Diversification of VAS/A200 and VDHG

Disclaimer – I am not associated with Vanguard or Betashares; I am just writing from my own experience and research. I am not trying to encourage any specific company to be invested in.

A lot of people within the FIRE community will rave on and on about Index Funds and ETFs, and for good reason, they are amazing! One of the biggest benefits that people always point to is the ability to diversify so easily compared to other asset classes (such as Property). And while this is true, it is also important to actually have a look at what is in each of your ETFs to see how diversified they actually are.

A200 / VAS

Two of the most popular ETFs mentioned within the FIRE community in Australia are A200 and VAS, for the sake of this I will say they are essentially the same. A200 is made up of the top 200 companies of the ASX, and VAS is made up of the top 300 companies of the ASX. But given the ASX is so top heavy, the ‘bottom’ 100 companies in VAS are almost insignificant.

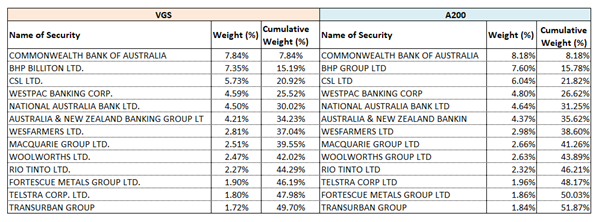

For example, 50% of each ETF is made up of the following companies:

Also note, these numbers were taken on 6th March 2021, and over time it will vary slightly. But as you can see, the bulk of these ETFs are remarkably similar so for the purposes of diversification I will treat them the same.

So, although we have an ETF with 200 or 300 companies, the bulk of it is still only made up of 13 individual companies. It might not be as diversified as what was initially thought.

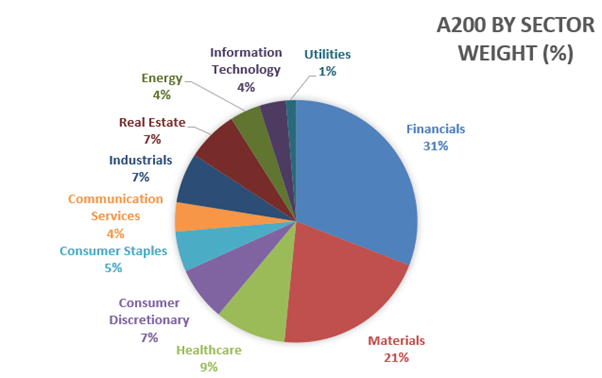

Looking further into it, across the whole A200 index, if we look at the sector of each company, we will see that Australia is heavily reliant on the finance industry and materials (banks and mining, that is all we are about in this country), with over 50% of the A200 index made up of these two sectors. A full breakdown of each sector is shown in the chart below.

So, again, although the ETF is spread across 200 or 300 companies, the majority of our investment is reliant on two sectors. So, it really may not be as ‘diverse’ as it might look on the surface.

VDHG

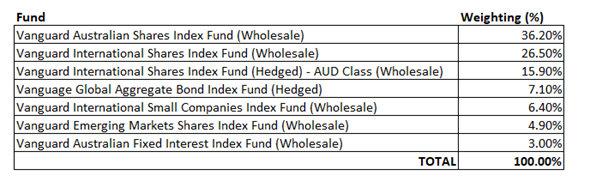

Of course, there are many other ETFs out there on the market which do provide more diversity. For an example, I will look at VDHG and what exactly makes up this ETF. Below is a summary of the Index Funds that make up the Vanguard Diversified High Growth Index.

Now it is important to remember that each of these Index Funds that make up the VDHG Fund are also built up of a wide range of companies.

Vanguard Australian Shares Index Fund

This is essentially the same as the VAS fund that was talked about earlier in this post.

