Dividends Effect on Ex-Dividend Date

A lot of people on financial discussions will talk about the benefits of dividends, and even in my hypothetical stock picking over here, using dividend yield is one of the metrics I use to determine if a stock is worth purchasing. So, I am not against dividends by any stretch of the imagination, but it is important to look at what you are achieving in terms of real return with regards to shares.

If you look at shares which do provide dividends, you will notice the share price on the Ex-Dividend Date will drop close to the dividend amount, essentially meaning you are converting share value into dividends, and if you simply reinvest these dividends, nothing will change.

For example, if a share is currently trading at $10.00, and they announce a $0.50 dividend with an ex-dividend date of 15/9/2021, then if you keep an eye on the share price then the value once that ex-dividend date has come will typically drop to $9.50.

That is the theory anyway, in this post I want to have a look at past results to see if this has been the reality for a variety of shares.

Methodology

I will use the top 10 companies of the Switzer Dividend Growth Fund (SWTZ). Paul Switzer is a big advocate for investing in dividend companies and has put together his own ETF which provides typically high and reliable dividends.

The Top 10 companies which make up SWTZ are:

- Commonwealth Bank (CBA)

- BHP Group (BHP)

- Westpack (WBC)

- Wesfarmers (WES)

- Spark New Zealand (SPK)

- Cleanaway Waste Management (CWY)

- Amcor PLC (AMC)

- Medibank Private (MPL)

- Qube (QUB)

- Woolworths (WOW)

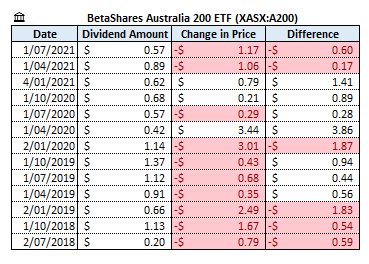

I will also include A200 ETF as well

I will look at the previous 10 years of dividends (if possible) for each Listing to determine how comparable the Dividend relates to any drop in the Share Price around the Ex-Dividend Date.

