DHHF vs VDHG

Even since DHHF came onto the scene in late 2019, there has been a lot of discussion on internet forums like Reddit about which ETF is “better” in terms of an all-encompassing diverse single ETF. I talked about in my last POST about if I was to use a single fund portfolio, then I would use a fund like DHHF or VDHG.

Now, I want to have a deep look into both ETFs to have a look at the individual holdings to see how much of a difference there actually is between the ETFs. First, I will do a bit of a summary of what each ETF does hold.

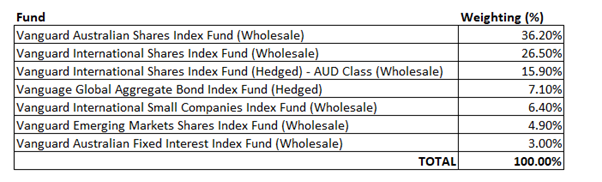

VDHG

Vanguard Australian Shares Index Fund

Vanguard Australian Shares Index Fund is comprised of the top 300 companies listed on the ASX

Vanguard International Shares Index Fund

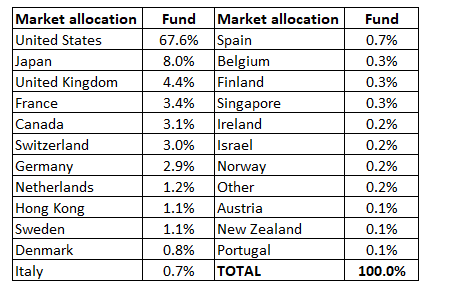

This is a wide-ranging ETF which gives significant diversification across the globe. Although it should be noted that the Index Fund has a heavy weighting (67.6%) towards the US Market. A full breakdown of the countries is in the below table:

The fund itself encompasses over 1,500 different companies across the world. However, 50% of the Fund is made up of the top 119 companies, the other 1,409 companies make up the remaining 50%.

Vanguard International Shares Index Fund (Hedged) – AUD Class

This is the same fund as previously, with the only difference that the fund is hedged to AUD currency, meaning there is no currency exchange risk associated with this part of the fund.

Vanguard Global Aggregate Bond Index Fund (Hedged)

This is a defensive asset part of the fund allocation. It provides exposure to securities issued by governments, government-owned entities, government-guaranteed entities, investment-grade corporate issues and securitised assets from around the world.

There are over 9,400 different holdings that make up this fund.

Vanguard International Small Companies Index Fund

The fund provides exposure to small companies listed in major developed countries. This provides a new dimension of diversity as the rest of the fund is concerned with large cap companies. This provides exposure to small cap companies.

There are over 4,100 different holdings that make up this fund.

One of the main differences with other funds is each weighting is significantly lower. The holding with the largest weighting currently (Plug Power Inc) only makes up 0.402% of the fund. Compared to VAS where CBA made up 7.8%, and even in the International Shares Index Fund, the holding with the largest weighting (Apple Inc) made up 4.54% of the fund.

The top 50% weighting of this fund comprises of almost 700 companies.

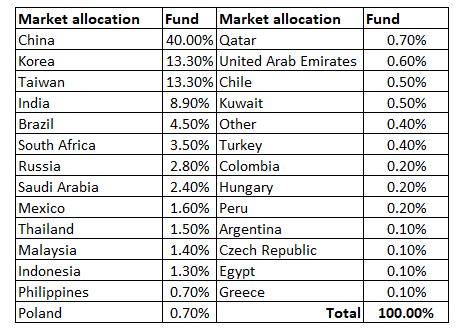

Vanguard Emerging Markets Shares Index Fund

This Fund provides exposure to companies listed in emerging markets and allows investors to add to their diversity by investing in different markets. There is a heavy weighting towards China (40%) in this Fund, a full breakdown of the countries in this fund is as follows:

This fund again is quite top heavy, with over 1,200 holdings as part of the fund, the top 55 make up over 50% of the funds value.

Vanguard Australian Fixed Interest Fund

This fund is another defensive asset which invests in securities issued by the Commonwealth Government of Australia, Australian State Government authorities and treasury corporations.

There are over 600 holdings that make up this Fund.

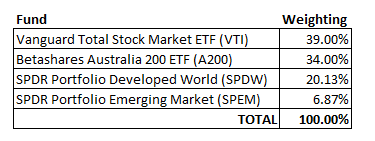

DHHF

VTI

Consists of over 4,000 holdings of a wide range of US listings from large, mid and small cap equity diversified across growth and value styles. The companies which provide the largest weighting in this fund are Apple Inc, Microsoft, Amazon etc.

The top 170 companies of the fund make up 50% of the total portfolio.

A200

Consists of the Top 200 holdings on the ASX

SPDW

Consists of almost 2,500 holdings from international companies from developed countries (except the US)

The top 180 companies represent approximately 50% of the fund portfolio.

