Full Cost of Investment Property

Just a heads up, in this post I am not going to talk about the benefits of investing in property compared to other investment opportunities, but just highlighting costs associated with investing in property. In future posts I will compare different type of investments, highlighting the advantage and disadvantage of each one.

When people first think about the idea of investing in property, it can be very easy to see a lot of the unknown costs associated with managing an investment property. There are a couple of main factors that are typically looked at when purchasing an investment property:

- Capital Growth

- Yield

Capital Growth

Capital growth of a property is difficult to predict, and yet it will have the biggest impact on whether the property will be a good investment or not. The biggest advantage of investing in property is leverage, being able to use a small portion of money, taking on debt, and allowing it to magnify your returns. Of course, there is a downside, any reduction in property value will be magnified and create significant losses. Given the potential unknown of capital growth on any certain property, that is why personally when I invested in property, I preferred to look at the yield of a property instead.

Yield

Yield is calculated relatively easily, by dividing the income received from the property and dividing it by the property value. For example, on a $500,000 property, if it was rented out for $500 per week. The gross yield would be 500 x 52 = $26,000. $26,000 / $500,000 = 5.2%

As you can see that is an easy number to calculate, and for any potential investment property listing it is quick to calculate and compare potential properties. That is why in the end it is important to take into account ALL costs associated with owning an investment property, and then calculating what the NET yield will be.

Calculating Net Yield

Net Yield is much more difficult to calculate, and it does involve some assumptions which need to be made to try and reflect a true value. For instance, the following other factors need to be taken into account if you were trying to calculate the net yield:

- Council Rates

- Water Fees

- Property Management Fees (if you will not be managing the property yourself)

- Vacancy Rate

- Body Corporation Fees (Strata)

- Maintenance and Repairs

- Insurances

- Loan Interest

As you can imagine, it does not take long for all of these numbers to add up and all of a sudden, the returns from your rent are diminished quickly. In a lot of cases all of these will add up to more than any rent collected, and you will end up with a negatively geared asset. If your expenses equalled your income, then it would be neutrally geared, and if you made a profit after expense, then it classifies as positively geared.

When I have looked at investment properties in the past, I have always aimed to obtain an asset which is positively geared. Typically for properties which are positively geared, the capital growth is lower, but I am fine with this as I prefer the almost guaranteed smaller returns.

Real Example

Alright, so it is all well and good to see what these numbers might be, but I always preferred to see a real-life example. As I have mentioned before, I currently own two investment properties. However, one of them I only purchased less than 6 months ago, so it is not really long enough to get a full picture of what the expenses would be.

On the other hand, my first investment property was first purchased back in 2014. However, this was my PPOR initially (and then for a short period in between tenants) as well, so although it was not always an investment property. But I am still able to isolate the costs incurred from when it was an IP and when it was a PPOR.

My property was an IP between the following dates:

- 3/12/2016 – 8/7/2017 (a total of 217 days)

- 28/9/2018 – 30/1/2021 (a total of 855 days)

That is a total of 1072 days, or just under 3 years this property has been an Investment Property.

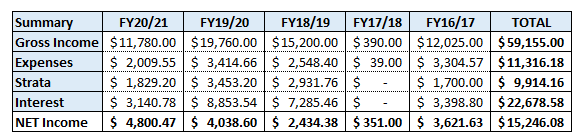

Summary of Income vs Expenses

As you can see from the above table, a lot of the costs associated with property is soon eaten up in expenses and all of a sudden, the nice-looking number of gross income is dwindled quickly down and returns are substantially less than what is initially indicated from gross income.

In the real-life example above, you can see almost 75% of the gross rent received is used up in expenses used to manage the property. There is one benefit and that is at least these expenses are tax deductible so they do provide some benefit on your tax return at the end of the financial year.

Example for Net Yield Calculation

If you are still looking at comparing potential investment properties, if you were hoping to get a more realistic picture of what sort of return (excluding Interest) you can expect from the asset. I would recommend finding out the gross yield, and dividing this number by two, and it should be relatively close to your answer.

To calculate the interest payable will determine a lot on how much you borrow and what sort of interest rate you have with your loan.

If we look at the original example from before:

$500,000 property rented out for $500 per week

$500 x 52 = $26,000

$26,000 / 2 = $13,000

$13,000 / $500,000 = 2.6% Net Yield

Now if you obtained a loan for $400,000 on this property, and your interest rate is 2.5%

$400,000 x 2.5% = $10,000

Return after Interest = $13,000 – $10,000 = $3,000

Calculating Investment Return – Example

Using the above example, to calculate the return of an investment property to be able to compare it to any other investments.

Initial Investment:

Deposit: $100,000

Stamp Duty: $18,200 (this will depend on your state – this number is for NSW)

Purchasing Costs: $3,000 (conveyancer fees, building inspections etc)

TOTAL Investment: $121,200

Value after One Year:

Home Value: $500,000 (assuming 0% capital Growth)

Income: $3,000

Loan Owing: $400,000 (Interest Only Loan)

Return on Investment: $3,000 / $121,200 = 2.48%

Now let’s try if we obtain even a minimal capital growth 2.00%

Value after One Year:

Home Value: $510,000 (assuming 2% capital Growth)

Income: $3,000

Loan Owing: $400,000 (Interest Only Loan)

Return on Investment: $13,000 / $121,200 = 10.73%

As you can see, with capital growth, it turns a mediocre investment into a great investment. However, it should be noted that to take into account the “liquid” value of a property, you should also take into account selling fees associated with property to get a real picture of how much your property is worth.

Conclusion

Gross yield is a useful indicator to compare investment property potentials, but it is important to realise there are a lot of costs associated with owning a property as an investment. Same as any investment, you need to do your due diligence to gain a full understand of what you are purchasing and what sort of realistic returns you can expect.