide any sort of information that I want relatively easily. Over time, my needs evolve, or I may come up with a new idea, and it is straight forward to be able to implement changes and incorporate that into the spreadsheet.

I also believe that as time progresses, it will be interesting to be able to look back on my life from a financial perspective to see how much has changed since I first began tracking. I do wish I started earlier as it would have been interesting to see my spending habits while I was in a high paying job and was not chasing FIRE as much as I am now.

Conclusion

I am providing this information about my own way of tracking finances, and in no way am I recommending what I do to anyone else. I urge everyone to track their own finances in a way that suits them. As you can see, I like to go into significant detail and track every little expense that I have, this may not work for everyone, and I can completely understand that. Overall, I do believe that tracking your financial information is a useful tool and it has a lot of positives that can help you on your own FIRE journey.