The highest weighted listings in the fund are Samsung Electronics, Nestle and Roche Holding.

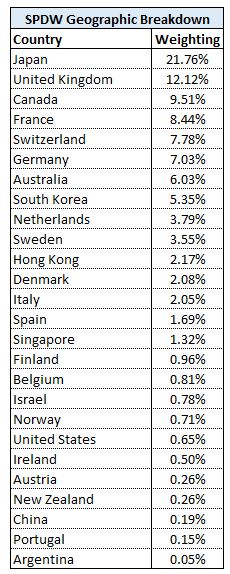

Below is a breakdown of the countries. I am not sure exactly why there is a weighting of US companies in there (although relatively small), and also not sure why there is a weighting of China companies as it should be under a developed country, although again it is a particularly small weighting.

SPEM

Consists of almost 3,000 holdings from international companies from emerging markets (predominately China, Taiwan and India)

The Top 100 companies represent approximately 50% of the fund.

The top holdings within the fund are Tencent Holdings, Alibaba Group, Taiwan Semiconductor Manufacturing.

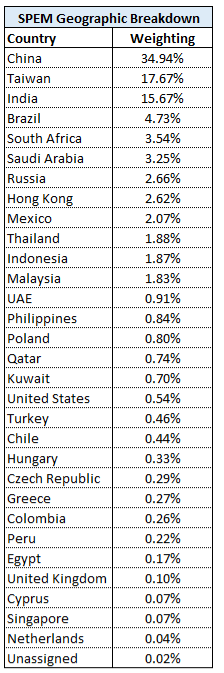

Below is a breakdown of the countries within the fund. Again, I am not sure why there are a couple of countries with listings that should count as developed. They are relatively small weightings, however.

Comparison Summary

Both DHHF and VDHG are relatively similar on the face, the main difference is that VDHG has 10% bond/defensive asset allocation, which DHHF does not have.

Listings Breakdown of VDHG vs DHHF

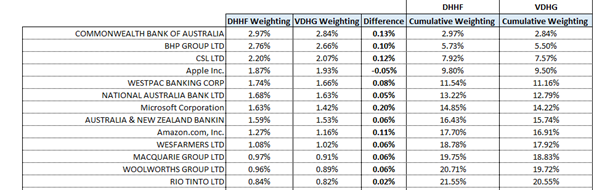

If you look at the top 20% of each ETF, you will see they comprise of the exact same holdings:

As you can see, there is a slightly higher weighting of the listings for DHHF, this makes sense as it does not have the 10% of bond allocation, so each of the holdings would be weighted slightly higher.

Overall, you can still see there is not much difference between the ETFs.

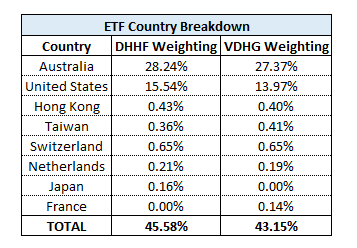

If you look further into it, and look at a breakdown of the top 100 holdings of each ETF. 95% of the companies overlap. The top 100 listings represent 45.58% of DHHF compared to 43.15% for VDHG.

Again, you can see that there is a significant overlap between the two different ETFs.

Geographic Breakdown

Looking again at the top 100 listings for each ETF, they have the following weighting by country:

It makes sense that Australia and USA are doing the heavy lifting when it comes to weightings for these portfolios, given the weighting breakdown of Australia and US based funds within the ETF.

The other countries are all quite similar though, with the only real difference is that DHHF has some weighting from Japan in the top 100 (from Toyota) which VDHG does not have. VDHG has weighting from France (from Moet Hennessy Louis Vuitton), which DHHF does not have.

Apart from Japan and France, the breakdown between countries is pretty similar throughout.

Full Breakdown

If you want to see a full breakdown of the holdings in VDHG and DHHF, there is a spreadsheet link HERE.

Conclusion

Despite both VDHG and DHHF having different underlying ETFs, they still end up with predominately the same listings among them. The weighting of the listings within the ETF is also relatively similar, although there does appear to be a typically higher weighting of the individual listings in DHHF compared to VDHG, due to there not being a 10% bond allocation in DHHF.

Overall, though, I believe the funds are very similar, so if I am ever asked if I have a preference between VDHG or DHHF, I typically say that I do not, and they are basically the same in my opinion.

Finally, I will mention that the MER of VDHG is currently 0.27%, compared to DHHF with has a MER of 0.19%. A lower fee may push a very slight advantage to DHHF.

Disclaimer

I currently have holdings of VDHG, I do not have any of DHHF but as I said I do not really have a preference of one or the other.

The listings were compiled around April 2021, so there individual listing weightings may have changed slightly over time.