Vanguard International Shares Index Fund

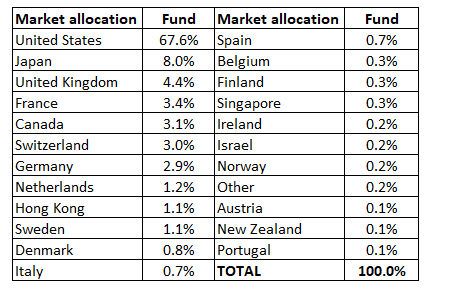

This is a wide-ranging ETF which gives significant diversification across the globe. Although it should be noted that the Index Fund has a heavy weighting (67.6%) towards the US Market. A full breakdown of the countries is in the below table:

The fund itself encompasses over 1,500 different companies across the world. However, 50% of the Fund is made up of the top 119 companies, the other 1,409 companies make up the remaining 50%.

Vanguard International Shares Index Fund (Hedged) – AUD Class

This is the same fund as previously, with the only difference that the fund is hedged to AUD currency, meaning there is no currency exchange risk associated with this part of the fund.

Vanguard Global Aggregate Bond Index Fund (Hedged)

This is a defensive asset part of the fund allocation. It provides exposure to securities issued by governments, government-owned entities, government-guaranteed entities, investment-grade corporate issues and securitised assets from around the world.

There are over 9,400 different holdings that make up this fund.

Vanguard International Small Companies Index Fund

The fund provides exposure to small companies listed in major developed countries. This provides a new dimension of diversity as the rest of the fund is concerned with large cap companies. This provides exposure to small cap companies.

There are over 4,100 different holdings that make up this fund.

One of the main differences with other funds is each weighting is significantly lower. The holding with the largest weighting currently (Plug Power Inc) only makes up 0.402% of the fund. Compared to VAS where CBA made up 7.8%, and even in the International Shares Index Fund, the holding with the largest weighting (Apple Inc) made up 4.54% of the fund.

The top 50% weighting of this fund comprises of almost 700 companies.

Vanguard Emerging Markets Shares Index Fund

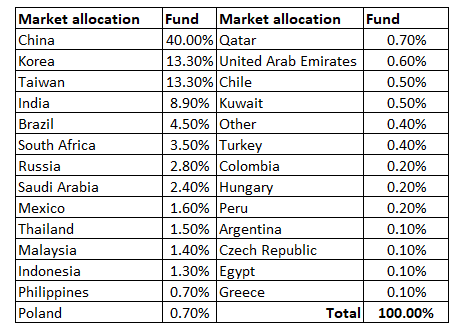

This Fund provides exposure to companies listed in emerging markets and allows investors to add to their diversity by investing in different markets. There is a heavy weighting towards China (40%) in this Fund, a full breakdown of the countries in this fund is as follows:

This fund again is quite top heavy, with over 1,200 holdings as part of the fund, the top 55 make up over 50% of the funds value.

Vanguard Australian Fixed Interest Fund

This fund is another defensive asset which invests in securities issued by the Commonwealth Government of Australia, Australian State Government authorities and treasury corporations.

There are over 600 holdings that make up this Fund.

Summary

As you can see the VDHG Fund is incredibly diversified as it provides exposure to over 7,100 companies, dozens of countries, and a range of large cap and small cap companies.

It is actually interesting to look at how small a % a holding makes up when you do invest in VDHG:

For example: The smallest holding for the Vanguard International Small Companies Index Fund is Crawford & Co. Class A (some insurance brokers in the US). The holding makes up 0.00013% of that Index Fund. But remember, that fund only makes up 4.90% of VDHG, so Crawford & Co. Class A actually makes up 0.00000637% of our portfolio.

But then if we look at the holdings which looked relatively large in their individual Funds (CBA and Apple Inc), it is worth noting the final proportion in the VDHG Fund.

CBA – 7.84% of VAS. VAS is 36.2% of VDHG. CBA makes up 2.84% of VDHG. CSL and BHP also make up over 2.00% of the VDHG fund as well.

Apple Inc – 4.54% of International Funds. International Funds made up 42.4% of VDHG. Apple Inc makes up 1.92% of VDHG.

In the end though, it really is difficult to get a product more diversified than VDHG.

The document HERE outlines why VDHG is diversified the way it is.