FIRE Milestones

In this POST I have outlined and detailed the FIRE Milestones that I use to help me stay motivated throughout my FIRE Journey.

I hope sharing these FIRE Milestones keeps you motivated on your journey. Without even realising you will be going through them faster than you ever imagined, but just remember to now let life simply pass you by while you look toward the future. Be proactive in enjoying your life in the moment as well, the journey is more important than the destination.

FIRE Milestones:

A lot of the earlier Milestones are estimates, as I was not tracking my financial details with any significance, but I am providing my best estimates.

Reach Positive Net Asset Value – Achieved Late 2009.

After studying Engineering at University I did have around $40,000 in HECS/HELP debt. I finished University in 2008 and when I started working full time in 2009 I was able to save a significant proportion of my salary to at least have more than savings than debt by late 2009. I remember buying my first property in Australia (joint PPOR with my brother) in September 2009, so given I had enough for a half a deposit with some remaining left over for emergencies I would have had a Positive Net Asset Value.

Build Your Emergency Fund – Achieved Mid 2010.

At the time I was not really on the FIRE journey so I did not call it an Emergency Fund, but I did have a fair amount of savings in my offset account for my home loan. My standard expenses would have been relatively high as well given mortgage repayments.

Reach $50,000 Net Asset Value – Achieved Mid 2012.

This is only an estimate as well. I remember buying my first US Property in April 2012, and my share was around $25,000 AU. I know it was only a fairly small portion of my total savings I had built up into my offset account so I would assume I had around $50,000 Net Asset Value around that time.

Reach FU Money – Achieved Mid 2013.

At this stage I had been working FIFO for a year now and my salary was significantly higher than what it was previously, I was careful not to increase my spending (at least not too much) so alot of my extra income turned into savings into my offset account.

At the end of 2013 and start of 2014 I did purchase two more properties in the US however. So although my Net Asset value did not change significantly, a lot of my money would have been a lot more difficult to access so it is difficult to determine if this would count as FU money or not. At the time I was fairly comfortable financially and I feel I could leave my job and sustain myself for at least 1 year if I needed to so I guess it would suffice.

Reach $100,000 Net Asset Value – Achieved Early 2014.

As mentioned above, my net asset value would have been over $100,000 by this time, but the funds would have been difficult to access if I needed to. Unfortunately it was not until 2020 until I learned enough about the share market to start investing.

I purchased my second PPOR in Central Coast, NSW in mid-2014, so this would have reduced my Net Asset Value (due to stamp duty and purchasing costs). Also, some people would not include PPOR equity in Net Worth calculcations. So there is a possibility that I might have dipped under $100,000 net asset value around this time.

Reach 20% of FIRE Target – $250,000 Net Worth – Achieved Late 2015.

I remember property values in the US started to increase significantly, my income was growing significantly and I was able to save a lot of money and put it on the offset of my home loan.

My last US property was bought at the end of 2015, and this was bought using existing rents received and I believe once this was purchased it would have pushed my Net Worth over $250,000.

I believe it was around this time that I finished paying off my HECS/HELP debt as well, I did not make any additional repayments and just paid the minimum the whole time.

Reach 40% of FIRE Target – $500,000 Net Worth – Achieved Mid-2017.

I am still only relatively estimating how much my Net Worth was at the time. But the 4 properties over in the US were doing very well, so although a lot of my net worth was not liquid and would have been difficult to access, overall I still had that value.

It was around this time I decided to stop working FIFO however, so my high income was going to be no more, but that was alright, because I feel I achieved what I set out to achieve working FIFO, I set myself up for the future and I needed a lifestyle change to keep my mental state where it needs to be.

Reach Half FIRE – $625,000 Net Worth – Achieved Early-2018.

It was around this time that my Net-Worth growth slowed significantly for a few months. I took around 6 months off work to go travelling around Australia, so although my work income was not coming, my assets (property) were still receiving rent and still growing due to capital appreciation. But I did not have that savings rate that was essential to keep that momentum going.

I also turned my PPOR on Central Coast into an IP around this time as well, and once I returned from my trip I have been renting ever since. This does in turn increase my Net Asset Value significantly (if you do not include a PPOR) but obviously increases my expenses significantly as well.

Reach 60% of FIRE Target – $750,000 Net Worth – Achieved Mid-2019

I had been back at work now for 6 months, and also had begun selling my properties in the US and bringing the money back to Australia. The last property we bought was sold first, and even though it was only owned for 3 years it still had a decent growth in that time. And the currency exchange rates were also fairly favourable at the time as well. I still had not put a cent into the share market at this stage, so my total assets was only based on property.

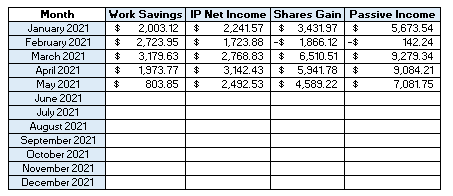

Investments Contribute More Than Savings – Achieved – Ongoing

As I have talked about previously, this one can be difficult to measure and also it will fluctuate over time. I will provide a monthly breakdown of how much my investments have grown, compared to how much I have been able to save. This will also include passive income generated from my investment properties.

Reach 80% of FIRE Target / Lean FIRE – $1,000,000 Net Worth Achieved – 23/5/2021

What a big achievement! And what a good feeling to know that if I wanted to retire right at this moment I could do so and while it might not be the most luxurious life, I would at least be able to survive.

Reach FIRE $1,250,000 Net Worth – NOT ACHIEVED….YET