Dollar Cost Averaging (DCA) vs Lump Sum Investing

This is a regular point of discussion which seems to happen quite often among the financial community. First, we will need to look at what sort of situation where this question will be relevant to an investor. Typically, it is relevant if you come into a relatively large sum of money, either via inheritance or selling of an asset for example.

For example, you sold one of your investment properties and now you have $100,000.00 which you want to invest in the share market.

Next, we need to look at what DCA and Lump Sum Investing involves.

What is DCA?

DCA is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase. The purchases occur regardless of the asset’s price and at regular intervals.

Typically, there will be a couple months between purchases, with the overall DCA period less than a year. There is nothing stopping you carrying out DCA over a longer period, but for the purposes of this post we will assume the investments occur over a year.

There is also the impact of having additional brokerage fees, but given the size of the purchases will be relatively high, it is not a significant impact and for the purposes of this post I will ignore them.

What is Lump Sum Investing?

As the name suggests, Lump Sum Investing assumes just investing the whole sum of money in one purchase, instead of splitting it up into smaller purchases.

There is a potential risk of a downturn in the market occurring after the purchase is made, and since the whole sum of money is invested, it can negatively impact the overall portfolio value if you do lump sum at the wrong time.

Comparing DCA vs Lump Sum Investing

Now that we have looked at the difference between both of the approaches, I want to look at past history to see if there is a financial benefit between either option.

I will mention now that this sort of analysis has been carried out extensively by other people, this study HERE shows that Lump Sum outperforms DCA around 67% of the time. From my other research, this appears to be a similar result. Still, I like to carry out some basic analysis myself just to serve my own curiosity.

Methodology

In this analysis I will be using the SPY ETF from historical data from 1/2/1993 up to 1/3/2022.

I will assume there is $100,000 to invest.

Lump Sum methodology will invest $100,000.00 initially

DCA will invest in 4 x $25,000 blocks with new purchases occurring every 3 months until the funds are exhausted.

I will run 57 different simulations; one starting every 6 months and determine the end value of each portfolio from each simulation. Comparing the difference between DCA and Lump Sum Investing.

Example

The first Lump Sum Simulation will invest $100,000 on 1/2/1993 in SPY

The first DCA Simulation will invest $25,000 on 1/2/1993, 1/5/1993, 1/8/1993 and 1/11/1993 in SPY

The final value of each portfolio will be compared from 1/3/2022.

Results

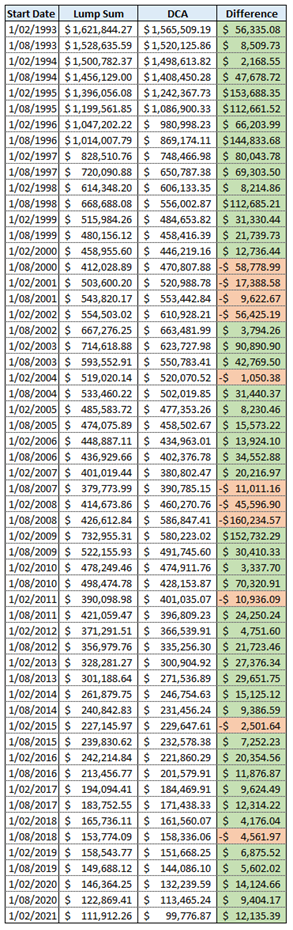

The above table shows a summary of the value of the portfolio from each simulation, with a comparison column between the Lump Sum and DCA Investing.

In summary, Lump Sum performed better than DCA 46 out of 57 simulations, approximately 80.70% of the time. This is slightly higher than the previous research which suggested approximately 67.00% of the time, but given the smaller scope of my analysis it is understandable to be a bit of a discrepancy.

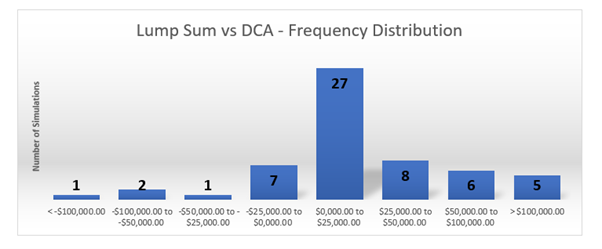

Above is a frequency distribution table of the results, as you can see the greatest occurrence is with a benefit between $0 and $25,000 if you lump sum invest compared to DCA. It is important to mention that it might have been more appropriate to compare it based on % because earlier simulations would be much larger in scale compared to more recent simulations, so a $25,000.00 in an earlier simulation would be less significant than if it was in a more recent simulation.

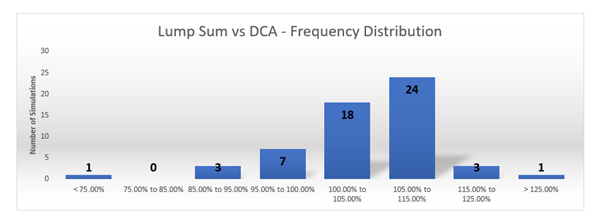

The above chart is a bit fairer as it is a % comparison between Lump Sum vs DCA Investing. If the number is > 100.00% then it indicates that Lump Sum performed better.

Again, you can see there were much more instances of Lump Sum outperforming DCA, with the highest instance with a 105.00% to 115.00% improvement.

No Brainer Right? Lump Sum all the way?

The numbers definitely do not lie, and probability says, based on historical data, that you will be better off more often if you invest lump sum compared to investing DCA. So why is there always a discussion over it? It looks like it should be settled and it has been proven to perform better.

Well, unfortunately there is a thing that humans have called emotions, and there is always that paranoia about a big downfall right before a significant drop in the market. DCA removes a lot of this risk, because it would be quite an emotional toll if you were to invest a very large sum of money and then see a big drop in the market shortly after that.

If you were to DCA instead, at least some of the purchases would happen after the drop and you will be able to purchase while the shares are at a discount.

The worst instance of Lump Sum vs DCA was in the simulation starting 1/8/2008 where there was a difference of $160,000.00, which represented almost 30.00% reduction in portfolio value. Even though there is such a higher probability of obtaining a higher return, to avoid a risk of something so devastating happening, a lot of people will still decide to DCA instead of Lump Sum for this exact reason.

Conclusion

In the end, it comes down to your own personal risk tolerance and what you are willing to accept. If you are fine with accepting the risk of it not working out in your favour, in an effort to hopefully chase higher gains, then by all means go for it and I hope it will work out for you.

But if you are more hesitant, then DCA might be the option. It is important to realise that money sitting on the sidelines for a long period of time (over 12 months) will typically cause you to lose money, so that is why personally I would not recommend a DCA occurring over a period longer than 12 months, but again that is just my personal preference.

In the future, I will most likely have an opportunity to DCA or Lump Sum, when I sell my IPs around the time I hit FIRE, I will need to make the decision. Given my position will most likely be quite precarious as I will be close to not working any longer, I will most likely go with a DCA approach, but it will also depend on the market at the time.