Crashes In The Stock Market

In this post I want to have a look at crashes or corrections that have occurred in the stock market since 1900. I will be using the Dow Jones Industrial Average. The Dow Jones Industrial Average (DJIA), also known as the Dow 30, is a stock market index that tracks 30 large, publicly owned companies trading on the New York Stock Exchange (NYSE) and the Nasdaq. The Dow Jones is named after Charles Dow, who created the index in 1896 along with his business partner Edward Jones.

Parameters

There is a lot that is left open to interpretation to determine what specifically is a crash in the stock market.

One definition is “A stock market crash is an abrupt drop in stock prices, which may trigger a prolonged bear market or signal economic trouble ahead.”

This sounds logical, and of course there are some obvious examples (Great Depression, Dot Com Bubble, GFC, Covid Crash), but there are some other instances which might not have been so dramatic, but still caused significant pain for investors at the time.

I also want to look at corrections, and according to Investopedia a correction is a decline of 10% or more in the price of a security from its most recent peak. At least this one is defined and easily measured.

For the purposes of this post, I will just look at every time there is a decline of 10% or more from the price of the index from its most recent peak. I will not be going into too much detail about the reasons behind the decline or further repercussions, I just want to focus on the size and duration of the decline.

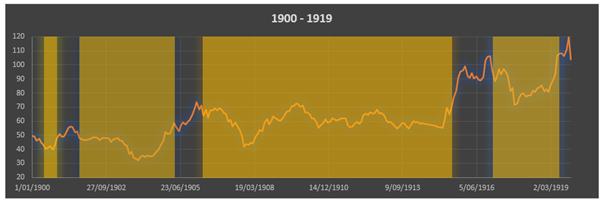

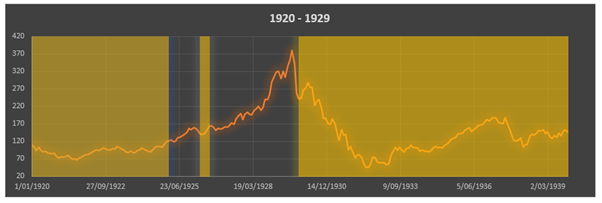

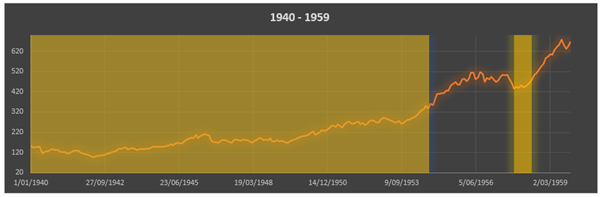

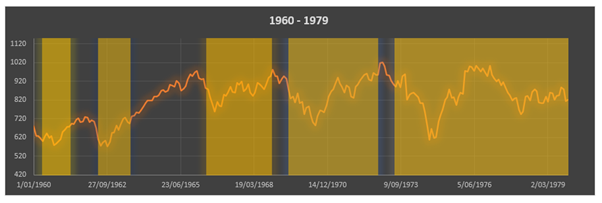

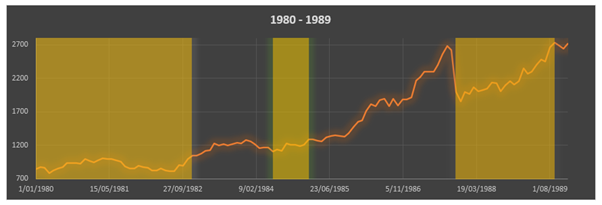

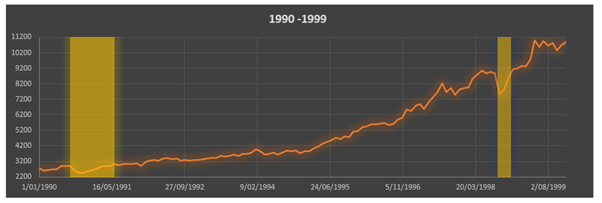

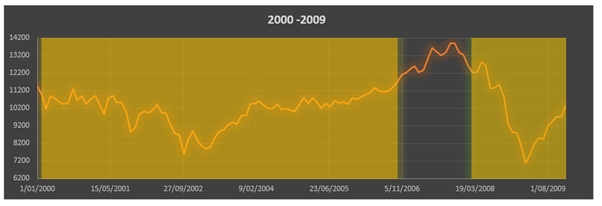

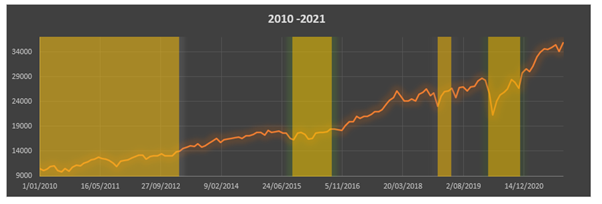

Charts of DJIA

Below are several charts of the DJIA broken up into shorter timeframes. Given the magnitude change over time, it was difficult to see what was happening back in earlier times. I have highlighted sections where the DJIA is in either a correction or crash recovery period.

As you can see, there is a whole lot of yellow on the charts! I was surprised at how extensive it really was. In fact, over 63% of days from 1900 to 2021 were actually spent while recovering from a correction.

