Changing My Living Situation

I cannot recall how many times my goals have changed throughout my life, or even a change in plans as life always inadvertently ends up throwing you a few curve balls that you need to adapt to. For these reasons I always like to make sure that I stay flexible with my plans, so that I am able to adapt to any changes that are thrown my way.

Not to mention, you can always increase your knowledge, so as you gain a new perspective, or circumstances change then it definitely makes sense that there might need to be a change in the plan. I am not necessarily changing my plans yet, but I am open to looking into the potential change to see if it will be worthwhile.

My initial plan (from around 12 months ago) was to purchase my future retirement long term home in the near future with the intention to rent it out until I was ready to move into it. In the meantime, I was planning to continue renting. After researching areas to retire, I realised I had no idea where I wanted to live long term, or where I would want to live in a few years’ time, so my plans ended up changing. My new plan was to continue renting until I reached my FIRE target, and once I reached that target I would look at buying a home retirement outright (by selling my two existing IPs and offloading any shares from my portfolio if I needed to).

I still have the same goal of owning my home outright when I do eventually retire, but instead of obtaining a loan now and paying it down when I retire, I was intending on just buying it outright when I reached FIRE.

After reading a recent book (No Worries Guide To Retirement) it gave me the perspective of changing homes within retirement, and while I am not planning that far ahead, I decided to look into buying a place to live in now, and then look at selling it and buying a new one when I am ready to retire (or there is always the potential to stay in there if I like the place enough).

For some reason, I did not want to buy a place that I was not intending to stay in for the long term (at least 10 years), so I did not even contemplate buying a place prior to FIRE. I was closed minded on the option to do this, and I never even ran the numbers to see if it could be a financially advantageous prospect.

Analysing the Scenarios

Although there is more to it involved than just financial impacts, I like to at least start with modelling the financial implications of the proposed plan. Once I have the financial implications known (or at least estimated), I can take into account non-financial impacts to come up with a way forward.

With regards to non-financial benefits, I definitely have a strong preference for owning my home rather than renting. For my own personal position, I find that a more enjoyable life, and if I am in a place that I like living in, I would much rather own it than rent in it. I understand in different parts of life, there are situations where renting is more advantageous, but that does not suit my situation. Even if the financial impact was slightly worse off owning than renting, for the non-financial benefits I may still opt to sacrifice money for life benefits.

With that being addressed, it is now time to look at analysing the different scenarios to determine which option works out best financially. Time to build a spreadsheet!

Building the Spreadsheet

I will use a spreadsheet to model the following two scenarios:

- Purchase a property to live in

- Continue to rent

I will model each scenario over 10 years to determine the financial position of each scenario over this timeframe. It is important to note that while buying a property will have a large up-front cost, it would mean that typically the financial benefit of Scenario 1 would most likely come to fruition later in the timeframe.

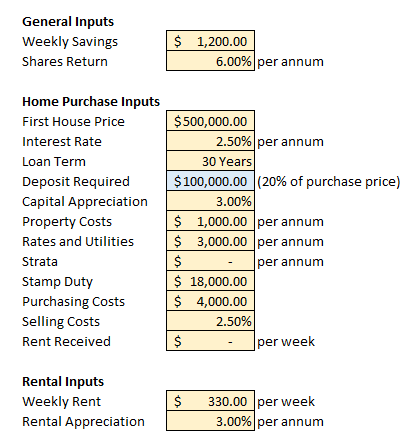

I will use the following variables to build the spreadsheet:

Common Inputs

- Weekly Savings

- Share Market Return

House Purchase Inputs

- House Price

- Interest Rate

- Loan Term

- Deposit

- Annual Property Costs

- Rates and Utilities

- Strata

- Stamp Duty

- Purchasing Costs

- Selling Costs

- Rent Received

- Capital Appreciation

Renting Inputs

- Weekly Rent Paid

- Rental Appreciation

As you can see, there are a lot of inputs around home ownership, most of them are relatively easy to approximate at least. But one of the trickiest variables to determine, which also has one of the biggest impacts with regards to final return, is the capital appreciation.

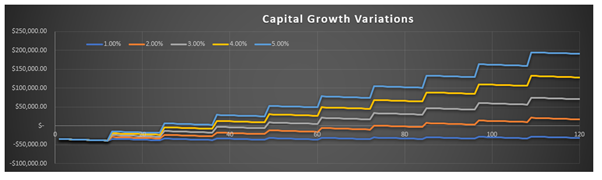

In this spreadsheet, I will also add a separate graph which will check 5 separate Capital Appreciation values, with all the other inputs remaining the same. This will allow me to carry out a sensitivity analysis to show how a small change in the estimation will have a large impact on the final result.

