Different Types of FIRE

Different Types of FIRE – What do they mean?

If you are into the FIRE life like me, and if you are on this website, then no doubt you are well aware of FIRE. But this post I want to explore the different types of FIRE that exist. It might be reassuring that there is no one size fits all for FIRE, it can be customised to suit your life and your goals.

For example, some people might not like the idea of retiring, they feel their employment gives them a sense of identity, a sense of purpose, well that is great, because even though retirement is in the name, it does not necessarily that you have to fully retire once you reach FIRE.

At the moment, there is five different types of FIRE, at least main types that I am aware of. There could be small variations and probably some I have never heard of, but I am sure they would just be variations of these main types anyway.

So what are the 5 main types of FIRE?

- Normal FIRE

- Fat FIRE

- Lean FIRE

- Barista FIRE

- Lean FIRE

Normal FIRE

This is at the core of the Financial Independence, Retire Early mindset. This is the FIRE that I am looking at trying to achieve personally.

The objective of Normal FIRE is to accumulate enough income generating wealth that reaches a level where it is enough money to cover the living expenses you want in retirement.

To achieve Normal FIRE (and the other types of FIRE as well generally), you will be aggressive in saving, minimising expenses and overall simplifying your lifestyle so that you are able to invest enough to reach FIRE early. By keeping your expenses low, not only will you able to contribute more to your investments, it will also mean you will need less in your retirement.

Once you reach Normal FIRE, you do not rely on any income from your employment anymore, working somewhere becomes an option and allows retirement significantly earlier than what the standard retirement age might be.

Fat FIRE

Fat FIRE is similar to Normal Fire, except that you do not want any mediocre lifestyle in retirement. You want that significant passive income that allows several overseas trips, or even endless travel. You want to live in luxury, you want to drive the newest cars. Basically, you want to have a much more flamboyant retirement compared to Normal FIRE.

For example, normal FIRE annual expenses might be around $50,000 per year, with Fat FIRE, we are talking about annual expenses around $100,000+ per year.

Of course, increasing that savings rate is still important for those aiming to reach Fat FIRE, but more important is being able to generate high income jobs while still employed. Given the amount of wealth that needs to be accumulated, you will need a lot of disposable income to invest to be able to reach the sort of investment levels required to reach Fat FIRE.

Lean FIRE

If Lean FIRE is all about living in excess and having an extravagant lifestyle, well Lean FIRE is basically the opposite. Lean FIRE follows the same principles as Normal FIRE and Fat FIRE, with the exception that you plan on having a significantly lower annual expense rate in your retirement.

The typical Lean FIRE annual expense would be anywhere under the $50,000 per year, with some people taking it to extremes of around $20,000 per year. Basically, simplify your life as much as possible to be able to live on as little money as possible in your retirement.

Reaching Lean FIRE is much more achievable for people with low or median incomes, and given the lower annual expenses required in retirement, the amount of wealth you need to accumulate prior to reaching FIRE will be a lot lower and can potentially be reached a lot quicker than Normal FIRE or Fat FIRE.

If living a minimalist life is for you, and you are not interested in regular holidays then Lean FIRE might be something you can look at pursuing.

Barista FIRE

While the first three types of FIRE (Normal, Fat and Lean) are all basically variations of the same principles, there are new types of FIRE that have popped up in the community over the last few years.

When I first heard the name, I assumed it had something to do with coffee, but I did not really understand how that was relevant to reaching FIRE.

So after a bit of research, I was able to learn that Barista FIRE means that you reach your FIRE number, but then still want to work a part time job just to supplement your income.

It really should be called “Part-Time FIRE”, but I believe they call it Barista FIRE because the idea is you take a different career path from your traditional employment and work more casual work just here and there to add a bit of extra income into your pocket.

You might have enough in your accumulated wealth to achieve the lifestyle you want, but maybe you want to just work a bit of part time to keep a bit more as more of a safety buffer if the stock market does take a bit of a downturn.

Coast FIRE

This is an interesting type of FIRE, and it might take a bit of explaining. In my opinion, it is more about reaching FIRE at a certain date, rather than just by reaching a certain amount. I will do my best to explain how it works, I hope I have made it clear enough.

Coast FIRE is about having enough money invested at an early age, that you no longer need to add more savings into your investment portfolio, because using compound interest it will grow naturally to your desired FIRE number that will cover your retirement lifestyle. While you let it grow, your income will cover your expenses only.

Now there is some calculations required to figure out how Coast FIRE works.

- Calculate how much you have already in your investment portfolio

- Determine how much you want your retirement income to be

- Use your retirement income to calculate what your FIRE number is

- Calculate using a conservative interest rate (around 6% should work) how long it will take to reach your FIRE number

Example:

Person A has $200,000 in investments at the moment, they want an annual retirement expense of $50,000.