I will also point out that while it looks like the yellow sections do not line up with the peak, keep in mind that the yellow section does not start until the share value has gone down from 10% from the recent peak, so there will be a lag. Also I have only used monthly data, so it is not going to be perfectly accurate, but I believe for the purposes of this post it will be more than sufficient.

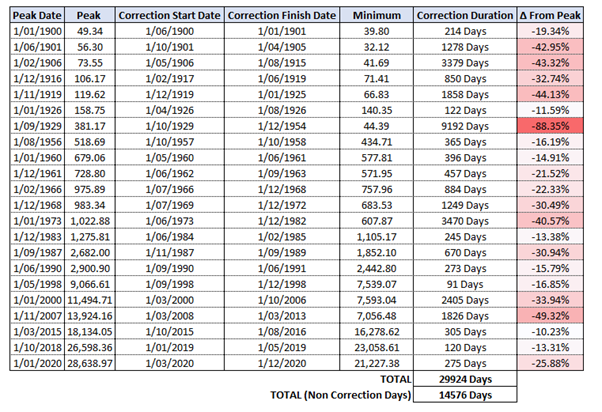

Table Summary of Corrections

The above table really illustrates just how significant some of the crashes were. I am just extremely thankful not to have had to go through the Great Depression. Losing almost 90% of value, with a duration of 9,192 days (over 25 years!) it is actually quite incredible how significant it was.

The closest we got to this was the GFC in late 2007, but that was “only” almost 50% of value wiped off and lasted “only” 1,826 days (5 years).

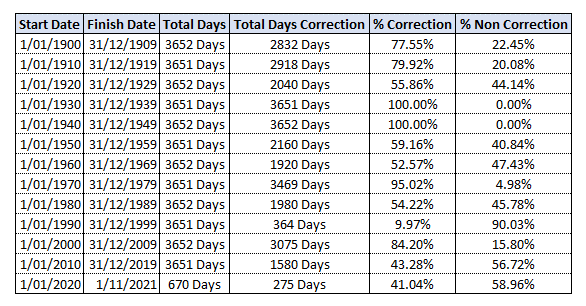

Lastly, I wanted to look at the number and duration of corrections for each decade, to see if there is anything interesting to be gathered from looking at that.

Again, this one highlights just how devastating the Great Depression was, the entire 1930s and 1940s were spent recovering from the crash which happened in the late 1920s.

Also, interesting to note that there are only 3 decades where less than half the time is spent in recovery from a correction, 1990s, 2010s and 2020s (although obviously the 2020s is only very early days).

Summary

Like I said at the start, I am not going to talk about what caused the crashes or how to get through them while investing. I have talked about recovering from a crash in this POST and this POST here if you want some more information.

I was just curious myself about how prevalent corrections actually are, and I was surprised because they are significantly more prevalent than I had actually anticipated. In my 34 years of life, I have already lived through 8 corrections, so if I am able to end up living until I am around 80 years old, then I would be due probably 10 or so more in my lifetime. That is a lot to get through successfully.

More than anything, I believe looking at this will at least let me understand how frequent these corrections are, and that despite the dozens of corrections over the past, the market has ALWAYS recovered, eventually. Sometimes it may take longer than one would hope, but it will eventually recover.