August 2021 – Net Worth Update

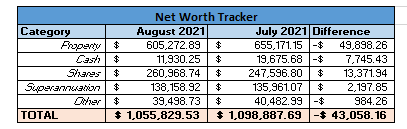

As part of my FIRE blog I will be tracking my net worth on a monthly basis and compare it to where I want to be when I reach my FIRE number. I will also compare it to where it was sitting last month. A summary of my assets are as follows:

Explanation of each category:

Property

As you can see there is a big change in this category, almost $50,000 lost compared to last month. That was due to one of my investment properties decreasing by $50,000 according to the website www.onthehouse.com.au. As I have said before I only take this number with a grain of salt as it is not really relevant unless I actually sell a property for that price. Also, I am not exactly sure what algorithms they use to come up with their values, but the area that property is in is tricky because there is not much sales history and there can be a big difference in property value depending on the location and the views.

I have noticed that the value of this particular property does seem to fluctuate a bit on that website, so I am not too concerned that my net worth is moving in a negative direction mainly due to the loss in property value. It is disappointing that I was so close to reaching $1.1m! only to fall back down to $1.05m.

Cash

I have had a fairly expensive month where just about every bills appears to have aligned to occur in the month of August. Both of my investment properties needed extensive repairs (almost $5,000 worth between them), property insurance was due for one, I needed to pay 2 lots of strata on my investment unit (okay this was my fault for missing the initial strata request). Anyway, it all just seemed to coincide with this month, so it has definitely left me poorer than I am used to.

The most disappointing part is that I will not be able to regularly invest in shares as I do not have the funds available. (Note that the majority of the cash in the table is actually in my US bank account).

Shares

Finally! some positive news! I deposited $5,000 at the start of the month but on top of that there were still some extensive gains. The snowball is well and truly in motion, and I am really enjoying the roller coaster ride that is share investments.

Superannuation

On the back of gains within the share market this has continued to rise a bit over the month.

Other

The reason this category has dropped almost $1,000 is because I finally withdrew all my funds from my BrickX account. I might do a post about my experience with BrickX (spoiler alert, it was not the most positive). Anyway, I am glad to remove it from my portfolio as I want to simplify things as much as possible.

August 2021 Budget Summary

Income – TOTAL: $8,044.10

- Normal Income: $4,084.00

- IP Income: $3,960.10

- Other Income: $0.00

Expenses – TOTAL: $11,997.61

- Normal Expenses: $2,831.66

- IP Expenses (not including Interest): $8,194.37

- IP Interest: $971.58

Savings Rate – -49.15%

Like I touched on before, it was a disaster of a month in terms of spending! A -49.15% savings rate for the month of August.

This experience does highlight one of the reasons why I want to sell my investment properties before I do reach RE, or at least sell them early on. These unexpected costs can be significant and can really ruin the cash flow especially if I was only living on a modest income. Fortunately, I have my emergency fund so these expenses were not an issue and with my work income I will be able to replenish my emergency fund and get back on track.

August has reduced my overall savings rate for 2021 down to 42.85% – which is still above my target of 40.00%, I just hope there are no more unexpected surprises to come down the line.

I also like to track my income and compare it to my passive income, including my gains for the month.

August Normal Income – $4,084.00

August Net IP Income – -$5,205.85

August Net Shares Gain – $8,371.94

Total Passive Income – $3,166.09

This is the first time in a while where my Passive Income has actually been less than my normal income. It was a terrible month in terms of expenses, and even with all that taken into account it was still relatively close. I was really fortunate that the share market had another booming month.

Plan for September 2021

I do not have any real plans for the next month, hope to just consolidate and build after this somewhat disappointing month.

Currently in lockdown in Sydney which is wearing a bit thin. Fortunately I am still able to get out of the house and go to work every day so I am not too hampered, but I would still like to see the backend of it, even though that likely won’t happen until October at the earliest.

The lockdown is not helping me try and sell my second car, which I still currently have. Unfortunately, not really able to have people to come look at it so it remains in my driveway. I might get lucky and find somebody local who wants to sell it but that is unlikely.

I have been talking with some friends about potentially doing a development project, basically just buying a large block of land, subdividing it and then selling the smaller blocks of land. Hopefully for a profit. Early stages yet but am hopeful it could be a more active way of generating income, sort of like a larger scale side hustle.