Book Review – Join the Rich Club by Peter Switzer

So, first a little bit of background on Peter Switzer

Peter Switzer is a leading Australian business and financial commentator, radio and television presenter, lecturer and author. Peter launched his own financial services business some 25 years ago. He holds a Master of Commerce and is a financial planner. He is an award-winning broadcaster, twice runner up for Best Current Affairs Commentator Award for radio, behind broadcaster Alan Jones.

So basically, Peter has some pedigree when it comes to talking about financial matters and there is no doubt a lot you can learn from him no matter your current financial knowledge.

This book was first published in 2019, and I do tend to prefer relatively more recent books because they seem somewhat more relevant to today’s world. It is also written from an Australian perspective which I do prefer as it does provide significantly more relevance compared to books from overseas, especially in practical financial matters, not necessarily personal growth areas.

What Does the Book Cover?

The book is pretty much a one stop shop with regards to all financial matters and provides a basic outline across a variety of different financial matters. It covers the following;

- Importance of Saving

- Basics of Stock Market investing

- Basics of Real Estate Investing

- Superannuation

- Tax Tips

As you can see the book covers a pretty wide range of topics and is most suited to someone relatively new or inexperienced, starting out trying to get a broad knowledge of financial matters. I would compare it to somewhere along the lines of “Barefoot Investor” in this sense. It is a great starting off point for anyone who is looking to get involved in investing and growing their wealth.

It also covers the 12 steps to get Richer.

- Focus on what you want. Write down your goals.

- Set out a plan to get richer.

- Find the money! Save smarter, get more income.

- Use the best money-making super, deposits and loans.

- Learn from rich, successful people.

- Get comfortable with stocks.

- Become an expert user of debt and banks.

- Become a property expert.

- Become a self-motivating expert.

- Become a super expert.

- Become a tax expert.

- Continually read “stuff” that will make you smarter and richer.

What you might notice, is that there is a lot of steps requiring you to become an expert in a wide range of matters. After reading the book, I don’t know if becoming a complete expert on all those matters is essential, it was more about just having a solid foundation of knowledge on the topics to best help you with returns and making money. Also the book did mention a lot that it is a great idea to actually use people who are experts to help you make money, mainly financial planners, accountants, tax experts and the like. It is these people’s jobs to be experts in these fields, and if used wisely then the “investment” you pay to use their knowledge can earn you real dividends in the future.

What I liked About the Book

There was a lot I liked about this book, it did not feel like I was reading a textbook, it flowed well for the most part and it felt more like I was having a conversation with Peter as the language felt more real and approachable.

The beginning of the book was a lot like other self-motivational books out there, which I think is important for a financial book. A lot of the time it is not a person’s lack of knowledge that is preventing them from building wealth but breaking down poor financial habits and personality traits that do not aid with generating wealth. Addressing these potential characters flaws in a person is a big step to improving their financial wellbeing, plus it is always good to build up a little motivation while reading.

There were a lot of personal case studies included throughout the book. Some people might see this as a negative, but personally I enjoy reading about how other people approach different matters in life. Also, given the personal stories were all from people who were vastly more successful than I am I feel there is a lot to learn from how successful people can approach things. So, although the book is written by Switzer and I appreciate the knowledge he is sharing, there is advice from dozens of other people scattered throughout the book and it can become helpful.

This may be more of a thing with books dedicated to FIRE, but I have noticed there seems to be a significant lack of information regarding property investing in financial books. So I did appreciate a chapter dedicated to property investing (although there was something I did not like about this as well which I will tell you about later). I know there are seemingly unlimited books available on property investing, but I have just found particularly with FIRE, it seems to fall by the wayside in favour of share market investing. However, I should note that this book itself is not FIRE specific in any way at all, so it definitely makes sense to include property.

Chapter 12 – 107 money tips to make you richer provides a nice summary of just a bunch of points which are useful. If every point was understood, then all you need to do is read the dozen or so pages that encompass these points and you will be well along your way to Joining the Rich Club.

My next point is something of a double edged sword I feel, there is a lot of real examples provided throughout the book, where current figures are used to illustrate potential returns or tax brackets, super contributions etc. I do like to see numbers because they have always made sense to me more than just looking at words, but I do worry that providing current information can soon become outdated. One example is in the property investing part it talks about finding the best interest rate, and talked about somewhere in the vicinity of 3.50% per annum is a good interest rate. Obviously back in 2019 this might have been the case, but now around 2.00% is considered a good interest rate (and who knows, someone reading this in 2030 might think 2.00% interest rate is ridiculous).

Overall I did enjoy the book, it illustrates that there is no rocket science to building wealth, it is all just relatively basic knowledge, which is important because at least it is not intimidating for anyone to read. You could read this book front to back and then think to yourself at the end of it “is that all there is to it?” and soon find yourself well on the journey to building wealth.

What I Didn’t liked About the Book

One of the main negatives I had with this book, and I really do not blame Peter Switzer at all for this, but there was a lot of self-promotion sprinkled throughout the book. He subtlety (or maybe not that subtle) mentioned his lending company, his dividend ETF, his website and a few other things he works on. Like I said, I do not blame him at all for this, I mean part of his business is marketing obviously and if you have a book like this out there it would be silly not to try to do some self-promotion, but I did feel it wear a bit thin sometimes.

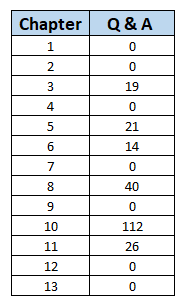

After a couple chapters in the book, he started to bring in these Q and A questions, where he would imagine the reader was asking a question which he believed might be a common question for a reader, and he would answer it. Something like a FAQ spread throughout the book. I did not have an issue with this at the start, but I did notice later in the book the number of Q & A questions rose significantly. I actually decided to do a summary to illustrate:

I really struggled to read Chapter 10 – Show Your S-U-P-E-R a little R-E-S-P-E-C-T, it really felt like the whole chapter was just Q&A the whole time, and while it was still informative, I did not feel it flowed as well as the rest of the book had. Although, to be fair, I think this chapter was mainly targeted to people who are about 10 years or less away from being able to access their Superannuation, so a lot of the information was not particularly relevant to my position so that could have been a reason why I struggled to stay focused during the chapter.

Although the book did talk about Property Investing, I feel it focused mostly on negative gearing of property, and although it did mention briefly that neutral and positive gearing is a thing, it did not really delve deep into the positives of this form of investing. It mentioned several times the tax benefits of negative gearing (reducing your tax bill and all that) but I do not believe it really touched on the potential for serviceability issues of negatively geared property. Personally, I would have liked a bit more detail on the advantages of neutrally and positively geared property which may not run into the same serviceability issues as negatively geared property.

Conclusion

Overall, I think the book is great for someone who is genuinely interested in learning about the basics of the financial world. If you were relatively experienced then I would still recommend reading it, but you may not get as much out of it as you would most likely already know the majority of what is talked about, but it can still be nice to have your own beliefs reinforced.

It is relatively short as well, and given it is so easy to read, if you do find the subject matter remotely interesting you could breeze through the book in a couple of hours. However, if you were a beginner starting out, I would probably recommend taking your time going through it, there are several exercises or homework questions which are asked through the book, which would be useful if they were gone through thoroughly.