Results

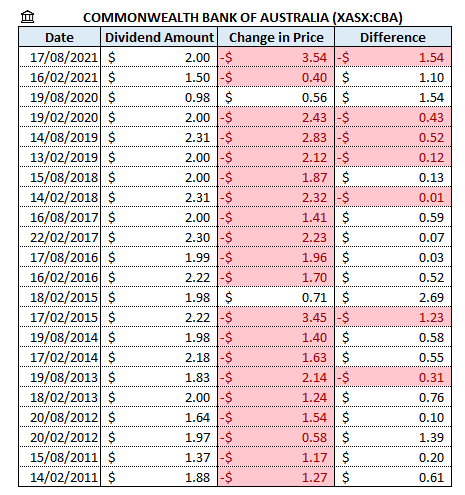

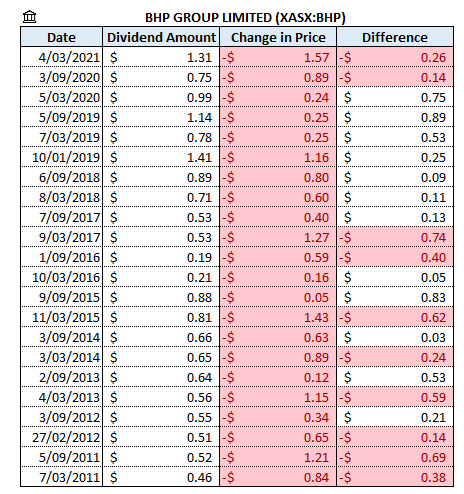

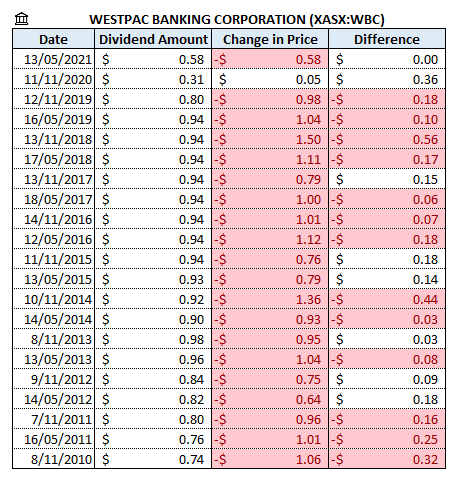

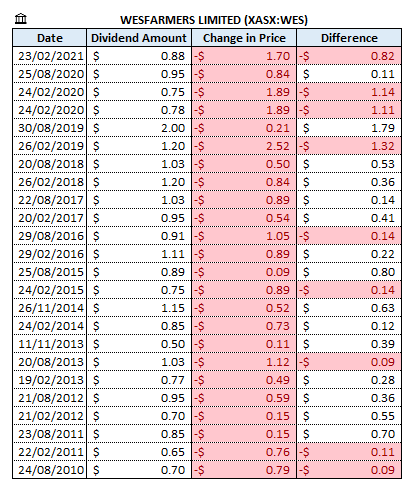

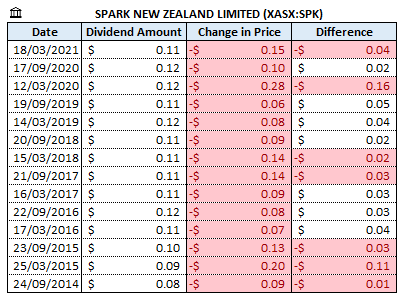

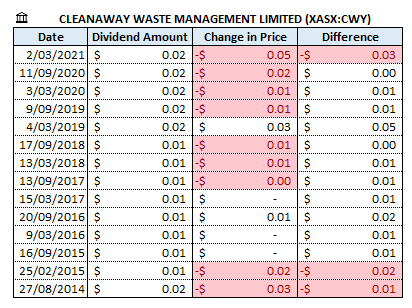

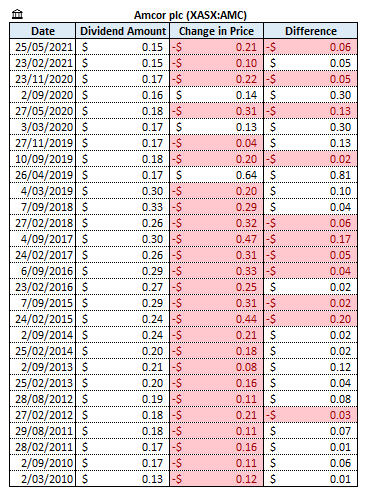

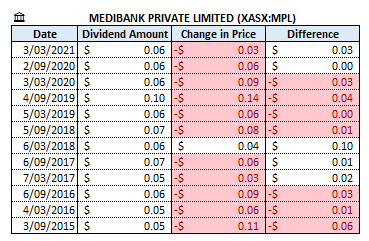

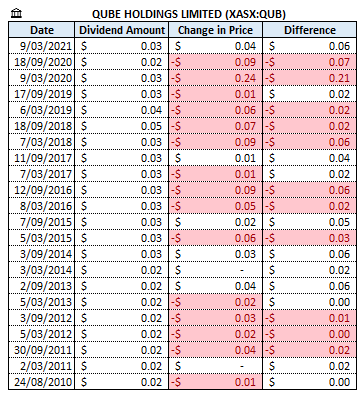

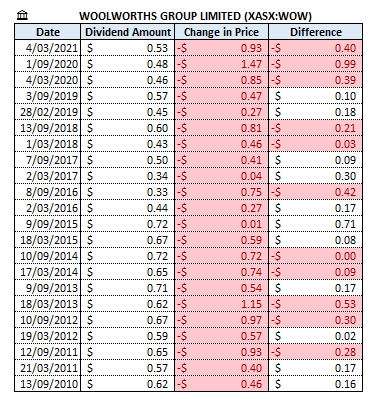

Below is a series of tables for each listing which goes through the following:

- Date (this is the ex-dividend Date)

- Dividend Amount

- Change in Price (from the previous day on the market and the ex-dividend date, a negative indicates the price was lower on the ex-dividend date)

- Difference (between the change in price and the dividend amount, a negative indicates the change in price is larger than the dividend amount)

There are of course instances where the share price will go up despite a dividend being paid out, however this is the market doing its thing and raising the price of the listing, irrespective of any dividends. It should be noted that any rise in price is still taking into account the dividend being paid out. For example, if there is a $2.00 dividend being paid out but the price goes up $3.00, then if there was no dividend the share price would most likely have gone up by $5.00.

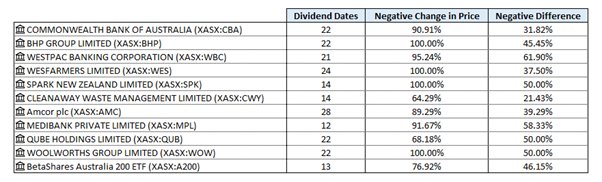

Below is a summary table of the above information, with the % of occurrences for both a negative value in the change in price, as well as negative occurrences in the difference section.

In the above table, you can see there is an overwhelming majority of occurrences where the share price drops on the ex-dividend date. Only CWY, QUB and A200 had lower than 89% instances where there was a negative change in price, and they were still all over 60%.

Overall, there is approximately 45% of cases where the drop in price was actually more than the dividend amount (although there is a pretty wide range of results with some listing being relatively low, and others being relatively high).

The last graph below is a frequency distribution graph which shows the distribution of occurrences of the actual ex-dividend price, compared to the expected price based on the price of the listing prior to ex-dividend price, minus the dividend. Again, a negative value indicates the ex-dividend price is lower than the previous price minus the dividend.

The above graph shows that the majority of instances occur between -1.00% and 1.00% of the expected price, with a slight leaning towards the 0 – 1.00% band. This backs up the earlier finding where it was only 45% of cases where the drop was more than the dividend amount.

Summary

As can be seen in the above data, it is fairly typical for the share price to drop roughly the amount of the dividend amount on ex-dividend date. This does make sense because essentially the value of the dividend is dispersed to the shareholders on this date, thereby reducing the value of the listing by pretty much the same amount.

If you do sign up for a DRP (Dividend Reinvestment Plan) and you are not using the dividends as any sort of receivable income, then on the surface it might look like there is next to no point of a dividend, although it is important to note there will be tax implications (but I will not get into that in this post). It is important to note that the market is able to price in a lot of things when it comes to creating the share price, including the expectation of a future dividend. So, from the point of the ex-dividend date where the share price has just dropped, the share price may be artificially inflated an expected dividend amount to compensate for the drop in price at the next ex-dividend date. And the reduced price that is reached on the ex-dividend date is the “True” valuation of the listing.