February 2022 – Net Worth Update

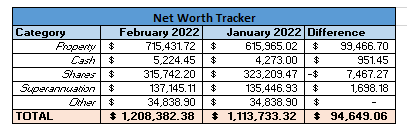

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

My first IP went up by $100,000 in value according to www.onthehouse.com.au which is the reason for the increase in this category. To be honest I do not believe the estimated value of $650,000 to be accurate, after looking at comparable sales in the area I imagine around $600,000.00 would be more achievable.

Cash

Cash has also been relatively stable for the month. I did not invest in any shares this month, but I did have to send over some money to the US which is where a lot of my money has gone to unfortunately.

Shares

There was another pretty average month, with around 2.3% drop in share value over the month. I did not invest any additional funds this month (fortunately) so the loss here is purely from the drop in the market. A lot of this has been caused with what is going on over in Russia/Ukraine at the moment, hopefully it is only temporary, but I guess we will wait and see.

Superannuation

I am not actually sure how this has gone up this month, I can only assume there is a significant lag in portfolio because it does not make sense for this value to have gone up while the rest of the market has gone down. I imagine next month will go down to properly reflect the market position.

Other

Minimal change

I was actually able to reach another $100,000 milestone this month! Up to $1,200,000 net worth now, although I feel that figure is a bit inflated with the property valuation of IP1, nonetheless it is cause for celebration!

It is also worth mentioning that I first reached $1,100,000 on 30/10/2021 – so the latest $100,000 has taken only 121 days to reach. The compound interest is really working in my favour now!

February 2022 Budget Summary

Income – TOTAL: $5,872.61

- Normal Income: $4,084.00

- IP Net Income: $1,788.61

- Other Income: $0

Expenses – TOTAL: $2,093.39

- Normal Expenses: $2,093.39

Savings Rate – +64.35%

I was able to keep my expenses down a bit this month which was good, although I am sure next month will have some unexpected expenses to push it back up. Also one of my IPs did not pay rent until 1st of March, so my rental income was slightly lower than normal this month, but it will be slightly higher than normal next month to make up for it.

February Normal Income – $4,084.00

February Net IP Income – -$434.93

February Net Shares Gain – -$7,467.27

February Passive Income – -$7,920.20

Another pretty terrible month for shares meant my passive income really took a significant hit. Missing out on the rent also hurt, but at least

Plan for March 2022

I will talk with the bank a bit more seriously about how much I can realistically borrow to see if buying a property to live in is achievable. Sydney does have ridiculously high property prices at the moment, even all the way out on the outskirts where I am, so it is definitely a turn off. After making a spreadsheet, it does not look like the numbers are too different if I rent or buy, so at least it is not really a financial impact one way or the other.

Share Purchases – March 2022

I will have approximately $4,000 to be able to invest this month. After this month I will look at boosting my superannuation in line with my 2022 goals, so this will likely be my last month until next financial year.

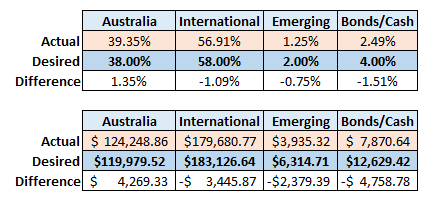

Below is my current allocation and how it compares to my target allocation

I will look to purchase $4,000 in VDHG this month.

2022 Goal Tracking

A new addition to my monthly summaries is tracking against my goals to hopefully have some accountability to ensure I do get there.

- Invest $30,000.00 into my share portfolio by the end of 2022

Currently achieved $7,000 out of the $30,000 goal!

- Invest an additional $10,000 into superannuation by end of financial year

Currently $0 out of $10,000 of this goal!

- Finish 2022 with a savings rate of 50%

Current savings rate of 57.39%

- Read and Review 12 Financial Books in 2022

Currently have read and reviewed 2 books

- Read 20 non-financial books in 2022

Currently have read 2 books non-financial related