Home Loan Comparison

A mortgage is the largest piece of debt that most of us will ever have in our lives. Even a “smallish” loan size for a property will still be at least six figures normally. So, it makes sense to do a lot of research when obtaining a loan to make sure you get what is the best for you. However, there is still a significant number of people who do not look for the best deal. Or, sometimes people are unable to determine which home loan product is the best deal. To be honest, I do not blame them, lenders will use a lot of language which is foreign to the average person so they simply do not understand the repercussions of what they might be getting themselves into.

This brings me to my first piece of advice:

- Use a mortgage broker, whether you are comfortable around finance language or not they will still be a great help. They deal with lenders on a day-to-day basis, I mean it is their job after all. They want what is best for you because a lot of the business in their industry will come from referrals, so it makes sense that they are looking out for you, the customer.

But even if you have the best mortgage broker on your side, it is still important to understand what you are signing up for, after all it is your money that you will be sinking into this mortgage so a little bit of research will go a long way into saving you some dollars down the line.

My second piece of advice:

- Use the comparison rate when comparing different mortgages, a lot of lenders will advertise a low interest rate to appeal to the customers, but then add in additional fees and charges into the home loan. The comparison rate incorporates these additional fees and will be able to provide you the true cost of a loan product.

Now that you have a mortgage broker on the line, and you understand the basics of which home loan product might be best for you, the next important step is to understand how much of a financial impact what you are about to sign into.

My third piece of advice:

- Use a mortgage calculator to be able to see exactly how much the mortgage will cost you through the life of the loan. Obviously there will be things you cannot predict (i.e. interest rates) but you can use assumptions and estimates to get a pretty good picture of the financial implications.

I have made a spreadsheet which is available here which can help you determine the full cost of a loan based on different variables. My main goal of this spreadsheet was to be able to compare different home loan products, as well as compare the potential savings of making additional repayments through the life of the loan.

Extra Repayment Comparison

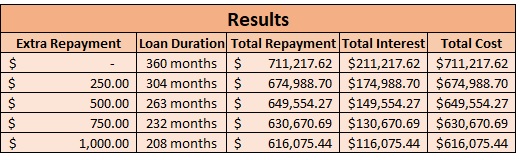

Making additional repayments has a significant impact on the total cost of a loan. In this example we will compare the following – a $500,000 loan amount, with a 2.5% per annum interest rate with the following additional repayments:

- $0 per month extra

- $250 per month extra

- $500 per month extra

- $750 per month extra

- $1,000 per month extra

Assuming a 30-year Principal and Interest home loan the results look like this:

So even putting in an additional $250 per month, will save you over $36,000 and almost 5 years in loan duration.

If you are able to put in an additional $1,000 per month, this will save you almost $100,000 and almost 13 years in loan duration.

It is incredible how much money you really can save if you put in a bit of extra money.

Interest Rate Comparison

It is also important to shop around because choosing a lower interest rate, even if it is only different by 0.1% can have significant changes by the time you reach the end of the loan period.

So, let us use the same example as last time and see the difference between the following:

$500,000 principal, 30-year loan term with a 2.5% per annum interest rate

= Total Cost: $711,217.62

$500,000 principal, 30-year loan term with a 2.4% per annum interest rate

= Total Cost: $701,894.46

Even a change of 0.1%, which might seem almost insignificant, will change the results by almost $10,000. You can really see the importance of shopping around, especially if you had an interest rate of 3.5% and do the same calculations, you will see it will cost you almost an extra $100,000 (compared to an interest rate of 2.5%) by the time you complete the loan.

Conclusion

Most people who obtain a mortgage are not experts in the finance community, but you do not need to be. At the end of the day, it all just comes down to the numbers, and by looking through in detail at the home loan products and playing around with spreadsheets you can easily find out which option will be the most cost effective for you in the long run.

It might take several hours of research to understand the jargon used by the lenders, but if the savings could be tens of thousands of dollars it is time well spent.

There is a whole lot more to compare when it comes to home loan products, in this post I only talked about additional repayments and interest rates because I believe they are typically the most significant. But there are several other comparisons to be made, establishment fees, monthly or annual fees, introductory rates, introductory rate periods. On the spreadsheet I have provided you are able to compare all of these to find out which home loan product will be the most beneficial for you.