Big Ways to Boost Your Savings

Whenever you aim to make a change in your life, it is always easiest to go after the low hanging fruit first. What does this mean? Well, you go after the easiest ways to make the most significant impact. For example, if you were looking to lose weight, then initially you would look at cutting out junk food and starting some light exercise. Saving money is no different, if you want to look at saving more money, then go after the low hanging fruit, go after the expenses in your life that make the biggest impact.

I have talked about the importance of savings rate HERE – and I passionately believe it is one of the two most important factors in building wealth (along with human capital).

Just a quick example to remind you how significant the savings rate can be using a compound interest calculator.

Compound Interest Example

Invest $1,000 per month over 10 years at 7.00% per annum – Total Return = $174,000.00

Now we can increase our investment to $1,200 per month – Total Return = $208,800.00

Back to $1,000 per month by 9.00% return – Total Return = $194,800.00

Increasing our savings by 20%, improves our return by 20% (makes sense, right?)

But if we increase our Investment return by 28.5%, it only increases our return by only 12%

Increasing our Monthly Investment

Now, that is only a basic example, but it just illustrates that improving the monthly investment has a significantly higher impact on overall return compared to investment return. So, if you want to increase your wealth, go after the low hanging fruit, go after what will make the most significant return. That means, we need to look at increasing how much we regularly invest.

To increase this amount, that means we need to either:

- Increase our income; or

- Decrease our expenses.

In this post I want to look at decreasing our expenses, but keep in mind that it is only one part of the equation.

Boosting our Savings

To boost our savings, we need to look at what our largest expenses are, as typically this will show us where we can make the biggest reductions in our expenses.

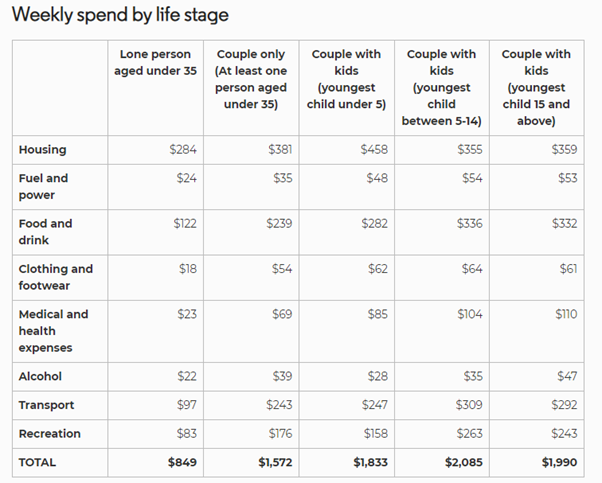

From the Moneysmart.gov.au website, you can see the typical spending habits among Australian people over different stages of life.

In each age category, the same three categories pop up as our main expenses:

- Housing

- Food and Drink

- Transportation

This means if we look at these three categories, we should realistically be able to reduce our savings with the lease amount of effort.

Housing

There are several ways we can look at reducing our expense when it comes to housing. And while some of them may not be practical to your unique situation, there is most likely at least one of them you could do to streamline your housing expenses.

My own example: In 2019 I was renting a 2-bedroom unit, living by myself, paying $400 per week. The place was far from glamorous, but it was in a convenient area, close to a train line that gave me quick access to the city (even though I rarely needed to go there). At the time, I did not mind paying a premium to live by myself, because I valued my privacy – and the place was not excessively big and even though it was two bedrooms, it would have been really cramped with an extra person.

But at the end of 2019, I wanted to really cut down on my housing expenses, so I wanted to find somewhere cheaper, and closer to work. I am fortunate in that my work is on the outskirts of Sydney, so rent is a lot cheaper, and I can still have a short commute to work.

By the middle of 2020, I had moved into a much nicer and larger place on the outskirts of Sydney (still near a train station, but it is a LONG train trip to the city) which costs $300 per week. Already I had reduced my expenses by 25% – and that does not include a shorter commute and a better quality of life.

To compound the savings however, my partner moved in and covered half of the rent, so now I was only paying $150 per week. My housing expenses had gone from $400 per week down to $150. That is a reduction in over 60% with minimal compromising in my overall life.

This might be an extreme example and might not be achievable for everyone, but I will go through a few other possible examples which you can look at to reduce your housing costs.

- Downsize

Where you live currently may be excessive to what you currently required, do you need an extra 2 bedrooms even though they do not get used? Particularly later in life if your children have moved out, then downsizing could be a great way to reduce your housing expenses.

- Get a Roommate

If you have a spare room in your place, why not look at getting an extra income from it and in turn reduce your overall housing expense. It does not need to be a forever deal, but even doing it for a short to medium term could really give you a head start with your savings goals.

- Geo-arbitrage

The average rent or house price in the middle of major cities like Sydney and Melbourne is ridiculously expensive. Maybe an option might be to move to a completely different city. If you can find employment in the new area (even if your salary is not as high) then your overall savings could significantly increase with the lower cost of living.

- Air BnB

So maybe you do not want a full-time roommate staying with you, but what about just temporary and short term stays for travellers from all over the world. Especially if you have a self-contained living area in your place it could really be a helpful option to help reduce your housing expenses.

- Refinance your Mortgage

Have a look at your current mortgage, and you may be able to refinance and obtain a better interest rate. Small changes in interest rates can have significant decreases in housing expenses over the long term.