While I do like to be conservative with my estimates, I feel like sometimes if I am overly conservative, I can end up missing out on significant returns in the future if I used an input that was more realistic in the first place. At least allowing for a quick comparison of several different capital appreciation values, I can at least see for myself what the impact would be of changing values.

I will use the following inputs to model the different scenarios:

I have left the rent received input at $0.00 for the moment, because ideally, I want to live alone, or at least not rely on a housemate to help cover bills. But there is at least an allowance for it to come into play if necessary.

I should also say that it is not easy to find a place for $500,000.00 around my area, but I would only need a small place and hopefully something might come up. I will try with some different house prices after the initial results as well to get more of an idea of different situations, which might also be more realistic in terms of what is available. It is also important to note that given my relatively low income, I may struggle to obtain finance if the loan was more than $400,000.00 as well. Ideally, I want to keep the house price as low as possible.

Results

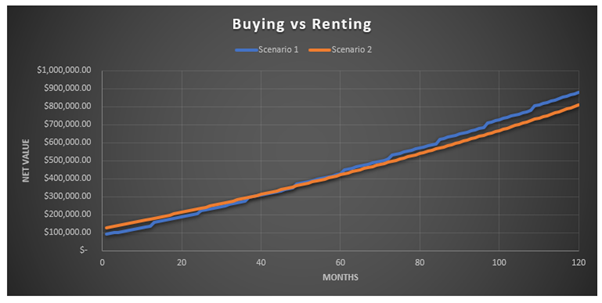

Chart 1 – Scenario 1 Net Value vs Scenario 2 Net Value

As to be expected, Scenario 1 starts well below Scenario 2 given the large upfront costs of purchasing a home. Over time however, it does become the beneficial position where the breakeven point is around 4 years’ time. Given I would likely look at purchasing my post-FIRE home around this time, it would indicate that it should be relatively close financially speaking whichever decision I went with.

The following chart has all the same inputs, but it has a varying capital appreciation so I can perform the sensitivity analysis

Chart 2 – Variable Capital Appreciation

There are large steps in the graph between I have the property value changing at the start of next year. Probably not the most accurate way of doing it but the results are informative enough for my opinion.

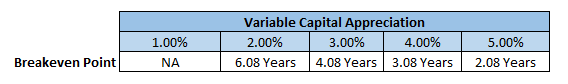

This chart only shows the difference between Scenario 1 and Scenario 2. A negative number indicates Scenario 2 is performing better and a positive value indicates Scenario 1 is performing better. As you can see, if we assume a capital appreciation of 1.00%, Scenario 2 is always the better scenario. Every other capital appreciation variation shows it as a benefit to go with Scenario 1. We have the following break-even points for each capital appreciation variation.

Results Summary

I found these results quite promising as it shows even with relatively conservative capital growth it still seems to at least be relatively close in terms of financial viability. One thing I did not really measure in the example shown here is a drop in property prices. Given the meteoric rise in property values over the past couple of years, there is always a possibility of prices slowing down and even reducing over the next few years. Obviously, this would definitely be a negative result in terms of financial comparison, and it would be a mistake of a decision.

I definitely think some areas around Sydney, which have seen really significant gains over recent years may experience a stagnant period, but in the areas I am looking it would be a different market, so the gains were not as significant but hopefully any future gains would still be achieved. I believe at least 2.00% capital appreciation would be the minimum.

Overall, I definitely think this could be an option worth pursuing. It will mostly be depending on finding the right property. I might actually ask my landlord if he would be willing to sell the property, I am currently renting to me. I enjoy where I live quite a lot and I do not think it would sell for too much, so if I was able to get it for the right price it really could be a great result for me. The only potential issue is that it is a duplex, and I am not sure if the title has been separated because I am pretty sure the landlord owns both sides. I suppose I will find out when I ask them.

Conclusion

The main point I wanted to get across in this post was the importance of being flexible with your approach to FIRE and life in general. I have been too close minded in my thought processes, and it was that limited thinking that may end up preventing me from achieving a better financial outcome. As well as better life outcome given I would prefer living in my own place rather than renting.

This is not the only aspect where I have had a change of heart, I have also adjusted my position on additional contributions to Superannuation, I will cover this in another post. But again, it is something where I was close minded. I had my mind made up and I was reluctant to look into it further and have realised that again it is only to my own detriment.

I urge everyone to keep an open mind, to be open to new possibilities, and most importantly just to be flexible and adaptable with your FIRE journey as being stubborn can limit your access to beneficial possibilities.