FIRE number = $50,000 x 25 = $1,250,000.00

Return Interest Rate = 6.00%

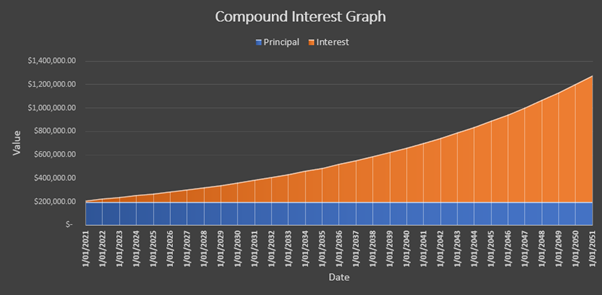

So how long will it take to reach this number without adding any more savings to your investment portfolio? As you can see from the chart below, it will take approximately 31 years to reach your desired FIRE.

Reaching FIRE might take substantially longer than if you actively kept investing your savings as you would with Normal FIRE but I believe there are two main advantages with Coast FIRE:

- If you wanted to semi-retire during Coast FIRE you can, you only need to cover your expenses so maybe you can drop your work back down to 2-3 days a week to cover your costs of living. It will almost be like a “soft” FIRE before you reach full FIRE

- Alternatively, if you wanted to keep working full time, you could really indulge with the extra disposable income. You know that down the line your investments are growing nicely, so you can really enjoy yourself, you do not need to save for a rainy day, so although it might take longer to reach FIRE, your lead up to retirement will be a lot indulgent.

Mixing Different Types of FIRE

It should also be noted that you can look at mixing the different types of FIRE.

For instance, let’s assume the following:

Person B has $200,000 saved currently and is able to deposit $2,000 per month for the next 5 years. After this 5 years they plan on doing Coast FIRE until they reach their retirement.

Once they do reach FIRE, they want to do Barista FIRE and plan on earning an additional $10,000 in part time income, so they will only need $40,000 to fund their retirement lifestyle.

Again we will assume a 6% interest rate of return for investments

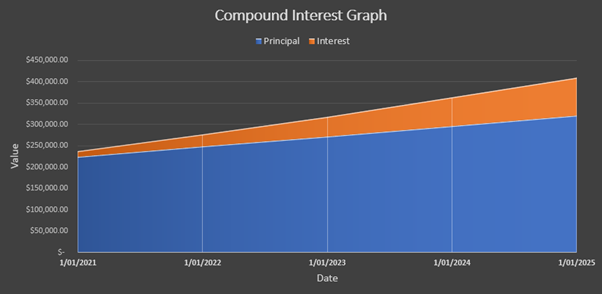

Step 1) – Normal FIRE

After 5 years the investment portfolio has grown from $200,000 to $410,000

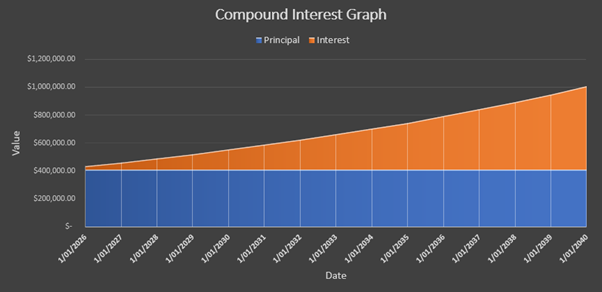

Step 2) – Coast FIRE

Our FIRE number is now only $40,000 x 25 = $1,000,000 (remember we will be earning some part time income so to supplement out retirement income)

We will be able to reach our FIRE goal in 20 years (5 years of standard FIRE plus the additional 15 years of Coast FIRE)

Step 3 – Barista FIRE

Now you have your $40,000 in income from your investments, as well as an extra $10,000 per annum from your part time work.

This example is just to show that there is flexibility, there is no set type of FIRE that has to be adhered to, you can be flexible and change. Over time your goals and desires may change, you might realise you want to pursue Fat FIRE and really want to enjoy your retirement, or you might want to get there as quickly as possible and are fine to live the Lean FIRE life? It really is up to you.

Conclusion

In this post I have outlined the several different types of FIRE that are available. There is no right or wrong answer on what type of FIRE is suitable for you (or even if FIRE is right for you at all, although, you are on this site).

Personally, I am currently aiming for Normal FIRE with an annual expense of $50,000. But that does not mean I am completely oppose to the idea of adding some extra income on the side. One idea I am currently thinking a lot about is buying a place for my retirement that comes with a granny flat or separate studio and renting it out on AirBnB for some extra income.

Whatever you do end up choosing to do, at least it leaves you with a life of financial independence, and at the end of the day that is all it is about. The freedom that comes with financial independence.