- Rentvesting

You may have bought a place where you want to live in the future when you have a family. But in your current life you do not need all that space. So why not rent it out, and then rent somewhere else that suits your current lifestyle. If you rent somewhere cheaper than your mortgage costs, you can end up ahead in your overall housing expenses.

Food and Drink

According to the above table from the Moneysmart website, Food and Drink is the second highest expense for each demographic. There are a lot of savings that can be achieved to reduce your food budget.

- Cook for yourself as much as possible

This is the most effective way to reduce your food budget. Eating out or getting take away is an expensive habit to get into. Of course, there is a convenience to it, but you are really paying a premium for this convenience.

If you were to eat out every meal, 3 meals a day, 7 days a week at $20 per meal. Then you would end up spending $420 every week just on food. Cooking your own meal will typically cost about $5 per meal (it can vary significantly depending on what items you use). Every meal you cook for yourself you can save $15.

Even if you still justified it to yourself to eat out once a day, you would still save at least $210 per week. Or maybe you wanted to only eat out once a week as a treat, this also has the added benefit of making the situation more special and meaningful, as well as saving you $300 for the week.

- Learn to Cook

This one might cost money upfront, especially if you choose to go through cooking classes, or even just the cost of experimentation. But there are literally millions of recipes and or video instructions of meals you can readily make for yourself. If you become a decent cook, then it will encourage you to prepare meals yourself rather than eating out. It will have the added benefit of improving your quality of life, I know I would rather eat Thai Green Curry Chicken rather than Eggs on Toast.

- Write a Grocery List

This is such a simple trick, but it is incredibly effective. If you go grocery shopping without a list, you find yourself doing one of two things. Either you buy items you already have or do not need, or you miss things you need and end up needing to go out again.

- Replace meat with lower cost food items

This is one I have started to do a lot of over the past 12 months. Meat can typically be expensive but can be replaced with significantly cheaper items with similar benefits. For example, if I was making spaghetti bolognaise, instead of using 500g of mine, I might look at using 250g of mince and 250g of beans or lentils. I have found the taste is not impacted at all but the cost of the meal has reduced significantly.

- Be flexible with Fruits and Vegetables

A lot of the time if you buy fruits or vegetables that are in season, then they will be relatively cheap. If you are determined to stick with the same fruits or vegetables, then if you need to buy them out of season then you will likely be paying a significant premium for this.

Transportation

The final significant expense in the typical budget is Transportation. This includes both private vehicles, taxis, Ubers and publican transportation. Like the others, there are a lot of ways you can reduce your expenses when it comes to transportation

- Use a bicycle or walk if possible

If you are only travelling a short distance, why not walk, or ride a bike. Not only will you save fuel, as well as wear and tear on your car, it will be better for your health (as well as the environment).

- Use Public Transportation

If public transportation is available, then use it where possible. Typically, it will be cheaper than driving your own car. And if you live in an area where public transport is readily available, then maybe question if you need to own a car at all. You can save a lot of money if you are not paying insurance, registration, fuel, maintenance on a car you do not use.

- Carpool

Too many times I see hoards of people all driving from similar starting points to similar destinations, sitting with their cars side by side through the commute. If possible, carpool as much as possible and you can share the costs of transport, as well as reduce traffic on the road. Not to mention being able to take advantage of the carpool lanes on certain roads.

- Shop around for Insurance

Like with any other insurance, if you shop around for your car insurance you can normally find a cheaper deal with similar coverage. Also, make sure the coverage is appropriate for your car. Do you really need comprehensive insurance for your car if it is only worth $4,000? Maybe Third Party will suffice.

- Avoid Financing where Possible

Try to avoid spending more than you need, and you should avoid going into debt for a car if you can. You will end up paying for the same car several years in the future, paying significantly more than what it is worth in the long run.

- Do not speed

The faster you go, the less fuel economy your car will have. If you drive to the speed limit you will increase fuel efficiency. Not to mention there will be no chance of getting a speeding ticket which can cost a significant amount these days. Also, losing demerit points can impact how much you pay for a license and registration. Sometimes it pays to keep in line.

- Take care of your car

Preventative maintenance can be a real significant cost saver in the long run. Ensure your tyres are full of air, regular oil checks and other maintenance helps your car run more efficiently and can help prevent larger repair costs down the line. I have made the mistakes in the past of not getting my car checked early enough, and turned a relatively cheap brake pad replacement into a significant expense given the additional repairs.

- Do not overspend on a car

Buy a car that suits your needs, do not feel pressured to buy a car to impress your family or friends. Buying a new car might feel a lot nicer, but if you can buy a car that is only 1 year older for 25% less of the price, then maybe it might be worth it.

Conclusion

These tips are mainly if you have just started to look at your budget and decided you want to significantly reduce your expenses. These three components are the low hanging fruit which you can reduce to make these significant reductions.

They are only examples based on the general population however, you may have significant expenses that form part of your unique budget. If that is the case, then ideally you will look at these to see if there is a way you can reduce this.

You may find that you cannot reduce your expenses any further in these categories, and that is good news! It means you are already well on your way to minimising your expenses as much as possible. In a future post I will explore further about the next step you can take to minimise your expenses and give yourself a real savings boost.